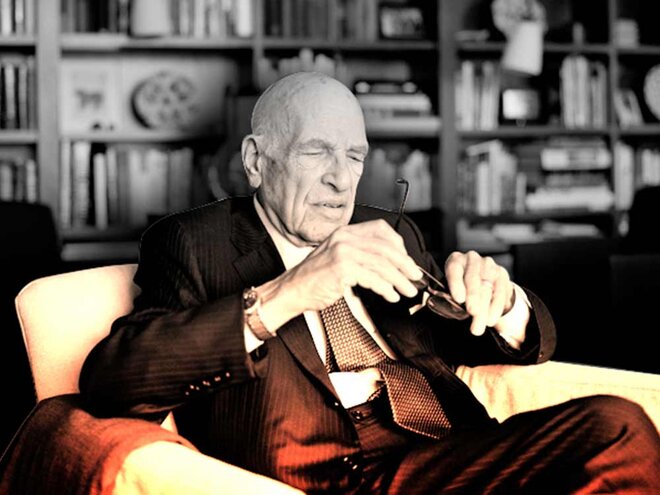

To be called a "super investor" by none other than Warren Buffett himself is no mean feat. Walter Schloss, a follower of Ben Graham's value investing approach, is known to look for bargain stocks that traded at huge discounts to there their value. Over a 50-year span, this super investor earned gross returns averaging 20 per cent annually.

We applied Walter's principles and refined them a little to match today's time and looked for stocks. We looked for stocks trading at discount to book value. Next, he preferred companies that had no or very low debt. We included companies that had financial history of at least 10 years with net profits compounding more that 10 per cent during the same time. Walter Schloss also preferred companies that were able to produce positive cash flows, that's why we included companies that delivered positive cash flows from operations over the past five years. Finally, he preferred companies with depressed stock prices, which is why we sifted through stocks that have current PE at more than 50 per cent discount to their five-year median PE.

Filters:

- Market capitalisation >Rs 400 Crore

- Price/book <1

- Debt/equity: 0-0.3

- Promoter holding >25%

- 3-year average ROCE >12%

- 10-year profit CAGR>10%

- Positive cash flow from operations in the last five years

- TTM PE is at or more than 50% discount to five year median PE

Force Motors (FM): Based out of Pune, Force Motors is an automobile company involved in manufacturing of LCVs (Light Commercial Vehicles), SCVs (Small Commercial Vehicle), utility vehicles, agricultural tractors and diesel engines for luxury auto brands -- Mercedes and BMW. The proportion of the company's sales value derived from vehicle manufacturing and selling on the one hand, and components - engines, axles manufacturing for Mercedes Benz and BMW on the other hand, is the same. During March 2018, the Company entered in a joint venture with Rolls Royce Power Systems to build Series 1600 generator sets, which are suitable for power generation and rail under floor applications, for Indian as well as global markets.

Post the Bajaj Group's exit in 2014, Force Motors has seen acceleration in sales growth, capex and tie-ups. The company has over the years reduced its long term debt and is currently debt free. It has been able to grow both its sales and net profits by about 14 per cent in the past 10 years, annually. The presence of the company across diverse business segments has helped it to reduce the pain from cyclic nature of the business. The company has faced multiple headwinds in the recent past like higher GST rate of 43 per cent, negative sentiments around diesel engines, evolving regulatory (axle loads, inner-city and inter-city permits) environment and introduction of BSVI engines in 2020. These headwinds have led to a price correction of more than 50 per cent in the last one year and it currently trades at a PE of 10.5x.

Gujarat Narmada Valley Fertilizers and Chemicals (GNFC): The company manufactures fertilizers and industrial chemicals. GNFC also has a small information technology business that supports various government organizations. It derives about 70 per cent of its revenues from the chemical business, while the rest comes from fertilizers and IT division. GNFC has two plants in Bharuch and Dahej (Gujarat). The company has evolved from a pure play fertilizer company to manufacture other high margin chemicals by forward integrating gas and ammonia used for urea production.

GNFC has more than 50 per cent market share in all its chemical product segments, except Ethyl Acetate and Acetic Acid. The company is the sole producer of Acetic acid in India. It is planning an expansion for production of Ascetic acid, as the demand for the product is about 1.5MT in the country, while GNFC has a production capacity of 159,000 tonnes only. Last year, the company repaid its debt and as a result the interest outgo will be negligible in the coming years. While cost efficiencies and zero long-term debt are support factors for sustainable earnings, variations in chemical pricing, delay in expansion plans and impact of government policies on the fertilizer business remain key concerns. The stock price has corrected by about 50 per cent in the last one year and currently trades at a PE of 4.0x.

Gujarat Alkalies and Chemicals (GACL): Incorporated in 1973, GACL is engaged in manufacturing of caustic soda (accounting for majority of its revenue) and 36 other allied products. It is one the largest producer of caustic soda in the country, with an installed capacity of 4.3 lac MT as of March 2018 end and has about 11 per cent share in the domestic chlori-alkali market.

GACL has two manufacturing plants located at Vadodra and Dahej, Gujarat. The Company exports its products to various Asian and African markets, which contribute about 10 per cent of the total revenue. GACL under its expansion plan had formed a joint venture with NALCO for setting up a caustic soda plant integrated with a coal-based power plant in Dahej. Some of the areas of concern for the company include cheap imports, rising cost of power and impact of appreciation of US dollar on imported materials such as rock phosphate and potassium chloride etc. The stock price has corrected by about 45 per cent in the last one year and currently trades at a PE of 4.4x.

Disclosure: The companies mentioned above are not our recommendations. If you intend to invest in any of them, do thorough research.