Foreign institutional investors (FII`s) have for long been drivers of Indian equities. They own 19.5% of the Indian equities, compared to 7.1% owned by domestic mutual funds. However, in the last one year alone, FIIs have pulled out more than Rs 38,000 crore from Indian markets, as the rupee depreciated sharply in 2018 and risk aversion set in. We thought it would be interesting to look at stocks that took the fancy of FIIs in the midst of all the turbulence. Taking this as a starting point, we tried to look out for companies that bucked this trend. And we did find companies in which FIIs acquired stakes for the very first time in 2018.

We found twelve such companies in which FIIs invested for the very first time in the last one year. A large FII holding does not necessarily ensure great performance. Some of the recent wealth destroyers -- Vakrangee, DHFL, Manpasand Beverages, Yes Bank, Gitanjali Gems and Infibeam Avenues -- have had substantial FII ownership in them. FIIs can take aggressive bets at times and in order to keep the focus on quality stocks alone, we applied some filters that eliminated companies based on operating margins, RoE, debt, cash flows from operations, sales and profit growth. This assured that we were left with only those companies that were growing, had lower debt, provided decent returns to it investors (ROE) and were also converting their sales in cash (Cash flow from operations). In the end, we also had a look at the valuations to ensure some margin of safety for the investors. After applying all these stringent criteria we were finally left with only two companies. Both come with their own share of pros and cons. One happens to be a turnaround story, while other happens to be a beneficiary of government schemes. Do they really deserve your attention? Read on for more.

Filters applied

- Market cap greater than Rs 500 crore

- TTM Sales increase by at least 15%

- TTM profit increase by at least 15%

- Increase in TTM operating margin

- ROE of more than 12% in FY 18

- Debt to Equity less than 1

- CFO positive in last three years

- PE less than 5 year Median PE

- Current stake of more than 3%

India Glycols (FII stake is 4.38%)

India glycols is a diversified green chemical company which operates in three segments: industrial chemicals, liquor and nutraceutical. It manufactures Ether Carboxylates and Ethylene Oxide Derivatives(surfactants), which are primarily used in consumer centric industries like cosmetics, polyester, detergents, pesticides, adhesives, pharmaceutical and paints. It is also the world's largest manufacturer of Bio - Mono Ethylene Glycol (Bio-MEG), which is produced by using renewable feedstock. Bio- Meg is primarily used in manufacturing of green PET bottles, which are used in packaging of beverages. India Glycols is also an exclusive global supplier of Coca-Cola for green PET bottles. Combined revenue contribution from its chemical segment, which includes Ether Carboxylates, Ethylene Oxide Derivatives and Bio-MEG was 62 per cent in FY18.

Its liquor division, which commenced in 2002, contributed 33 per cent to its revenues in FY18. Indian glycols has the license to sell its liquor and Indian made foreign liquor (IMFL) in states of Uttar Pradesh , Uttarakhand., Chandigarh, Punjab, Rajasthan under brand name of V20 Vodka, Beach House Rum, Soulmate Whisky and IGL, which is a part of its IMFL portfolio. The company also operates three distilleries in Uttarakhand, Gorakhpur and Saharanpur. It also has also tied up with Bacardi for bottling of its product.

The company also operates in nutraceutical segment, which is a newly incorporated business. It specialises in developing and manufacturing natural active pharmaceutical ingredients (APIs) by extracting medicinal value of seed or flower. Nutraceutical contributed 5 per cent to its revenues in FY18.

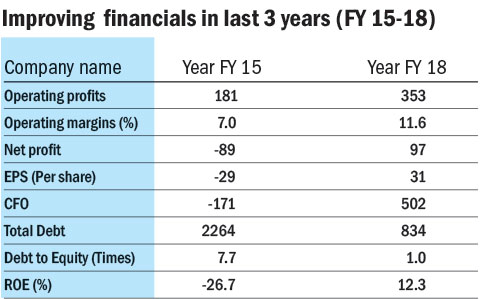

Company currently derives 30 per cent of its revenues from exports, which are expected to increase to 45 per cent in long term. In past 3 years, the company has shown significant improvement in its operating margins, profitability and RoE on the back of improving product realizations and higher efficiency, which makes it a prefect example of a turnaround. Below table summarises the turnaround of the company in last three years.

