When this Value Research reader is not working on technology to meet the emerging business needs of a world-renowned planemaker, he spends a lot of time reading about investing. Hailing from E. Pannaipatti village in Dindigul district in Tamil Nadu, Madhanmohan Savadamuthu, the son of a college lecturer turned principal, chose the engineering profession and worked hard to create his own niche.

Over the years, he has worked for some of the biggest MNCs in the world and established himself as an emerging technology architect. Unlike many youngsters today, Madhan started saving and investing right after he received his first salary.

Madhan married in 2007. His wife, Dr P Vimala, works as an associate professor in a private engineering college. The couple has two children, aged two and ten. Madhan wants to leave a good fortune for his family. 'My knowledge of finance was very limited till I went to college. I had only heard about stocks and all I knew was banks and their services. I was spendthrift during my school days and I was getting more money than a normal kid. Things changed when I went to college and my money flow got limited,' he says.

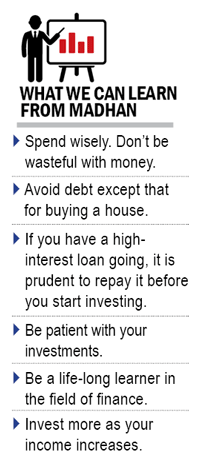

When the money supply reduces, the true value of money becomes apparent. Also, Madhan saw a tragedy from close quarters. 'I saw one of my relatives going broke financially and then I decided to pull up my socks and learn more about money. I became selective in my spending,' he recalls.

The biggest shock of his life came after he had completed engineering from the University of Madras. Banks turned down his education-loan request. 'I didn't get an education loan for my master's degree and then I realised the importance of money. I was also shocked about the amount of interest my grandmother was paying on a loan of Rs 1 lakh,' says Madhan, who eventually completed his masters of technology from VIT after his father arranged finances.

During his final semester, Madhan worked as an intern and earned Rs 6,000. He learned to survive with minimal support from his father. He also made some financial resolutions that included paying down debt. By the time he completed his masters, Madhan had a total loan of Rs3 lakh in 2002 (about Rs 8 lakh at today's prices). He decided to pay the high-interest loans first. He also paid off his grandmother's loan.

In terms of investments, Madhan started with life insurance policies. He also invested in the Public Provident Fund. 'All these happened because of my reading habit. I read personal finance magazines and finance-related articles on the Internet,' he quips.

His interest in finance further increased after Madhan was introduced to Value Research. 'Since that time, I have been very closely following Value Research,' Madhan says.

Largely attributing his investment philosophy to Value Research, Madhan says he owes it to Dhirendra Kumar and the Value Research team.

Having dabbled in insurance and the PPF, Madhan then transitioned to mutual funds. His investments in gold are through the mutual fund route too. Today, about 20 to 25 per cent of his money is in mutual funds, with the rest being in EPF, PPF, insurance, jewellery and real estate. He has no exposure to direct equities yet.

Madhan's financial goals are straightforward - buying a house, saving for retirement, and kids' education and marriage. 'I have already accumulated about 50 per cent of the amount needed for buying a house. I expect to achieve this goal in another five years,' Madhan says. For retirement, Madhan is investing in the EPF, PPF and the NPS. 'I have earmarked my mutual funds for my kids' education and weddings,' he reveals.

Having been exposed to the dark side of loans early on, Madhan is clear about avoiding debt. 'Debt should be avoided except that for buying a house. Use your regular income for all other things,' he opines.

With his income growing steadily, Madhan has increased mutual fund investments. 'I have increased my savings and investments proportionally and I have started investing more in mutual funds in recent years,' he adds.

Of all the important money/finance lessons that he has learned all these years, Madhan talks about patience and the need to be a life-long learner in the world of investment. 'I know my risk appetite and I know it changes based on earnings. Be open to change,' he signs off.