Long-term investing is an integral element of the wealth-creation process. Value Research undertook a study to see how long term equity funds' holdings are. For this, we studied nearly 188 funds across ELSS, large-cap, large- and mid-cap, mid-cap and multi-cap categories. We didn't take sectoral, thematic, index and exchange-traded funds as they tend to have stable holdings anyway.

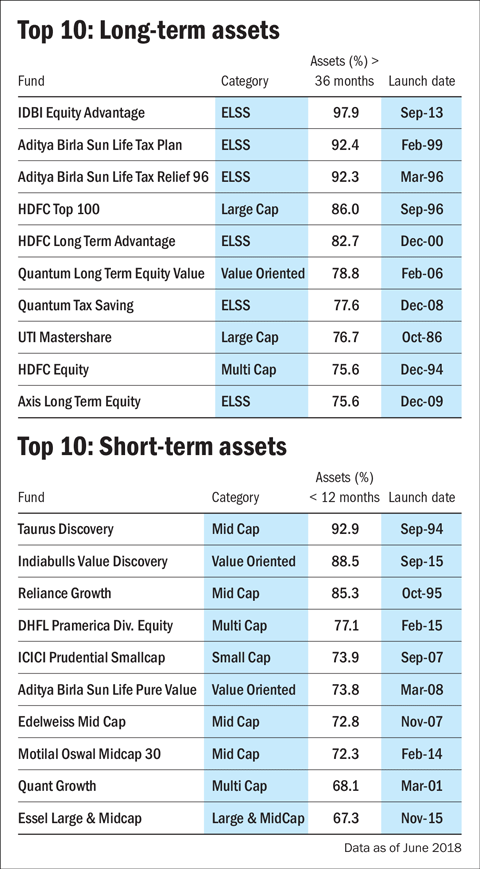

The tables below show the funds that have the largest share of long-term assets (more than three years old) and short-term assets (less than 12 months old).

Keep in mind that recently many funds had to rejig their portfolios to adhere to SEBI's recategorisation initiative. In some cases, funds have undergone significant changes in character and strategy, because of which they might have been forced to completely shuffle their portfolios.

Categorically speaking

Certain categories are expected to be more long term than others. Let's see how they stand.

ELSS: Out of the 40 ELSS funds that we studied, three funds, viz., IDBI Equity Advantage, Aditya Birla Sun Life Tax Plan and Aditya Birla Sun Life Tax Relief 96 are notable. They have over 90 per cent of their portfolios in long-term assets.

Value-oriented funds: This category contains 15 schemes, with the oldest one launched way back in January 1994. Value investing almost always involves buying stocks that are beaten down currently but may turn around later. As such longevity of holdings is an integral part of value-oriented funds. Four funds, Quantum Long Term Equity Value Fund (79 per cent), UTI Value Opportunities Fund (63.2 per cent), JM Value Fund (63 per cent) and Reliance Value Fund (60.4 per cent), have the highest proportion of long-term holdings.

Small is beautiful: Small-cap funds should be ideally long term in nature. This is because investors will gain as small-cap stocks turn into mid caps and large caps. Out of the 13 small-cap funds studied, three, viz., Sundaram Small Cap, DSPBR Small Cap and Franklin India Smaller Companies, hold 60-74 per cent of their investments in long-term assets.