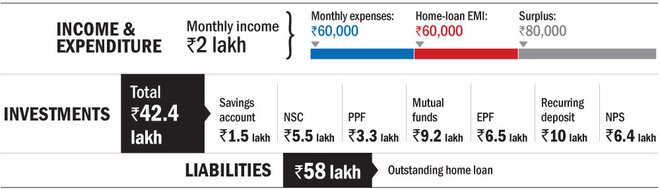

Prateek works with a software company and earns about Rs 2 lakh monthly. He lives with his homemaker wife and two kids - a five-year-old daughter and a three-year-old son. His monthly expenditure is Rs 60,000. Besides this, he pays an EMI of Rs 60,000 for a home loan that he took a couple of years back. The current outstanding amount of the loan is around Rs 58 lakh. With this, the family's total monthly outgo is Rs 1.2 lakh. Besides getting an investment road map for his retirement and children's higher education, Prateek wants to know if he should divert the surplus to prepay his home loan. At present, he has a sizeable corpus of Rs 42.4 lakh spread across mutual funds, NPS, PPF and others.

Emergency corpus

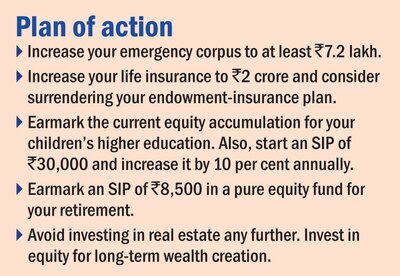

Prateek maintains a buffer of Rs 4 lakh in a combination of a savings bank account and debt mutual funds. It's a wise decision to invest a part of your contingency fund in liquid and ultra-short-duration funds to earn higher returns without compromising on liquidity. However, Prateek should increase the contingency fund to at least Rs 7.2 lakh, equivalent to six months of his expenses. He has a five-year-old recurring deposit, which will mature within three months and is likely to fetch him around Rs 10 lakh. A part of it can be used for this purpose.

Insurance

Both Prateek and his wife have term insurance of Rs 1 crore each, along with a floater health cover of Rs 15 lakh. The health cover should be sufficient for now. But since Prateek has an outstanding loan of Rs 58 lakh, a life cover of a mere Rs 1 crore may not be sufficient for the family's living expenses and the children's higher education if he should not be around. He should increase his life cover by another Rs 1 crore. On the other hand, since Prateek's wife is a homemaker with no financial dependents, she doesn't need such a hefty life cover. You need a life cover only if you have financial dependents. Prateek's wife also has some investment in an endowment policy, for which they are paying Rs 17,000 every year as the premium. Endowment life insurance yields poor returns and provides insufficient cover. The couple should consider surrendering it and invest the proceeds in equity mutual funds for better returns.

Children's higher education

Prateek feels that a corpus of Rs 1 crore will be sufficient for the higher education of his children. He would need this amount in approximately 13 to 15 years from now at an inflation-adjusted level. His equity-fund portfolio is around Rs 6.7 lakh. Considering a modest return of 12 per cent per annum, this would fetch him about Rs 29 lakh after 13 years. An SIP of Rs 45,000 in pure equity funds would help him meet the required goal. Alternatively, he can earmark an SIP of only 30,000 for this purpose, but that would require him to increase the contribution every year by 10 per cent.

He has also been investing some amount in Sukanya Samriddhi Yojana (SSY) for his daughter's wedding. While SSY gives you guaranteed returns, it may not be the best product to invest in for such a long horizon as it is purely a fixed-income product. To get inflation-beating returns, Prateek should invest Rs 2,500 in equity funds and increase the contribution by 10 per cent every year.

Retirement

Given his current expenditure level, Prateek would need a corpus of around Rs 7.4 crore. His investments in the NPS, National Savings Certificates (NSCs), the PPF and the mandatory EPF contributions are likely to fetch him Rs 2.7 crore by the time he retires. For the remaining amount, he should earmark an SIP of Rs 8,500. The SIP contribution should be increased by 10 per cent every year.

Home loan

By prepaying the home loan, Prateek would save on the interest, which is around 9 per cent. But a good equity mutual fund can give him a significantly higher return over a long period of time. As a category, flexi-cap funds have returned around 12 per cent over the last 10 years. So, it may not be a wise decision to use the surplus to repay the loan early for as long as it helps Prateek earn more than what he would save on the home loan interest.

However, if Prateek is not confident of maintaining a similar income in the future or if he feels nervous with such a huge liability, he can choose to prepay the home loan.

Portfolio

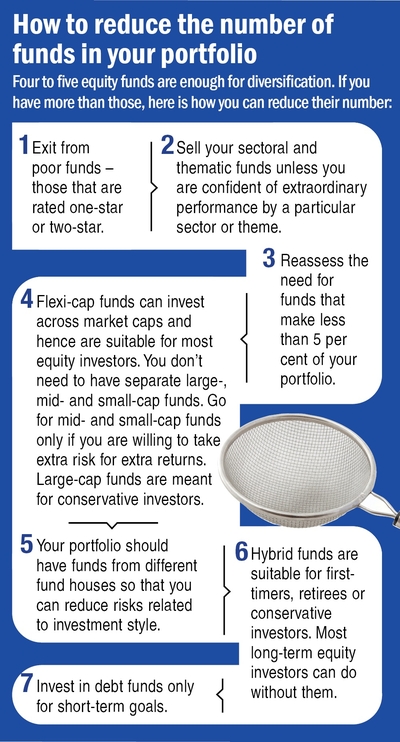

Prateek has invested in 19 equity mutual funds. He should consolidate his portfolio to four to five funds, including a tax-saver.

Since all his goals are more than 10 years away, equity funds are suitable for him. He can go for flexi-cap funds as they can invest in companies of all sizes. Prateek has also invested in some sectoral funds. As a general principle, retail investors should stay away from sectoral funds. They provide limited diversification and can be highly volatile and risky.

Prateek already owns two homes - one in his home town and the other where he lives. We would advise not to invest any further in real estate. Real estate usually has high maintenance costs and may not yield higher returns vis-a-vis equity over the long term.