However, even after a dream-run in its operating performance, its RoE still remains around 12 per cent, while its dependence on short term borrowings and debt heavy status still continues to be a concern. Given chemicals is a cyclical industry, its business model still remains prone to external demand shocks. It currently trades at 5x its earnings in comparison to five year median of 14 times. Its stock has also fallen by around 45% in last one year, but this alone does not make it a potential 'buy' opportunity. Thorough research should be done on the part of investors to understand factors, which can impair this turnaround.

Confidence Petroleum (FII stake is 4.98%)

Incorporated in 1994, Confidence Petroleum is the Asia`s largest cylinder manufacturer. It is still run by its first generation entrepreneur, who started the company more than two decades back. Confidence caters to four segments: LPG cylinder manufacturing, LPG bottling assistance, Packed LPG Cylinders and ALDS ( Auto LPG dispensing stations).

Its 15 LPG cylinder manufacturing units have ability to manufacture around 50 lakh cylinders, which the company expects to increase to 70 lakh cylinders in next three years. Recently, company has also launched light weight, and blast proof cylinders under the brand name "Go Elite".

LPG bottling assistance segment caters to refilling of LPG cylinders with the help of 58 LPG cylinder Or stations in 22 states in India, which are further expected to increase to 100 stations in the next three years. Its plants are strategically located, which results in saving transportation cost. This strategy benefits the company in two ways: 1) They act as a storage points for its auto LPG pumps. 2) They provide cost efficient filling services to its clients like IOC, BPCL and Reliance. The company has a dealer network of more than 800 dealers across india.

Packed LPG cylinders division sells LPG cylinders to domestic, commercial and industrial segment with the help of its strong dealer network. This segment has also benefited from lower GST rates on domestic LPG cylinders. Recently, the government revised the GST rates on domestic LPG cylinders to 5 per cent in comparison to 18 per cent earlier, which has provided level playing field to private players.

Auto LPG dispensing systems (ALDS) is one of the fastest growing segment for Confidence Petroleum. The company operates under the brand name of "GO Gas". It provides dealership to dealers in this segment based on their credit-worthiness and ability to make significant investments. After fulfilment of the basic eligibility criteria company provides them with the dealership without any initial deposit and further provides them with the marketing assistance. Growth in this segment is not only driven by easy dealership process, quick break even of investment in less than 20 months but also by the government push towards cleaner fuel in Karnataka, Andhra Pradesh, Tamil Nadu and Maharashtra. In comparison to just 100 ALDS stations in 2016 its current stations stands at 178 as of Jan,2019 which are further expected to increase to 200 by March,2019.

Recently, the company has benefited largely by government's push towards cleaner fuel in southern India and the Ujjwala Yojna and direct transfer of subsidies to retail customers. Any change in regulations towards subsidy burden, LPG cylinder price regulation or increased government focus towards CNG can derail the company from its growth path. Further, the management is approaching its business very aggressively even projecting growth rates of 100-500 per cent in some of its segment in next three years, which may not be met. Although the management has infused Rs 105 crore in the company recently, it has also raised another Rs 78 crore from private placement.

Its revenues and profits have grown by more than 55 per cent and 212 per cent in last one year, while its ROE has also shot up to 13 per cent in 2018 against five year average ROE of 1.3 per cent. It also trades at 20 times earnings against five year median of 50 times driven by rapid earnings growth. One has to wait and watch if the company can sustain this growth in future.

Disclosure: The companies mentioned above are not our recommendations. If you intend to invest in any of them, do thorough research. TTM (Trailing twelve months)