In our previous part, we see how falling interest rates affect the income of retirees.

In order to tackle the problem of falling interest rates, retirees need to build resilient portfolios instead of simply depending on fixed deposits for their income. Fixed deposits prove to be highly inadequate instruments for generating a fixed income, and in the context of falling interest rates the problem is even worse. Equity is the only solution. But retirees need not move their entire corpus to equity, but instead maintain a careful allocation between fixed income and equity in order to grow their corpus, while also not taking on too much risk.

Fixed-income alternatives

When it comes to the fixed income part of their portfolio, retirees should look beyond fixed deposits. They should consider switching to the Senior Citizens Savings Scheme (SCSS) or the Pradhan Mantri Vaya Vandana Yojana (PMVVY), which at present are offering 8.6 and 8 per cent, respectively. While the PMVVY comes with a lock-in period of 10 years, the SCSS has a tenure of five years, which can be extended for three years. The Post Office Monthly Income Scheme (POMIS) offering 7.60 per cent is another option.

There is however an upper limit to how much you can invest in such schemes. Secondly, the rates offered by these instruments may face the axe as well since they are subject to market-linked revisions every quarter.

The core solution: equity

Equities are one asset class that inevitably delivers inflation-beating returns in the long run. While retirees may worry about the high volatility of equity, there is a via media.

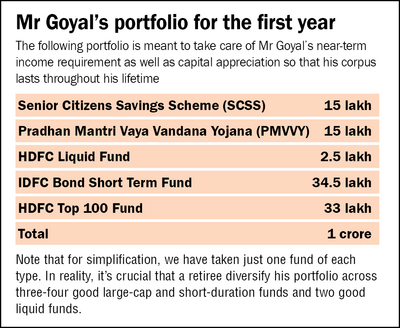

The key lies in combining the fixed income from debt with the high return potential of equities in such a way that the volatility of equity doesn't come in the way of deriving a steady income. Let's see how Mr Goyal's retirement years would have evolved if he decided to combine fixed-income and equity investments in the following manner (see table 'Mr Goyal's portfolio for the first year'):

- For an assured income, he sets aside the first year's post-retirement income in a safe mix of SCSS/PMVVY (up to the maximum permissible limit of Rs 15 lakh) and a good liquid fund.

- Next, he invests a third of his corpus in equity via a conservatively managed large-cap equity fund. To make sure that his overall equity allocation always remains within the 30-35 per cent range, Mr Goyal rebalances his portfolio annually.

- For the balance amount, he invests in a low-risk short-duration fund.

- To generate a continuous income stream, he sets up a systematic withdrawal plan (SWP) in the selected liquid fund and each year moves money from the short-duration fund to the liquid fund to keep the income flowing.

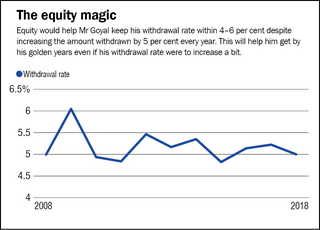

- He starts with a conservative withdrawal rate of four to five per cent and increases the amount withdrawn by about five per cent every year to keep up with inflation. However, to avoid eating into his retirement nest egg, he should ensure that his withdrawal rate doesn't exceed six per cent of his capital, at least in the initial years of his retirement.

Testing the plan

Mr Goyal's investments in PMVVY, SCSS and the liquid fund will take care of his annual income requirement of Rs 5 lakh in the first year.

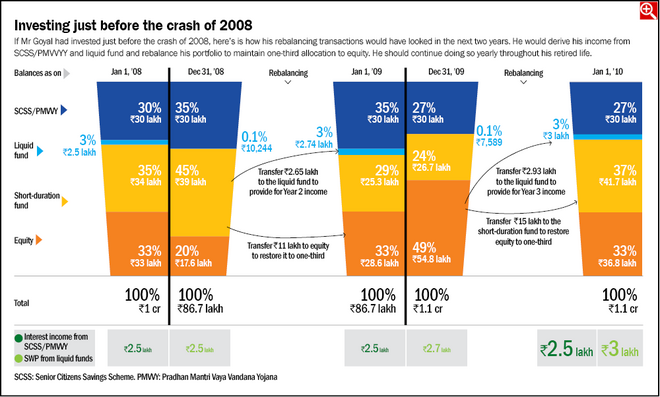

To test the efficacy of the plan, let's assume that Mr Goyal put this plan in action at the worst time - at the start of 2008 after which the equity market fell by almost 52 per cent.

In the first year, Mr Goyal's equity investments would halve to Rs 17.6 lakh, but by keeping a few years' income in safe debt options, he would be able to fulfil his income requirement. The next year, to restore one-third allocation to equity, Mr Goyal would move about Rs 11 lakh from his short-duration fund to the large-cap fund. Further, he would shift the required income for the next one year from the short-duration fund to the liquid fund.

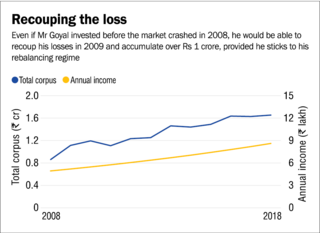

When the markets bounce back in 2009, Mr Goyal would amass a total of about Rs 1 crore. By following this plan, even in the worst of times, Mr Goyal would be able to grow his withdrawals with less variability and despite the periodic ups and downs, his retirement corpus would grow to Rs 1.65 crore by the end of September 2019.

The key takeaway from this illustration is that to be able to maintain a rising standard of living without having to worry about running out of money, the fixed-income 'fan' in you must accept an equity allocation. This helps compensate for falling rates. Also, periodic rebalancing of the portfolio is key. If Mr Goyal had panicked on seeing the extent of equity-market decline in the first year and shied away from equity allocation, his long-term portfolio value would have taken a significant hit.

Read the first part of the story here

.