Long-term wealth creation is a process that entails a lot of discipline and patience. This is why many investors foment ways to quickly make money. Let us study the risk and rewards of one such method. In a bid to replicate the 'bottom-fishing' concept in mutual funds, some investors pick up 'loser' funds that are at the end of the performance chart in one year and wait for them to turn around in the subsequent year. Value Research analysed the biggest losers in the equity fund arena for every year in the last 20 financial years (FY98 to FY17) to see if such a strategy actually works.

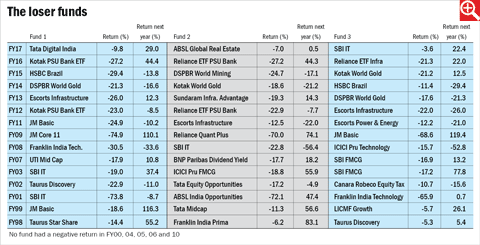

We studied the three worst performing equity funds (those that gave negative returns) of each financial year since 1997-98. Out of these 20 years, in five years, there was not a single fund that posted a loss. Hence, we ignored those years. In the rest 15 financial years, we looked at the worst three funds of each year and monitored their NAV performance in the subsequent fiscal year. In summary, here are our findings.

The probability of positive returns in a loser fund: Normally, the probability of generating a positive return in any fund is 50 per cent. But if you buy a loser fund that has already posted negative returns in one year, are your chances of getting a positive return significantly higher in the subsequent period? Not really! There is a 58 per cent chance that a loser fund can generate a positive return in the next year, which is not very different from 50 per cent for any fund. Hence, if you think that buying a loser fund gives one a magic door to gains in the next year, that is not true. Performance, poor or good, in the past is not an accurate guarantee of future returns.

Double trouble: After posting terrible returns in one year, some loser funds gave sparkling returns in the next. For instance, Aditya Birla Sun Life India Opportunities lost 72 per cent in FY01 and then rose 47.36 per cent in 2001-2002. But the other dud funds in 2000-2001 did not have such a remarkable recovery. SBI IT Fund lost 73.8 per cent in FY01 and lost 8.73 per cent in FY02. Franklin India Technology Fund lost 65.87 per cent in FY01 and ended FY02 with less than 1 per cent gain.

There are also examples of funds which have done badly for two to three years successively. In FY02, Taurus Discovery lost 22.91 per cent and in FY03 it again lost 11 per cent. In FY15, HSBC Brazil shed 29.36 per cent and in FY16 lost another 13.82 per cent. In FY11, JM Basic Fund fell by 24.88 per cent and then it again dipped by 10.19 per cent in FY12.

Losses can be big: In some of the instances, it was seen that a dud fund's losses in a year can become bigger in the subsequent year. Take for example the three worst funds of FY14. DSP Black Rock World Gold Fund (-21.26 per cent), Kotak World Gold Fund (-18.56 per cent) and HSBC Brazil (-11.4 per cent) had a bad year in FY14.

In the subsequent year, two funds posted even bigger losses! In FY15, Kotak World Gold Fund lost another 21.24 per cent and HSBC Brazil Fund tanked by another 29.36 per cent. So in the bid to make profits, you can actually end up buying more losses for your portfolio.

Multi-year bad themes: Thematic investing gives good returns in good times, but when things turn bad, returns can really make you suffer. Take for example infrastructure funds. In FY11, Escorts Infrastructure Fund lost 12.49 per cent. If somebody had bought the fund at the start of FY12, he would be disappointed. In 2011-12, Escorts Infrastructure lost another 22.01 per cent. In FY13, the fund again lost 25.96 per cent. It was only in FY14 that the fund finally generated some positive return.

Technology funds also made investors suffer in FY08 and FY09. In FY08, Franklin India Technology Fund (-30.52 per cent), SBI IT Fund (-22.82) and ICICI Prudential Technology Fund (-15.71 per cent) set investors back by quite a bit. In the next year, losses grew much larger as Franklin India Technology Fund tanked by over 33 per cent, SBI IT Fund by 56 per cent and ICICI Prudential Technology Fund by almost 53 per cent.

Hence, investing in loser funds is no short cut to profits. While in some instances investors did gain 100 to120 per cent after buying a loser fund, you will also have to be prepared for those nasty years when you are hit with 50 per cent losses. A better way to profit from equity is to invest in good funds for the long term.