Do stock markets really reward you with higher returns for risks? That's a question worth asking today after the carnage in some stocks in the last six months. Taking stock of Indian stock-market returns today (June 1, 2018), there's good reason for scepticism, too. The Nifty 50 has managed an uninspiring CAGR of 8.2 per cent over the last 10 years. The top-performing liquid funds in the market have delivered a 7.9 per cent CAGR in the same period.

Surely, that 0.40 per cent extra return is a poor reward for dealing with the stress and risks of equity investing. Given that fixed deposits in India often yield 7-8 per cent without much risk-taking, investing in stocks or equity funds would be worth it only if you can end up with that 12-15 per cent CAGR that financial planners talk about. That's not as easy as made out to be.

The low-return challenge

In India, most people shy away from equities because they fear the capital losses that stocks are notorious for. But they're worrying about the wrong problem. Given that bear phases in India have seldom lasted for more than three years, you could have avoided capital losses from equities simply by committing to a longer investment horizon.

We ran a rolling-return analysis on the Nifty 50 Index from January 2000 to May 2018, covering three complete market cycles, to take stock of the five-year holding period returns at every month-end. The analysis shows that investors who held onto equities for five years on an average made a negative annualised return (capital losses) only 6 per cent of the time in this long 18-year window. That is, the chance of making a capital loss was only six in 100 if they held on for five years.

What you should be worrying about, however, is the possibility of making a low return that fails to reward you sufficiently for equity risks. The same rolling-return analysis showed that, over the 18-year window, there were 103 periods out of the total of 216, when investors earned less than a 10 per cent annualised return after holding their stocks for five years. That's a 47 per cent probability that your equity returns will turn out to be in the single digits.

The 15 per cent annualised return that most people target cropped up only 29 per cent of time in the five-year rolling returns in this long period. A 20 per cent annualised return was even rarer and was restricted to 19 per cent of the time periods.

These statistics clearly show that, as an equity investor, your main concern should be avoiding poor returns, and not just staying off capital losses.

Therefore, investors in both stocks and equity mutual funds need to pay special attention to how they can ensure that their equity returns do end up at 12-15 per cent instead of the single digits. There are three clear strategies that can help pump up your returns.

A dose of mid/small caps

To make sure that your equity portfolio does deliver a double-digit return in the long run, it is important to ensure that you allocate a portion of it to mid- and small-cap stocks or funds investing in them. Mid and small caps offer you a far better shot at outperforming the market than index names.

In India, there's a yawning divide in terms of research, liquidity and investment interest between the top 100 stocks and the 5000-odd other stocks listed on the exchanges. The top 100 blue chips are widely tracked by an army of analysts and chased after by the who's who of foreign funds looking to take an India bet. With the rise of passive investing, a whole lot of global money flowing into India also makes an automatic beeline for the index names, without sparing a thought for any other stock in the market.

This trend of too much money chasing the top 100 names in the market is bound to erode the alpha-generating ability of large caps over time. One can already see this playing out, with large-cap equity funds struggling to beat the Nifty 50 in the last one year.

But India's mid-cap and small-cap spaces still offer a lot of opportunity for investors willing to do some deep digging to unearth earnings compounders. The majority of mid- and small-cap stocks don't attract much attention from sell-side analysts (yes, there's a pick-up in interest in big bull markets, but it fades at other times). Foreign investors and even large domestic funds often don't venture beyond the top 200 stocks because many of these stocks lack the liquidity to enable large institutions to build or exit positions without impact costs. But this means more opportunity for savvy individual investors or fund managers to extract extra returns from small or mid caps.

This argument is backed by numbers. Applying the above rolling-return analysis to the Nifty 500 Index, a far broader index than the Nifty 50, shows that the probability of getting to a 15 per cent return is higher when you broad-base your investment universe.

A five-year rolling-return analysis from 2000 to 2018 showed that investors in the Nifty 500 had the same probability of making a negative return at the end of five years (6 per cent of the time) as Nifty 50 investors. But their chances of making a 15 per cent CAGR were higher, at 34 per cent, compared to 29 per cent for Nifty 50 investors. The 10-year CAGR for multi-cap equity funds, at 11.7 per cent, beats large-cap funds by 1.2 percentage points.

