Jai and Veeru were having some lemon tea and plum cake at the neighbourhood bakery to celebrate the Christmas eve.

Jai: I am so happy that we have just a week remaining in this year, Veeru. 2018 has been so horrible for my work and investments.

Veeru: I completely agree. Usually, if the stock market is behaving crazily, I like to park my Diwali bonus in debt funds. But recently, going from equity to debt has been like jumping from the kadai into the tandoor. With AAA-rated companies defaulting and NBFCs going through the Lehman moment, it was a tough time!

Jai: Yeah, but look at the positive side. It is because of this panic that we may get 8 or 8.5 per cent on debt funds, when inflation is 2.3 per cent. You're pocketing a 5 per cent real return. What a Christmas gift!

Veeru: You mention 'pockets' and here's our friend Gabbar looking like Santa Claus. Gabbar, what've you got for us? Your pockets seem to be full.

Gabbar: The kids asked for sweets from Mangatram. But good that you reminded me of my pockets. You see, after you two asked me to redeem small-cap funds, I put the money in debt funds. But some of them lost money in the IL&FS crisis and SEBI has now allowed something called 'side pockets'. They will take my money, invest in bad bonds and then put the bad bonds into their side pocket. Isn't it? Criminal that SEBI is allowing this!

Jai: Gabbar, side-pocketing for mutual funds is not like hiding your Diwali bonus in your pant pocket to save it from Bhabhiji!

Veeru: Ha ha, don't get so agitated, Gabbar; side-pocketing is a good thing.

Gabbar: How come? I have never heard of 'good' side pockets.

Veeru: Think of debt funds as the vegetable basket in your kitchen. Suppose you have a few potatoes, tomatoes, onions and a pumpkin in it. But the tomatoes are old and you suddenly find some are rotting. What will you do?

Gabbar: Take out the tomatoes and throw them so that the other vegetables don't go bad.

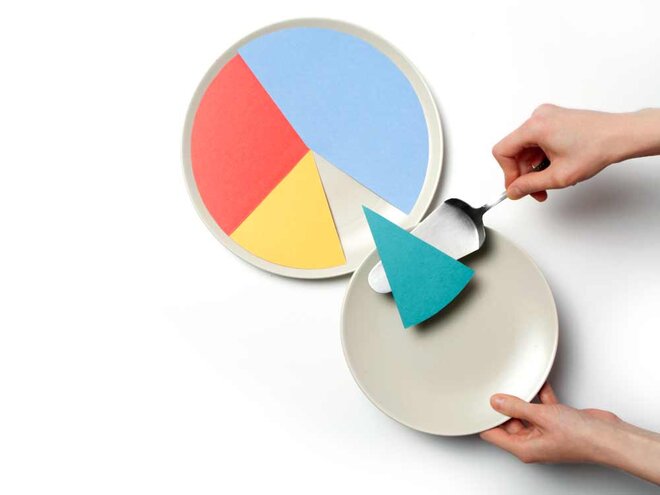

Veeru: Side-pocketing is very similar. For simplicity, think of a corporate-bond fund that has a portfolio made up of 10 bonds. Suddenly, one bond, which was rated AAA, went bad because the company stopped paying interest. So what should the fund do?

Gabbar: Sell it immediately, of course.

Jai: That's not as easy as you think, Gabbar. Once the buyer knows your tomatoes are bad, will he buy them? The bond market is the same. The moment everyone knows a company is not repaying, buyers avoid its bond. So, it isn't easy for a debt fund stuck with a default-grade bond to sell it.

Veeru: You should understand that the Indian bond market is not like the stock market. In the stock market, generally, there are buyers for stocks of stressed companies at a low price. But corporate bonds in India are bought mainly by banks, insurance companies and pension funds, which are very particular about the kind of tomatoes, sorry, bonds they own. So, it isn't easy to find buyers for risky bonds.

Gabbar: That doesn't mean the fund can pocket the bond. It's bought with my money.

Jai: No, no! Here's how it works. Suppose a bond fund managing Rs 1,000 crore has 10 per cent each in 10 bonds. Suddenly, one of those companies that has issued a bond - call it Chaupatram Limited - suddenly skips its interest payment and it is now doubtful if it can repay the principal. The fund, as per SEBI rules, has to write off the value of that one bond in its portfolio, maybe by 50 percent. This means that if the fund's NAV was Rs 100, it suddenly drops to Rs 95.

