India's fourth-largest NBFC-Micro Finance Institution (MFI) with a loan book of Rs 4,437 crore (as of FY19), Spandana Sphoorty provides income-generating loans to women from the low-income group under the joint liability group model, with 94.6 per cent of its portfolio located in rural areas. According to the joint liability group model, 4-10 individuals come together to avail loans on an individual basis or through the group mechanism against the mutual guarantee. The company went into Corporate Debt Restructuring mechanism in 2010 owing to the enactment of AP Microfinance Ordinance, which enforced several restrictions on the operations of MFIs, thereby impacting the debt servicing capability of the company.

Further, the company restructured its debt and made efforts towards portfolio diversification, process improvement and cost rationalisation. All these initiatives led to operations turning profitable by March, 2014. In 2017, the company received a capital infusion of Rs 300 crore from

Further, the company restructured its debt and made efforts towards portfolio diversification, process improvement and cost rationalisation. All these initiatives led to operations turning profitable by March, 2014. In 2017, the company received a capital infusion of Rs 300 crore from

Kangchenjunga, corporate promoter and a fund with a majority holding of Kedaara Capital along with other global funds and Kedaara AIF - 1.

Since exit from CDR in 2017, the company's credit rating (by ICRA) improved from BBB- (Stable) in August 2017 to BBB+ (Stable) in May 2018 and to A- (Stable) in March 2019, which helped it access funds from multiple sources to fuel growth in AUM at 85 per cent CAGR between FY17-19. Through the IPO proceeds, the company is looking forward to increasing its capital base by Rs 400 crore of fresh issue and pursuing its expansionary business plans.

Strengths

1) Geographically diversified operations: Spandana operates in 16 states and one union territory, covering 269 districts through its 929 branches. The company has put various caps on gross loan portfolio at the state and district levels. As a result, no single state and district contributes more than 20.0 per cent and 1.8 per cent, respectively, to the AUM.

2) Improving asset quality and credit profile: Since its exit from CDR, the company's credit rating (by ICRA) improved from BBB- (Stable) in Aug 2017 to BBB+ (Stable) in May 2018 and to A- (Stable) in Mar 2019, enabling it to access funds from multiple sources at lower costs and grow its AUM aggressively. Also, over the years, the company's asset quality has improved, with net stage three (excluding AP portfolio) Portfolio at Risk which represents the total loan outstanding that are overdue for 90 days or more at 0.01 per cent as of FY19.

Weakness

1) Limited testing period: The company came out of the CDR mechanism in 2017 and therefore, FY18 and FY19 were the only two meaningful historical years for review. During both these years, the company pushed growth aggressively, registering a disbursement growth rate at 87 per cent and 27 per cent, respectively.

2) High attrition rate: The rate of attrition starting from branch manager and above, who are critical for the business, was 25 per cent in FY19.

Risks and concerns:

1) Geographical risks: As of FY19, around 73 per cent of the company's portfolio was concentrated in the five states of Odisha, Madhya Pradesh, Karnataka, Maharashtra and Chhattisgarh. Any problem in these states, including economic slowdown, natural calamity, political unrest and others, can impact the company's operations.

2) High Gross NPA: In FY19, the last three-year average Gross NPA was more than 25 per cent. High Gross NPA year on year results in the company making higher provisions which affect profitability.

3) Higher risk than secured lending: Microfinance loans are unsecured in nature and carry a substantial risk of default.

4) High rural concentration: About 94.6 per cent of the company's portfolio is concentrated in rural areas. Although it enables the company to grow in under-penetrated areas, it puts the company at a greater risk of any adverse development to the rural economy.

Total IPO size: Rs 1,198-1,201 crore

Fresh Issue: Rs 400 crore

Rise in Capital Base: Rs 400 crore

Offer for Sale: Rs 798-801 crore

Promoter Group

Kangchenjunga: Rs 510 crore

Padmaja Gangireddy: Rs 121 crore

Vijaya Siva Rami Reddy Vendidandi: Rs 68 crore

Other Private equity Investors: Rs 100 crore

Additional details

Price Band: Rs 853-856

Subscription Dates: 5-7 August 2019

ROE (FY 2019): 19.0 %

Revenue (FY 2019): Rs 1048.5 crore

Post-IPO, promoter holding: 63 per cent (including Promoter group)

Post IPO valuation: Rs 5,485-5,504 crore

Equity (Pre IPO): Rs 1,890 crore

Equity (Post IPO): Rs 2,290 crore

Management

1. Has the company been free of any regulatory penalties?

Yes. However, RBI, in its annual inspection of the company for FY18, shared concerns regarding the company's adherence to pricing guidelines as prescribed under the RBI's Master Directions. The company has already submitted its response and is now awaiting a reply.

2. Does the company adequately provide for its non-performing assets (NPAs)? More specifically, is the ratio of provisions to Gross NPAs more than 50 per cent?

Yes, the company provided for the provision of almost 100 per cent for FY19 Gross NPAs, leading to 0.0 per cent Net NPA.

3. Do the top five managers have stock as a meaningful part of their compensation (More than 50 per cent)?

No, the company introduced its ESOP plan in 2018 but no options have been allotted or exercised as of now.

Financial Strength and stability

1. Does the company have fresh slippages to total advances ratio of less than 0.25 per cent? (Fresh slippages are loans that have become NPAs in the last financial year).

No, for FY19, the company had fresh slippages of 0.6 per cent to total advances.