Yes, mid and small caps are a risky terrain for retail investors to navigate. A variety of business and governance risks can crop up suddenly with these stocks. Their losses in bear phases can be far greater than anything you can experience with the blue-chip names. But by owning multi-cap funds or allocating a fixed proportion to small-cap funds in your equity portfolio, you can reap the higher rewards of small-cap investing through a professional manager. Think of a mid/small-cap allocation as a must-have instead of an optional add-on, if you are keen to get to a good equity return.

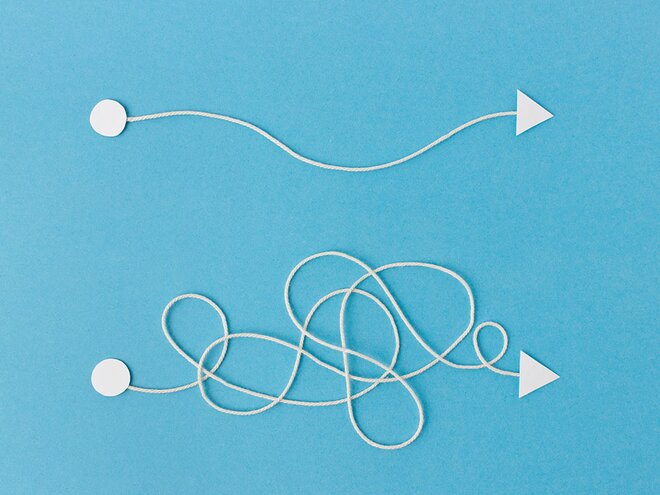

Spread it through SIPs

While financial firms may advise you to focus more on 'time in the market' rather than timing the market, timing does play a big role in deciding your equity returns. Yes, even in the long run.

For instance, the 10-year annualised return on the Nifty 50 looks so anaemic today, at 8.2 per cent, mainly because of the starting point on that investment, which was May 2008. The Nifty 50 was at over 4,870 points then, as it had not cooled off entirely from the boom years of 2003-2008.

Investors who bet on the Nifty 50 just five months later in October 2008 (Nifty 50 level of 2,880) will have made a much higher annualised return of 15 per cent till date. Given that a few months' delay can make such a huge difference to your long-term returns, the time at which you make your entry into equities matters a lot to your final investment results.

But unfortunately, without the benefit of hindsight, none of us can really say what a great entry point is into the stock market. In these circumstances, using SIPs or systematic investment plans is the best way for you to ensure that poor timing doesn't derail your investment plans.

Stretching the above example, if the investor had not bet all her money in May 2008, but instead spread it through monthly SIPs for the next three years (May 2008 to May 2011), her effective returns today would be 11 per cent instead of 8.2 per cent.

Therefore, if you have a lump sum to invest, don't jump in with the full sum even if you think the markets are doing great. Spread the investment out over the next two to three years through monthly SIPs. This is particularly important if you are investing after the stock market has seen a sustained rally, as it has now.

Persist in hostile markets

A final element of your investment strategy that is essential to get you to a double-digit return is to continue investing in hostile markets. While it is easy to build the conviction to invest in equities when markets are making new highs every day, that conviction often crumbles quickly when the ride gets bumpier.

In the last couple of months, a number of investors have actually redeemed their equity funds to 'book profits' on their long-term portfolios. They argue that as one never knows where the correction will end, it is best to cash in while the going is good. Others are talking of stopping their SIPs and waiting on the sidelines until the mid-cap and small-cap carnage is over.

But these investors actually run one of the biggest risks in equity investing - that of missing out on the market bottom in their eternal wait for friendlier market conditions. Investors who have the best five-year returns to show on their equity investments in the last 18 years were those who invested during the worst times for the market. The brave investors who bet their shirt on the Nifty 50 in mid-2012 or October 2008 to March 2009 were the ones sitting pretty on strong double-digit returns five years later. The people who continued with their SIPs and didn't stop during those stormy months can now look back with satisfaction, too.

So, to answer the question at the start, the stock market does reward you generously for taking on risks. But just like Lady Luck, it favours only the brave.

This story first appeared in the July 2018 issue of Mutual Fund Insight.