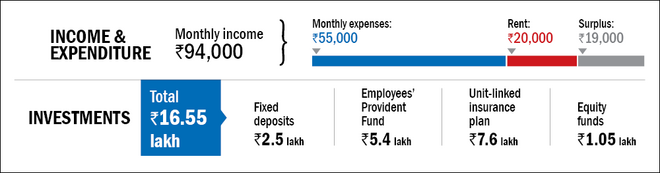

Himanshu (37) works with a KPO and earns Rs 94,000 monthly. He lives in a rented house with his homemaker wife and their five-year-old daughter. He pays a rent of Rs 20,000 per month and other monthly expenses are usually around Rs 55,000.

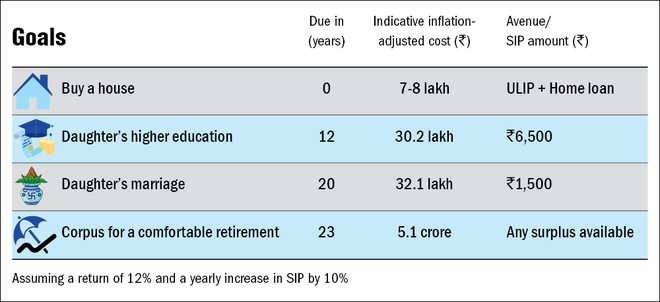

Himanshu wants to buy a house and accumulate a sufficient corpus for his daughter's higher education and wedding. While all these goals look achievable, it could be quite challenging for him to save enough for a comfortable retirement after he has invested for his other goals.

Emergency corpus

As his emergency fund, Himanshu has a fixed deposit of Rs 2.5 lakh. Ideally, one should have an emergency corpus equal to six months of expenses. It helps in dealing with any unforeseen financial emergencies that can derail one's finances. For Himanshu, this amount would be Rs 4.5 lakh. Although his FD is considerably less than the required amount, that shouldn't be a problem. He is in a fairly stable job and quite confident about his future income. Besides, he has adequate health insurance for medical emergencies. However, he can explore liquid funds to invest a part of the fixed deposit. While FD returns are taxable, one doesn't have to pay tax on investments in a debt fund unless one sells these. A good liquid fund can provide him FD-like returns.

Insurance

Himanshu has a pure term plan of Rs 1 crore and a family-floater health cover of Rs 7 lakh. These policies are in addition to the coverage provided by his employer. As of now, the coverage seems sufficient. Nevertheless, he should revisit his insurance requirement after every two to three years. As he is planning to buy a house on loan, his life cover should be simultaneously increased by the loan amount. Besides this, he holds a unit linked insurance policy (ULIP) with a value of around Rs 7.6 lakh, which is about to mature in a few months. A ULIP provides both insurance and investment. That may look like a great proposition but one should generally abstain from buying such hybrid products as they are neither good as an investment nor as insurance; both these components are usually inadequate. Also, the cost of such hybrid products tends to be high. Himanshu should exit his ULIP when it matures.

Buying a house

The maturity amount of the ULIP can be used for the down payment of his house. For the remaining amount, he can take a home loan. Assuming an interest rate of 7 per cent, a home loan of Rs 32 lakh for a 20-year term would cost him about Rs 25,000 per month. Taking a home loan will help him build his own asset and save on the rent. In addition, he will get a tax break on both the principal repayment and the interest.

Daughter's higher education and wedding

Considering the current costs, Himanshu feels that amounts of Rs 15 lakh and Rs 10 lakh, at inflation-adjusted levels, should be sufficient for his daughter's higher education and marriage, respectively. For this, he should start an SIP of Rs 6,500 and Rs 1,500 for her education and wedding, respectively.

Assuming he can increase his contributions every year by 10 per cent and that the funds chosen by him return at least 12 per cent per annum, Himanshu will be able to achieve these goals. These goals will fall due in approximately 12 and 20 years, respectively.

Retirement

If we assume an inflation rate of 6 per cent, Himanshu's monthly expenditure of Rs 55,000 will become Rs 2.1 lakh by the time he turns 60. He would need a retirement corpus of Rs 5 crore to maintain the same lifestyle for 25 years after he retires. A return of 8 per cent is expected on the corpus during the post-retirement years.

However, accumulating the required corpus looks quite challenging for Himanshu. He would be left with Rs 5,000 to invest for his retirement after paying for monthly expenses, EMI and investing for his daughter's education and wedding. If we assume that he can increase his contributions every year by 10 per cent and earns 12 per cent on it, he will be able to accumulate Rs 1.4 crore through SIPs. His current accumulation in equity funds is around Rs 1 lakh, which is likely to grow to Rs 14 lakh in 23 years. Himanshu's EPF account is likely to fetch him another Rs 1.7 crore at a conservative rate of 8 per cent, provided his basic pay also increases by 10 per cent every year.

Although Himanshu will be able to invest more for his retirement after 12 years after meeting his daughter's higher education requirement, it still may not be enough for him to reach the Rs 5 crore mark by the time he turns 60. He will be short by approximately a crore. But the good news is he still has 23 years to make a provision for it. The box 'Three ways to reduce the deficit' has some suggestions that can help him meet the deficit.

Three ways to reduce the deficit

Invest any windfall that you may get

Do not completely spend your annual bonus or any other windfall that you may get. Make it a point to invest a significant part of it in equity funds. Given that you still have 23 years at hand, compounding can work wonders for you. However, do not invest the entire amount at one go. Spread it over a period of time. That will help you avoid catching a market high. The general thumb rule is to spread over half the time it took you to earn that amount. For an annual bonus, spreading it over six months is sufficient.

Take risk in a measured way

Once you get comfortable with the volatility in flexi-cap funds, consider investing a small part of your SIP for retirement in mid- and small-cap funds. Mid- and smallcap funds can help you earn higher returns over a long period of 15-20 years. However, do note that these funds are extremely volatile over the short term and can give you nasty surprises.

Try to increase income or reduce expenses

It may be worthwhile to explore how you can increase your income so that you are left with a higher investible surplus. Alternatively, check your expenses. Are there any expenses that can be curtailed? Draw up a strict budget and try to cut discretionary spending.