Early 2017 was when we started seeing ads on our TVs and other mass media channels that demystified myths and educated people about Mutual Funds. The broad storyline featured a common working class individual being informed about Mutual Funds by his friend/colleague in a conversation which might have taken place in any of our lives. The ad/conversation usually ended with "Sahi Hai" which roughly translates to "It is Good". The phrase caught on pretty quickly among the masses. But ever wondered - Mutual Funds Kyun Sahi Hai?

Indians have historically been good savers. We do a reasonably good job of saving some money from our monthly incomes. But saving alone is not enough. You must aim to grow your savings faster than the rate of inflation, so that in the future you can afford the same things at the very least, but ideally much more. This is where investing helps you.

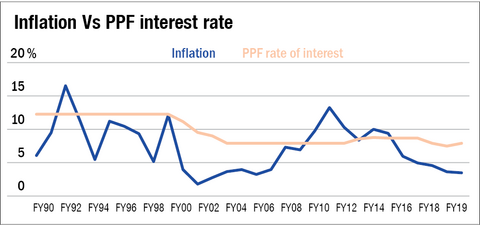

But our traditional investing options are far from optimal. The illusion of high assured returns has kept us hooked to fixed income alternatives such as bank deposits and small savings schemes for a long time. There was a time when our trusted friend PPF used to offer as high as a 12% annual return, while the returns from other small savings avenues were also thereabout. But what investors need to realize is that even inflation used to be a double-digit number in those times (see graph below). Therefore in real terms, after accounting for inflation, they hardly earned anything. In recent times, as inflation has climbed down, so has the interest offered on bank deposits and to some extent on government-backed saving schemes as well.

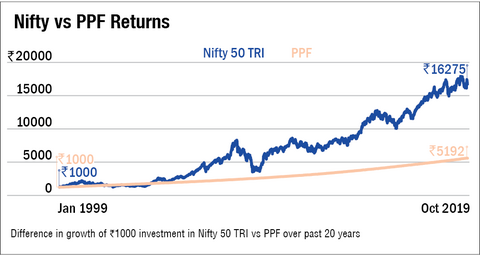

The bottom line is that fixed income investments barely yield any meaningful returns above the rate of inflation. Investors must shed their affinity to fixed income and embrace equity to beat inflation by a wide margin and become rich. The graph below shows the magical difference equity can make to your money's worth over a long period of time.

But despite its wealth-creating potential, the sharp ups and downs of equity markets act as a big deterrent. For those used to the steadiness and predictability of PPF, it can be extremely intimidating to see their investments rise and fall by 15-20%, or even more!.

If you notice in the graph above, while equities rise and fall in the short run, they move steadfastly up in the longer term duration of 5 years or more. As the investment horizon increases, equity investments comfortably outperform any other avenue.

So how does one start investing in equity? The simple answer to that is through Mutual Funds, which are great vehicles to invest in equity markets. They offer many advantages to small investors.

- Professional help: Unlike a PPF or a bank FD, investing in equity requires skill which most small investors don't have. But a mutual fund employs an entire team of professional investors to invest on your behalf.

- Diversification: With as little as Rs 500, you are able to get a stake in a diversified portfolio of several stocks which is otherwise not possible in your individual capacity.

- Invest-as-you-go: You don't need a mountain of money at the outset. You can start investing in mutual funds with even as little as Rs 100 a month. Besides facilitating small ticket investments, investing monthly through a systematic investment plan (SIP) also helps tide over anxieties related to market volatility to some extent, since your cost of investment gets averaged out across several months.

So go ahead and take your first step towards equity! If you're too worried about the ups and downs, go for hybrid funds instead of pure equity funds. They invest a portion of your money in safer debt instruments and therefore fall less when equity markets do. That helps you stay the course.

Remember the first time you rode a bicycle and how someone held the rear end of your cycle seat to prevent you from falling? Didn't it give you confidence even as you peddled ahead shakily? Hybrid funds work in a somewhat similar way. The safe hands of debt ensure that you don't land hard if markets were to crash, even as the equity portion peddles on to grow your money. And before you know it, you'll learn to ride the proverbial "investment bicycle" on the path to prosperity!

Remember, saving is important to create wealth, but not sufficient. You must invest wisely as well. And what better way to grow you money than the "sahi" way, kyon ki "Mutual Fund Sahi Hai!"