Intrinsic value is a company's fair value, its real worth. As a popular practice, it is calculated through 'discounted cash-flow analysis,' which tries to calculate the present value of future cash flows. In simpler terms, it refers to the price you are paying today for the company's future profits, taking into account the risk involved.

For instance, a person who is expected to receive Rs 1 lakh in 10 years from now should be equally satisfied if he receives Rs 32,000 today, assuming he expects to earn a return of 12 per cent per annum in the next 10 years. Similar is the case with the intrinsic value of a stock. It is the sum of the present value of a company's future cash flows. If the current price of a stock is below the intrinsic value, then the stock is undervalued. If it's over that, the stock is overvalued.

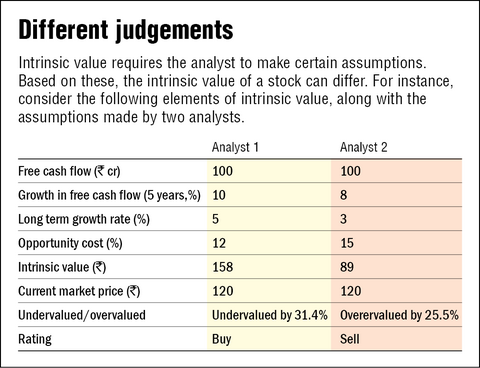

The calculation of future cash flows isn't easy. While calculating future cash flows, several assumptions are made about the company's revenue growth, margins, profitability and discount rates. So, in the practical scenario, these assumptions can go for a toss, thereby leading to significant deviations in the stock's actual intrinsic value. Even the slightest difference in discount rates can lead to a significant difference in the intrinsic value of a stock. Probably, therefore, the target prices of different brokers differ considerably (see the table).

Benjamin Graham, who was one of the most prominent believers of intrinsic value, often emphasised margin of safety. Margin of safety means buying a stock below its intrinsic value. But how can we ensure that the calculated intrinsic value is trustworthy or the assumptions used in the calculation are correct?

Given the subjectivity involved in its calculation and the unavailability of qualitative measures like management quality or corporate governance, we cannot repose our faith in intrinsic value alone. If the intrinsic value is wrongly calculated, the investor might feel he is buying the stock with a margin of safety, which is not the case after all.

The concept of intrinsic value will not hold if the company has corporate-governance issues. This is because in such companies, the financials are probably fudged. It may work for stable companies; however, many of those companies may trade far above their intrinsic value for a long period of time, owing to their superior earnings quality and management.