Over the last six months till December 2019, mutual funds collectively raised stake in close to 60 mid-cap companies by investing more than Rs 15,000 crores. These mutual funds put their best foot forward to beat the market and deliver superior returns to its investors. So, we keep a check on where these mutual funds have their bets.

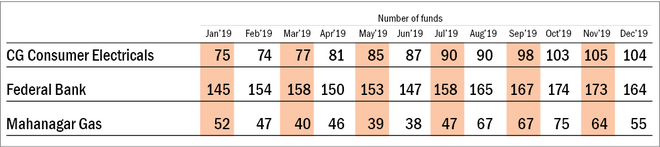

In this article, we have zeroed in on three mid-cap companies wherein mutual funds have increased their stake the most in the last two quarters. Apart from the below-listed companies, mutual funds also invested in IRCTC for the first time. Also, we have looked at the numbers of mutual funds invested in these three companies during the last 12 months.

Crompton Greaves Consumer Electricals

Stake increased to 25.3 per cent from 16.3 per cent

The electric goods maker operates under two segments: electric consumer durables (77 per cent of the revenues as of September 2019) and lighting products (23 per cent of the revenues). The company is a leader in most of the segments, including fans, lighting, home appliances and water pumps. Besides, it has ventured into new products, such as coolers, water heaters, irons, among others. Although Crompton initially focused on the lower end of the market, it has now shifted towards delivering high consumer value and premium products. Some of its new products include Air-360 fans, dust-free fans, anti-bacterial LED, sensor fans and so on.

Crompton's go-to-market strategy hinges on expanding the reach and distribution of its products while strengthening its brand. This strategy has resulted in an increase in its revenues, which grew by close to 10 per cent in FY19. Apart from this, the company's profit margins improved from 5.8 per cent in FY16 to 8.9 per cent in FY19. Driven by all such factors, the company's TTM return on equity stands at 39.6 per cent.

Recently, its two promoters: Advent International and Temasek Holdings, which together held 34.36 per cent of the stake, have trimmed it down to 26.2 per cent, making near three-time returns on the four-year-old investment. Currently, the stock trades at a P/E of 34 times.

Stake increased to 10.2 per cent from 5.9 per cent

One of India's leading natural gas distribution companies, Mahanagar Gas has its major operations in Mumbai. The company is the sole authorised distributor of compressed natural gas (CNG) and piped natural gas (PNG) in Mumbai and its adjoining areas, including Raigarh.

It was set up as a joint venture between GAIL (India) Ltd. and the BG Group (U.K.) - in which both jointly held 65 per cent of equity between them. However, the latter sold the entire stake in the company in the quarter ending September 2019.

What gives this company a competitive advantage is its business model. Mahanagar Gas operates in a business that has high entry barriers, regulatory hurdles and significant capital-expenditure requirements. All these factors provide the company with a monopoly position. Besides, the growing demand for gas has allowed the company to generate cash flows as well. The company catered to more than 1.2 million household customers with piped gas, 3,923 industrial and commercial customers and 244 CNG stations as of the quarter ended September 2019.

In terms of financials, as of the quarter ended September 2019, TTM ROE stood at 28 per cent with more than 21 per cent profit margin. Over the last one year, EPS has grown by over 46 per cent and the stock price has appreciated by 22 per cent. Even after this rally, the stock currently trades at a PE of 15 times as compared to three-year median PE of 17.8 times.

Stake increased to 27.1 per cent from 21.4 per cent

The history of this bank dates back to the pre-independence era. Incorporated on April 23, 1931, the bank was set up as the Travancore Federal Bank Limited. In December 1949, it was renamed Federal Bank Limited, which now has its presence in over 25 states, four union territories and listed on BSE, NSE and London Stock Exchange.

With a network of 1,251 branches and 1,669 ATMs, Federal Bank had an asset base of more than Rs 1.6 trillion as of September 2019. Corporate and retail banking are its key focus areas, contributing 35 per cent and 37 per cent, respectively, to the total assets.

Looking at some key financial ratios, the gross NPAs (non-performing assets) and net NPAs stood at 3.07 cent and 1.59 per cent, respectively, for the quarter ending September 2019. On the TTM (trailing twelve months) basis, the net interest margins stood at 10.8 per cent and return on equity stood at 11.2 per cent. The bank's stock has rewarded its investors with a return of over 13 per cent, compounded annually over the last ten year and currently trades at a PB of 1.29x.