In spite of the hiccup in recent times, the markets are still euphoric. The BSE Smallcap index is trading at a PE of 105x, while the Midcap index is close to 45x. In the heated markets we find ourselves in today, it has become increasingly difficult to find value. It is now more common to come across stocks that have run up far ahead of their fundamentals. In this article, we bring to you stocks that still offer value on the table and those that do not. In order to come up with these lists we have applied certain filters that have further refined our results. However, please note that the value stocks listed in this story are not our recommendations. The list is just a starting point to unearth value opportunities in today's markets. You should thoroughly research the stocks before investing in them.

In search of value stocks

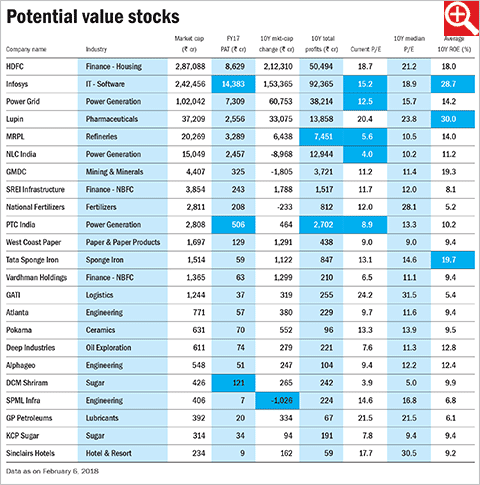

Here are our criteria that we used for short listing value stocks and for finding those that can be potential wealth destroyers.

In our search for companies that have not run up ahead of the underlying business and are still available cheap, we tallied up the profits that companies have earned over the last decade and compared them with the increase in their market-capitalisation over the same period. We then picked those companies where the increase in market-cap does not commensurate with the total profits. In other words, in the past, with growth in profits, their market-capitalisation increased at a faster rate. But over time the rate of change in market-cap slowed down due to a variety of reasons, many of which could be temporary.

While compiling this list, we also checked for mergers, demergers and issuance of rights shares as these events significantly impact market capitalisation.

Filtering out the most promising ones

On the list of stocks that we so obtained, we applied the following filters:

- The current price to earnings multiple should be less than 25 and lower than the 10 year median.

- The company should have turned a profit in the previous financial year.

- Cumulative profits should be at least Rs 50 crore in the last decade.

- Market-cap should be over Rs 200 crore.

Unsurprisingly, at the end of our search, we were left with only a handful of stocks that can be viewed as undervalued. There could be a variety of reasons responsible for this. For instance, consider the following cases:

There's Infosys with its rocky past couple of years. Infosys earned cumulative profits of over Rs 92,000 crore in the last 10 years, while its market value has increased about 1.6 times during this period. Also, it trades at PE of 15x, much lower than its 10 year median of close to 19 times earnings.

HDFC is one of the most efficient housing finance companies in India. A large-cap with a decent growth track record and outlook, it has shown consistent profitability but growth in market-cap still lags behind. Currently, it is trading at a PE of 18.7 times in comparison to the 10 year median PE of 21.2.

Also making the undervalued cut is Power Grid Corporation, specialising in power transmission, with 85 per cent inter regional market share and cumulative net profits of Rs 38,200 crore in the last decade, during which time its market-cap grew by 1.6 times, too. Power Grid trades at a PE of 12.5x, which is lower than its 10 year historic valuation of 15.7x.

This story was originally published in the March 2018 issue of Wealth Insight.