As the competition among mutual funds is intensifying, fund managers and of course, the funds they manage are under pressure to outperform the benchmark. Since fund houses have people with in-depth experience and expertise in making buying-and-selling decisions, it is worth tracking their buys to get a good idea of what kind of bets they are willing to take and where they are willing to take them.

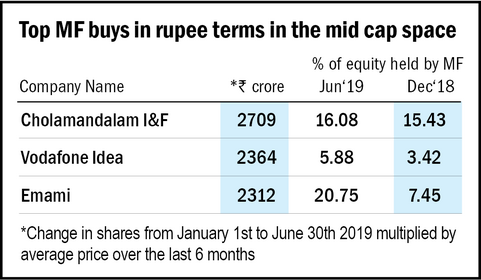

We have delved into the highest amount spent by the mutual fund industry in the mid-cap space in the first half of the calendar year and come up with the following three stocks. With an NBFC and a struggling telecom operator coming up as the top buys, we wonder whether managers have resorted to contrarian bets to generate significant alpha.

Cholamandalam Investment and Finance Company

Starting its journey as an equipment finance company, this part of the Murugappa group has now become a full financial services company offering vehicle loans, home loans, home equity loans, SME loans, investment advisory services, stockbroking, to name a few. The company operates through 911 branches and its assets under management stood at Rs 57,560 crore as of FY19.

Like any other NBFC, this company faced the brunt of the IL&FS defaults and the liquidity crisis thereafter. As a result, in line with most NBFCs, its borrowing profile has shifted more towards bank borrowings than market borrowings. The share of bank borrowings in the borrowing profile increased from 41 per cent in FY18 to 49 per cent in FY19.

Coming to its financials, the gross NPAs came down significantly from its highs in FY17, which were at 4.7 per cent compared to 2.7 per cent in FY19. Growth in disbursements saw a drop from 35 per cent in FY18 to 21 per cent in FY19, which is still decent, given the health of the sector. However, a concern is its net interest margin, which has been declining consistently from 8.7 per cent in FY16 to 6.9 per cent in FY19. Capital adequacy ratio as on FY19 stood at 17.4 per cent, which is above the required 15 per cent. Its assets under management have increased at a CAGR of 20 per cent in the last five years. The company currently trades at a price to book of 3.27 times, which is at its five-year median.

Vodafone Idea

A merger that came out of two telecom players fighting for survival post-Jio's disruption in the sector, Vodafone India and Idea as a single entity has the highest market share in terms of wireless subscribers, with a 33.36 per cent market share according to TRAI's May 2019 press release. However, the company is on thin ice, following Reliance's claim in its recent AGM to be the largest telecom operator in the world with 340 million subscribers and still growing. On the other hand, Vodafone Idea and Airtel keep losing subscribers.

A significant jump in mutual funds buying in the company is because of the Rs 25000-crore rights issue that the company had in the last year. Nevertheless, in the last quarter, most of the mutual funds sold a significant stake in the company.

In the last year, the company admitted consolidating its subscriber base owing to a significant fall in its average revenue per user (ARPU) following Jio's entry. The company ensured minimum recharges and lost subscriber base in the process but was also able to increase its ARPU, which reflected in its Q4 FY19 revenues. The company's ARPU has been on a rollercoaster ride since the last financial year, declining from Rs 92 in the first quarter to Rs 89 in the Q3 and then, going up to Rs 104 at the end of the year, which showed their consolidation of subscribers working out. However, the ARPU is still lower than its rivals Bharti Airtel and Reliance Jio.

Emami

Incorporated in 1974, this FMCG company has its niche in segments like antiseptic cream, talcum powder, cooling oil, pain balm and pain reliever. Its power brands, namely Navratna oil, Boroplus cream, Zandu, etc., contribute around 75 per cent to its total revenue. The company's network covers more than 60 countries, with exports contributing 13 per cent to the total revenue.

Recently, its stock has come under pressure owing to its weak operating performance and high pledge of promoter stake. At the group level, debt is high because of its investments in cement, power and healthcare. Its promoters, on the other hand, are trying to monetise assets and have even divested their stake, which came down to 52 per cent by the end of June 19 from 70 per cent as on December 2018. The promoters have also guided for clearing all the debt at the group level, which stands at Rs 2600 crore, in the next nine months.

In terms of financials, its sales have increased at a compounded growth rate of eight per cent over the last five years. However, its earnings have decreased six per cent in the same period, which has resulted in ROE consistently declining yet it remains at a healthy 15 per cent. Operating margins, too, have been on a consistent decline in the last five years. The company currently trades at a PE of 44 times, down from its five-year median of 60 times.

Disclosure: The intent of the article is not to recommend any specific stocks. If you wish to invest in any of the above-mentioned securities, please do thorough research.