Raghav (26) started working with an IT company around two years ago. He gets a salary of Rs 34,000. In spite of his job tenure, he has savings of only Rs 20,000. This is despite the fact that he lives with his parents and doesn't have any major responsibilities. Raghav loves exploring every new cafe that opens in the city. Besides, he likes to go out for concerts and movies with his friends. Raghav has made two significant purchases since he started working: a motorcycle and an iPhone. He now seeks our guidance on how he should start saving and managing money. He specifically mentioned that he loves traveling and visiting new places often, and would like to plan for this. Here are some simple steps that will help him get started.

Make a budget

- Spare some time every month to make a budget.

- Try to limit your monthly expenditure to Rs 10,000 to Rs 12,000.

- Differentiate between needs and wants. A 'need' is something that you cannot compromise on. A 'want' is something you would like to spend on, but which is not necessary.

Start saving and investing

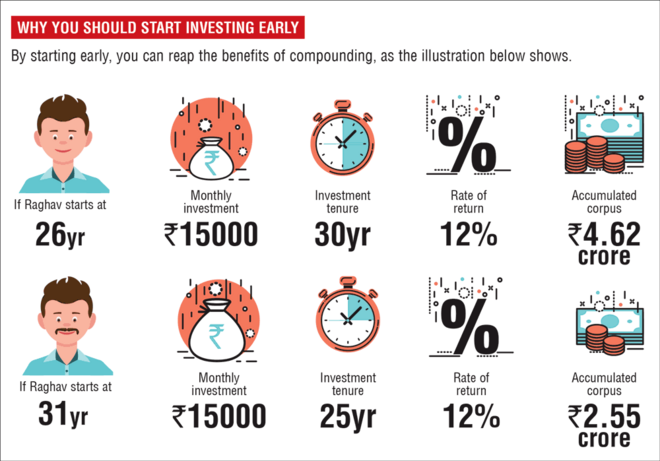

- By starting early, Raghav can accumulate the required corpus faster.

- Think of your short-term (less than five years) and long-term (over five years) goals.

- For your short-term goals, such as replacing your mobile, invest in ultra-short-duration funds or short-duration funds.

Why ultra-short-duration funds?

These funds provide FD-like returns, but unlike an FD, you don't have to pay tax on the interest unless you sell. If you sell these funds after three years, you also get the indexation benefit, which reduces your tax outgo.

- For his long-term goals, Raghav should start investing Rs 15,000 every month in two top-rated aggressive hybrid funds. This money can be earmarked to a long-term goal such as retirement.

Why aggressive hybrid funds?

Aggressive hybrid funds invest around 65-80 per cent of the money in equity and the remaining in debt. Small exposure to debt securities helps to stabilise equity volatility. Hence, they are ideal for new investors.

Avoid borrowing

Raghav has recently bought a credit card from the bank where he holds his salary account. Although the credit card has been offered to Raghav at no extra charges, he should note the following:

- The interest rate which banks charge on credit cards is usually in the range of 30-36 per cent.

- Avoid opting for a credit-card EMI because of its high cost structure.

- Even the 'no-cost' EMI often has hidden processing charges.

- First accumulate the required amount and then buy something.

- Do not deviate from your monthly budget, whatever be the credit limit granted to you

Set up a travelling fund

In order to fulfil his passion for travelling, Raghav can do the following:

- Invest Rs 4,000 every month in a good liquid mutual fund. This way he will be able to earmark around Rs 50,000 on an annual basis for travelling.

Why liquid funds?

Liquid funds have the potential to earn slightly higher returns than a bank fixed deposit without compromising on liquidity. You do not have to commit a minimum time period for which you plan to invest. You can also withdraw money anytime from a liquid fund. It usually takes one to two working days for the withdrawn amount to come to your bank account.

Don't ignore these

Emergency fund:

Create an emergency corpus equivalent to at least six months of your expenses. Park it in a mix of sweep-in FD and liquid fund.

Life insurance: Buy a term plan when you have financial dependents.

Health insurance: Buy sufficient health insurance of your own even if you have an employer-provided one.