The biscuits industry in India is largely dotted by the unorganised sector. Organised manufacturers have only 29 per cent of the market to themselves. This makes organised biscuit manufacturers a rare breed. Today, there are three large players in the industry: Parle, Britannia and ITC. Of these, Britannia (estimated market share of 34 per cent) is the only listed pure-play you can bet on if you believe people will continue to have their chai-biscut for a long time to come. It's no surprise then that Britannia is a huge favourite with the market amongst FMCG companies. Here are some reasons for the development.

Potential gainer of the shake-up in the industry post GST launch: The formalisation of a number of industries post GST is expected to be seen in the biscuit industry as well. With a large part of the industry unregulated, unorganised and already seeing the pinch of post-GST environment, organised players like Britannia stand to gain market share.

Improving operating margins: A number of measures for Britannia to expand its operating margins are already in or falling in place. These include higher premiumisation-led gross-margin expansion, efficient promotion spends, increasing share of in-house manufacturing and cost-savings programmes. These measures are likely to elevate Britannia's margins over the next couple of years.

Rapid network expansion from 0.7 million outlets in FY14 to 1.6 million outlets in FY17: The company has targeted to add another 2.25 lakh outlets annually in the medium term. While augmenting its presence, network expansion will also alleviate part of the rural weakness of the company. Rural sales accounted for 30 per cent of FY17 revenues.

Why you should still avoid the stock

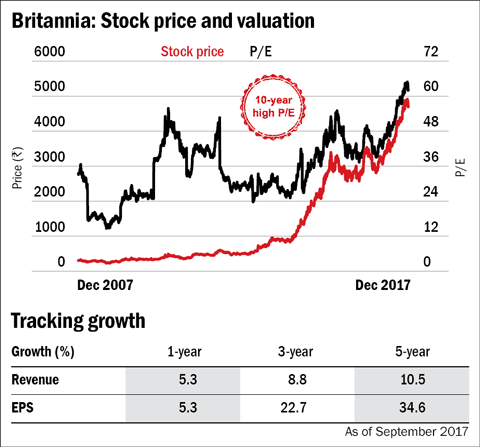

The Britannia stock has gained 60 per cent in the last one year - much higher than the S&P BSE FMCG index. This has stretched valuations to 62x - close to its all-time high valuations of 65x. The market is betting a post-GST business environment which will be beneficial to organised players like Britannia. That could very well play in Britannia's favour but valuations appear to have run away already. Even if you assume that Britannia can repeat the higher earnings trajectory of 35 per cent seen in the last five years (average annual), current valuations of 62x appear to factor in the higher earnings growth as well, leaving little room for a fresh investor. A better bet will be to snack on the truly wonderful new launch, Good Day Wonderfulls Choco and enjoy Nuts cookie with chai for now, and waitfor valuations to cool down.