2. Did the company generate a current return on equity (RoE) of more than 12 per cent and return on assets (RoA) of more than one per cent?

Yes, the company recorded an ROE of 19.0 per cent and a return on average gross AUM of 8.2 per cent as of FY19.

3. Did the company increase its loan book by 20 per cent annually over the last three years?

Yes, on a standalone basis, the company increased its loan book by 27.3 per cent in the last three years.

4. Did the company increase its Net Interest Income (NII) by 20 per cent annually over the last three years? (Net interest income is the difference between the revenue that is generated from a bank's assets and the expenses associated with paying out its liabilities).

Yes, on a standalone basis, its net interest income grew by 46.8 per cent during the 2016-19 period. It grew from Rs 214.4 crore in FY16 to Rs 678.2 crore in FY19.

5. Is there any direct relationship between the increase in loan book and the increase in Net Interest Income (NII)?

Yes, they both appear to move in line with each other with a very strong correlation of 0.98 (Correlation of one indicates a perfect relationship with each other) during the period FY16-19.

6. Is the company's capital adequacy ratio more than 15 per cent? (The capital adequacy ratio (CAR) is a measure of a bank's capital. It is expressed as a percentage of a bank's risk-weighted credit exposures).

Yes, as of March 31, 2019, its capital adequacy ratio stood at 39.6 per cent in comparison with 15 per cent mandated by RBI. Further, the proceeds raised from the IPO will be used for increasing the capital base.

7. Can the company run its business without relying on external funding in the next three years?

No. The company came out of CDR mechanism in 2017 and since then, has resorted to aggressive disbursement. In view of lowering interest rates in the economy, improving credit profile for the company and a lower loan portfolio per branch as compared to larger peers, the company would require to rely on external funding for further expansion.

8. Did the company generate average NIM of more than three per cent in the last two years? (Net interest margin or NIM denotes the difference between the interest income earned and the interest paid by a bank or financial institution relative to its interest-earning assets like cash).

Yes. The company generated an average NIM 15.7 per cent in the last two years, since getting out of CDR mechanism.

9. Is the Average Gross NPA Ratio (Gross NPAs/Total Advances) over the last three years less than one per cent and the Net NPA Ratio (Net NPAs/Total Advances) less than 0.5 per cent?

No, being in highly risky microlending business, the average Gross NPA for the last three years stood at 25.3 per cent and the average Net NPA for the same period stood at 1.06 per cent.

10. Does the company have a cost-income ratio of less than 50 per cent?

Yes, the cost-income ratio stood at 25 per cent for FY19.

Growth and Business

1. Will the company be able to scale up its business?

Yes. The company is present in 16 states and one union territory, with a total of 929 branches and around 7000 employees. In terms of AUM, the company is the fourth largest NBFC-MFI. Also, according to 2011 Census, rural India accounted for about 47 per cent of the net domestic product but only 10 per cent of the country's total credit as compared to 90 per cent for urban India giving ample potential to microlenders to grow in rural India. Low loan ticket size, under penetration of credit, maturing industry along with regulatory oversight, governments push towards financial inclusion and direct benefit transfers, use of technology and increasing mobile/internet penetration will drive the scalability.

2. Does the company have a loan book of more than Rs 100,000 crores?

No, Spandana had a loan book of Rs 4267.8 crores as of March 2019.

3. Does the company have a recognisable brand truly valued by its customers?

No, the cost of borrowing for the company stood at 12.8 per cent compared to 9.8 per cent of the market leader. Plus, it is the fourth-largest player in a highly competitive and commoditized market. Although the company increased the total number of clients to 2.4 million in FY19, they were still way lower than the leader, Bharat Financial Inclusion's 7.4 million clients.

4. Does the company have a credible moat?

No. Although the company in the last two years after exiting from the corporate debt restructuring mechanism in 2017 improved its operational efficiency and raised its ROE to 19 per cent in FY19, it still remains a mediocre player in the commoditised microlending industry. This is depicted by a higher cost of borrowing by the company relative to its peers.

5. Is the level of competition faced by the company relatively low?

No. The company faces significant competition from unorganised, small participants in the market, in addition to other small finance banks, MFIs, scheduled commercial banks and NBFCs, as well as local money lenders.

Valuation

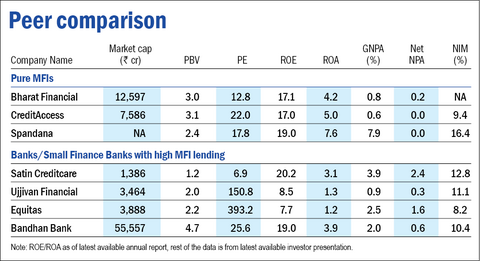

1. Is the company's price to earnings ratio less than its peer median level?

No, it is priced at a PE of 17.8 based on post IPO fully diluted earnings - above the industry median PE of 12.8.

2. Is the company's price to book value less than its peer median level?

Yes, its price to book stands at 2.4x based on fully diluted post IPO basis, which is less than the industry median of 3.2x.

3. Is the company's PEG ratio less than one? (The price/earnings to growth ratio (PEG ratio) is a stock's price-to-earnings (P/E) ratio divided by the growth rate of its earnings for a specified time period).

No, its PEG ratio stands at 2.0 times based on three-year CAGR earnings growth.

The book running lead managers- Axis Capital, ICICI Securities, IIFL Securities, JM Financial, IndusInd Bank and Yes Securities

* The lower the score you find here, the riskier the stock

Disclosure: Author may be an applicant in this Initial Public Offering.