In a bid to safeguard investors' interest, Aditya Birla Sun Life Mutual Fund, yesterday, side pocketed its exposure to Adilink Infra & Multitrading Private Limited, a part of the "storied" Essel Group, in three of its schemes namely Aditya Birla Sun Life Dynamic Bond Fund, Aditya Birla Sun Life Medium Term Plan and Aditya Birla Sun Life Credit Risk Fund. This move came in the wake of the default of a security issued by Adilink Infra & Multitrading Private Limited to another bondholder on November 25, 2019.

Collectively, all three schemes held about 15 per cent of the debt issued by the company. Therefore, the NAVs of Aditya Birla Sun Life Dynamic Bond, Aditya Birla Sun Life Medium Term Plan and Aditya Birla Sun Life Credit Risk Fund fell by around 5, 7 and 3 per cent, respectively. The fall in their NAVs reflects the level of exposure each of these funds had to the troubled bond.

As per the provision, ABSL AMC will now have two different portfolios for each of these schemes - with separate NAVs. The NAV of the main portfolio will have good bonds, while the bad one will be separated with a different NAV. Besides, any fresh subscriptions will continue for the mainstream fund, while no new subscriptions and redemptions will be allowed for the segregated portfolio(s). However, upon recovery of the money, it will be distributed to the investors who owned units in these funds as on November 25, 2019, in proportion to their holdings.

Aditya Birla Sun Life AMC is the fourth fund house to have actually created side-pockets across a few of its schemes. Previously, three AMCs, including Tata Mutual Fund, UTI Mutual Fund and Nippon India Mutual Fund (erstwhile Reliance Mutual Fund) created side-pockets across a few of their schemes, owing to their respective exposure to DHFL, Altico and Reliance Capital.

Undoubtedly, it is unfortunate to witness a credit event (the borrower's inability to pay interest or principal amount on time) in the portfolio holdings. But the creation of a segregated portfolio at least works towards safeguarding the interest of existing investors. With the creation of side-pockets, those investors who would want to exit can redeem at least from the healthy portion of the fund that, too, without booking any loss, while their claim to their proportionate share in the segregated portfolio remains intact. Besides, at the time of default/downgrade in a portfolio holding and the resultant fall in the NAV, smart guys try to benefit unduly by entering the fund at beaten-down NAVs and sharing the gains in the case of a greater-than-expected recovery in the bond. Side-pocketing thus helps in protecting the interest of those who are genuinely entitled to the recovered amount.

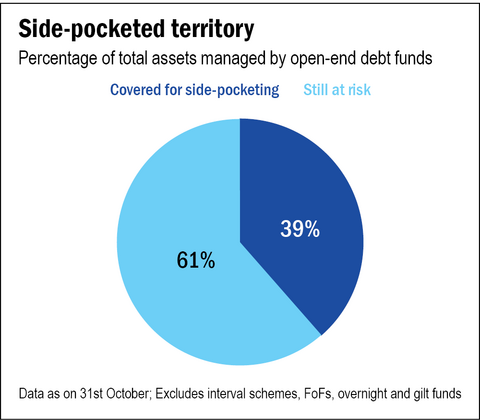

Despite the obvious benefits for investors, a lot of AMCs have not yet enabled side-pocketing provisions in their debt funds. A Value Research analysis of the enabling provisions put out by AMCs suggests just 39 per cent of the total AUM managed by open-end debt funds is covered under the side-pocketing provisions. So, effectively, about 61 per cent of the debt AUM still isn't equipped for any unforeseen downgrades. This isn't good news for the investors who have witnessed dramatic declines in their debt NAVs and are unsure of how to deal with them during blow-ups, which smashed the debt industry in the recent past.

As of today, only 16 AMCs covering about 116 out of 267 open-ended debt schemes have enabled or announced the insertion of the side-pocketing provisions into their debt scheme documents.

In the realm of debt funds, default bells have been ringing since long. But why have AMCs taken so long to get things going despite the regulation?

It seems the reasons could be many. For one, inserting the provision into the scheme information documents (SIDs) will require AMCs to provide a load-free exit window to their investors. However, AMCs are afraid that such a clause can trigger discomfort and redemption by investors, as they may not fully understand the provision. And therefore, AMCs have been shying away from its implementation. Secondly, the provision makes it easier for investors to vote with their feet from the fund, as they can redeem at least the 'good portfolio' without incurring any loss. This can cause a rapid drawdown in the AUM of a fund which side-pockets. Clearly, this goes against the business interests of AMCs.

Thirdly, with SEBI requiring the trustees of AMCs to review the performance incentives of fund managers when their debt schemes side-pocket, the provision may have implications on fund managers' compensation, explaining their further reluctance. Finally, the operational hassle of creating a side-pocket and declaring a separate NAV may be seen as a deterrent by fund companies.

To reiterate its significance, at a time when issuer-level defaults have spiked, AMCs should expedite work towards inserting the side-pocketing provision across all their schemes.