Gabbar: How horrible! That's a good bit of my yearly returns gone.

Veeru: Yes, that is unavoidable. But the reason why fund houses wanted side-pocketing was to ensure that the rest of the portfolio also doesn't take a hit. You see, when a bond fund suddenly sees a big drop in its NAV and you come to know it's because of a default, what will you do?

Gabbar: I will redeem that fund and think of going back to my small-cap fund.

Veeru: That's exactly the wrong thing to do. But many investors react like this. So, when one of the bonds in the fund is downgraded, investors often rush to redeem their units. Now, suppose 10 percent of the investors panic like this. The fund manager now has to sell one-tenth of his portfolio to repay them. But he knows that he can't sell the bad bond because nobody will buy it. He ends up selling the good and the most liquid bonds he owns. So, investors who stayed in the fund and didn't panic are now left with nine bonds, one of which is bad.

Jai: Yes, and they are worse off than before. Because earlier 10 percent of their portfolio was in the bad bond, but now that exposure has gone up to 11 percent. The more the investors who want to redeem their units, the worse the situation for those who stay back.

Gabbar: Sometimes panic is rewarding.

Veeru: Not always. Suppose Chaupatram Ltd sells its assets and repays 80 per cent of its dues to its bond investors. Then the fund would recover Rs 80 crore out of the Rs 100 it lent to the company. So, though it has valued the Chaupatram bond at Rs 50 crore in its portfolio, it has now got a bonanza of Rs 30 crore above that, which will go into its NAV.

Gabbar: But that's unfair to investors like me, no? I won't get that money because I redeemed my units.

Veeru: What is worse, your friend Basanti who bought the fund after all the panic at the lower NAV will now get to enjoy the extra Rs 30 crore.

Gabbar: What! Basanti pocketing it is even worse than my losing money.

Jai: That is exactly why SEBI has approved side-pocketing. With side-pocketing, as soon as Chaupatram Ltd defaults, the fund can decide to move the Rs 100 crore bond into a separate portfolio until it is finally sold. The NAV of the fund will be recalculated to exclude the bad bond, while the side pocket will have its own NAV based on the valuation of the Chaupatram bond.

All investors in the fund will get additional units in the side pocket. But new investors buying the fund after the default will not get shares in it. So, if Chaupatram Ltd pays up, only old investors with the side-pocket units will get the money.

Veeru: This helps in two ways. Your fund will not suffer panic exits from investors because the rotten tomato immediately gets separated into a side pocket. At the same time, you will get to enjoy it if the bad bond finally realises something.

Gabbar: Sounds like a wonderful idea.

Veeru: This idea isn't a new innovation. In markets like those of the US, hedge funds use side pockets all the time.

Jai: But side pockets can have some minuses. In fact, that is why when JP Morgan Fund first asked SEBI about side pockets a few years ago, it didn't permit it.

Gabbar: Why?

Jai: The worry is that once you allow debt funds such an easy solution to bad bonds, fund managers will take too many risks and create too many side pockets. What's happening in those side pockets can become quite difficult to track for investors and raters, too. Over time, people can lose track of the side pocket.

Gabbar: Hmm, I can understand. When I wear my cargo pants, I always forget which pocket I put my car keys in.

Veeru: Valuation is another issue. Because the side pocket always has doubtful bonds which are not very liquid, its NAV can be computed in any way by the fund house. In the US, I heard of a case where a hedge fund overvalued its side pocket, so that it could continue to earn a fat management fee on it.

Jai: It is best that funds are not allowed to charge fees on side pockets. First you make a mistake and then charge fees! There was also this case where the US SEC, which is like our SEBI, found the fund company quietly taking away the dividends and other earnings from the side pocket because investors didn't know what was going on in it.

Gabbar: Oh, but how can they do that? Surely, someone should be checking the side pocket, as my wife does.

Veeru: Yes, possibly the fund's trustees can be asked to do so.

Jai: There's another tricky issue when you allow a fund to create a side pocket. If the news of default leaks out, panic exits can happen even before the creation of the side pocket.

Veeru: Yes, SEBI has just allowed side-pocketing, so the rules on such issues may be announced later.

Jai: Also, I don't think funds will use the side pocket too often, just because it is allowed. Every time there's a bond default, there's so much furore over it. Open-end funds can't afford such reputation damage.

Gabbar: Yes friends, you have convinced me that side-pocketing is a good idea. Now let me hurry home before the sweets in my side pockets melt to zero value.