Asset-management companies manage the assets of their clients. In 2017, Reliance Nippon Life became the first AMC to list on Indian exchanges. It runs mutual funds, including exchange-traded funds. They also manages funds for high net-worth individuals and institutional investors. Further, it runs alternative investment funds and is a manager of various pension schemes and Employees' Provident Fund. In August 2018, HDFC AMC became the second such company to get listed.

The business model

AMCs primarily make money from fund-management fees. Fund-management fee is the fee charged as a per cent of assets under management (AUM). Factors which impact management fees are:

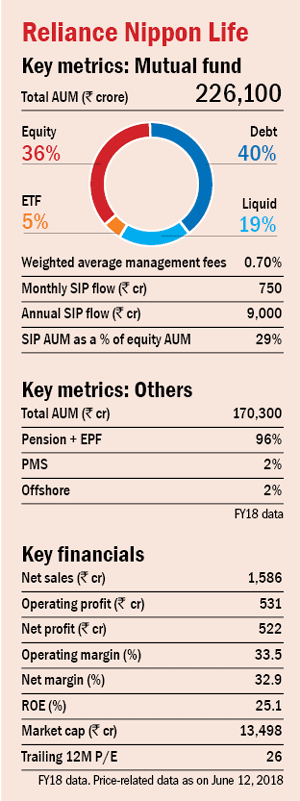

Product mix of the company: Product mix means the split between equity and debt assets. Equity instruments carry management fees of about 1-2.5 per cent, whereas debt funds have fees of about 0.1-1 per cent of AUM.

Pension funds managed: Government pension schemes carry low management fees since they consist mostly of debt securities and AMCs have little or no bargaining power in this matter.

Size of PMS in managed-funds portfolio: Portfolio-management services carry higher management fees, which ranges from 1.5-2.5 per cent of assets and also carry profit-sharing clauses.

Key metrics

Here are some key determinants of this business:

Size of AUM: The higher the size of AUM, the better it is, for it means higher fees.

Weighted average management fees: An AMC which is able to charge higher management fees will generate higher revenues and profits on the same asset base.

Monthly and annual SIP flows: Constant flows through systematic investment plans (SIPs) show investors' belief in the AMC's ability to generate constant returns. They also provide future visibility about the profitability of the company.

SIP AUM as a per cent of equity AUM: Systematic investments mean a steady flow of assets to an AMC. The higher the per cent of SIP AUM in the total equity AUM, the better it is.

This article is part of a series on how to assess new business models.