The next three months could be the last opportunity for senior citizens to lock their money at a guaranteed annual return of 8 per cent. As per the extension made in the 2018 Budget, Pradhan Mantri Vaya Vandana Yojana (PMVVY) is open for subscription till March 31, 2020. Whether the subscription window will get further extended or not is a question only time can answer.

PMVVY initially became operative for just one year, starting May 4, 2017 after a mention in the budget, and was later extended by two more years in the 2018 Budget. At the time, the maximum permissible investment amount was also doubled to Rs 15 lakh from Rs 7.5 lakh.

PMVVY is a pension product for senior citizens which is backed by the government of India and operated by LIC which enables investment in the scheme through both online and offline modes.

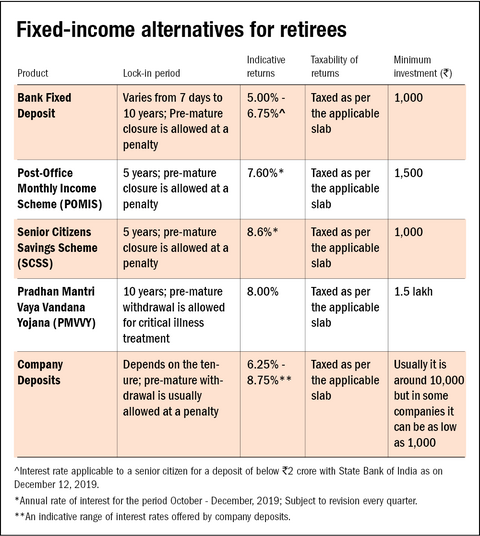

Investments in the PMVVY will fetch an interest rate of 8% per annum for the next 10 years. This looks attractive in the current macro-economic context and will likely remain so if inflation remains in the target 4-6% range. Among the assured return avenues available to a retiree, this yields the next highest returns after the Senior Citizen Savings Scheme (SCSS) which yields 8.6%. But SCSS rates are subject to quarterly revisions and given the RBI's accommodative stance on interest rates, may be headed towards a downward revision in the near future.

You also have the flexibility to choose the frequency of interest payouts, with options for monthly, quarterly, semi-annual and annual payouts.

PMVVY is certainly a worthwhile alternative for retirees to allocate a portion of their accumulation. And now you just have a three-month window to invest in it.

But we would like to reiterate, as we often do, that retirees should not completely depend on fixed-income investments. They must have at least some investment in equity as well to provide inflation protection.

Salient features - PMVVY

Eligibility: You must be 60 years old or above

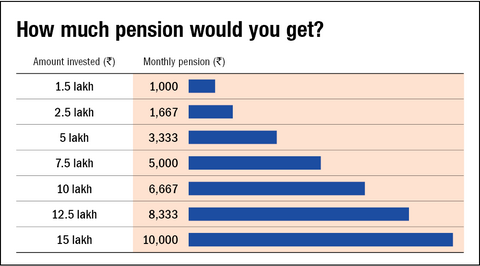

Minimum Investment: Rs 1.5 lakh

Maximum Investment: Rs 15 lakh

Rate of return: 8% per annum compounded monthly

Interest payout: Monthly, quarterly, semi-annual or annual at investor's discretion

Tenure: 10 years from the date of investment

Liquidity: Premature withdrawal is allowed at a penalty of two per cent but only if the money is required for the treatment of a critical illness.

Maturity benefit: The whole investment amount (principal) is returned along with the last interest payment at the end of 10 years. If the subscriber dies before this maturity date, the entire investment amount is given to the nominee immediately.

Taxability: The interest income or the pension received is taxable as per the applicable slab.