Making money in the stock market requires a great deal of discipline. You will encounter various distractions that can derail your investing journey. The 'financial-noise' industry has a way of getting to people - through the internet, television, newspapers and second-hand opinion of those who follow it. It's very hard indeed not to succumb to it all. You need to turn a deaf ear to the noise and continue to back your convictions. That should hold you in good stead.

At Value Research Stock Advisor, while we keep a constant vigil on the stocks that we recommend, we don't forget that much of the news is actually pointless as far as long-term investing is concerned. We have witnessed many cases where investors sold out of their stocks prematurely and hence were deprived of true wealth creation.

Here are some of the reasons which, on their own, are not good enough to sell a stock.

The stock price has gone up

Often the difference between a great investor and an average one boils down to when he exits a stock, not when he buys it. A lot of investors book profits after a stock has risen two or three times. Just a few have the conviction to hold onto it to watch it grow 10, 50, or 100 times.

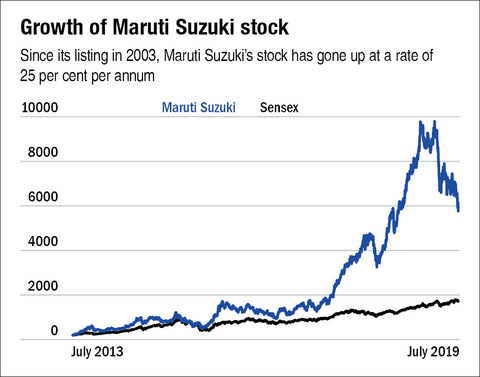

Take Maruti Suzuki for example. After making its stock-market debut at a price of Rs 164 in July 2003, the stock rapidly grew by more than three times in less than one year. It trades above Rs 5,000 today, yielding more than 25 per cent return per annum since its listing. Imagine the amount of wealth you could have foregone by exiting it too soon.

Don't sell your stock simply because it has doubled or trebled. Solid companies with great products and exceptional managements are capable of generating far more wealth than that. The last thing you want to do is to clip the wings of your high fliers. If your investment rationale is intact, let your winners soar higher and higher.

The stock price has gone down

In the short term, the market is just a barometer of investor sentiment. Time and again, the price of your stock may fall sharply without there being anything fundamentally wrong with the company. The fall may be triggered by some petty news about the company or due to a market-wide correction. Refrain from acting in response to such events. Instead, keep focusing on the fundamentals of your stocks rather than stock prices. Wishing that your stocks should go up every single day, week or month is not how you should expect them to behave. It just doesn't. As Rudyard Kipling said, "If you can keep your head when all about you are losing theirs, you'll be a man, my son.''

A bad quarter or two

It's important to focus on the long-term performance of a company. Not-so-great results in one or two quarters don't necessarily mean that the fundamentals have changed. If the company or the industry is going through a rough patch, trust the management of a well-run company to steer it back on track. As Nick Train, co-founder of Lindsell Train, a fund manager said, "It seems to me that it is more likely that experienced, smart managers of a company with temporary problems will find a solution to those problems than that I will successfully switch out of said challenged company into a better one."

Rebalancing

You would have heard about the virtues of rebalancing your portfolio from time to time to avoid concentration risk and to book profits in holdings that have run up. But practise it with caution. You should not sell your performers in the name of rebalancing.

Even the best of equity portfolios will have several average-performing stocks, a few poor ones, and a handful that become multibaggers to deliver blockbuster returns. The last ones drive the portfolio's outperformance and it's important that you don't sell them just because their concentration has gone a bit out of proportion.

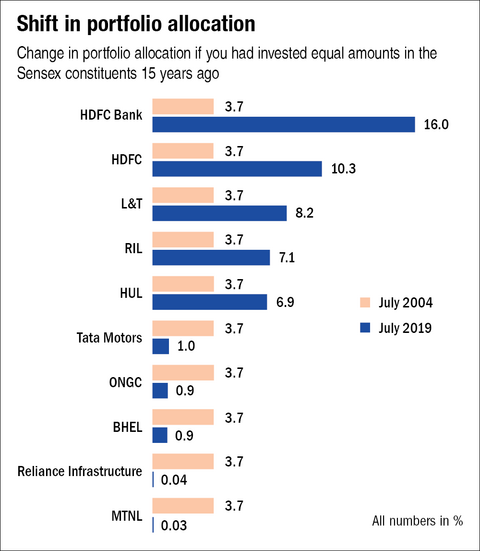

Here's a simple analysis of the S&P BSE Sensex to demonstrate this point. We took the constituents of the Sensex 15 years back, in July 2004 (excluding three companies whose recent price history is not available due to delisting, merger, etc). If an investor had put equal amounts in the remaining 27 stocks in July 2004 and held onto them for the next 15 years, he would have earned 15 per cent annually. But over a third of these returns would have come from only the top three stocks!

As a result of their outperformance, the allocation to these three stocks in the portfolio increased from 3.7 per cent each at the start to 16 per cent, 10.3 per cent and 8.2 per cent, respectively. Had an investor partly sold off these stocks because their allocation grew four or five fold, he would have earned much lower than 15 per cent.

Your winning stocks matter a lot. Even one or two multi-baggers can completely change the scale of your portfolio returns. It's true that over a period of time, their outperformance will skew your portfolio allocation. But don't let that bother you too much.

Retail investors have an advantage here. Institutional investors will be constrained by mandate on how much they can allocate to individual stocks, the minimum number of stocks they must hold, etc., but you can invest without such constraints. Let your multi-baggers make you rich, very rich!

How does Value Research Stock Advisor help you stay on course? As a subscriber of Value Research Stock Advisor, you get frequent updates about the long-term health and potential of the recommended stocks. These ensure that you don't sell out your winners Prematurely.