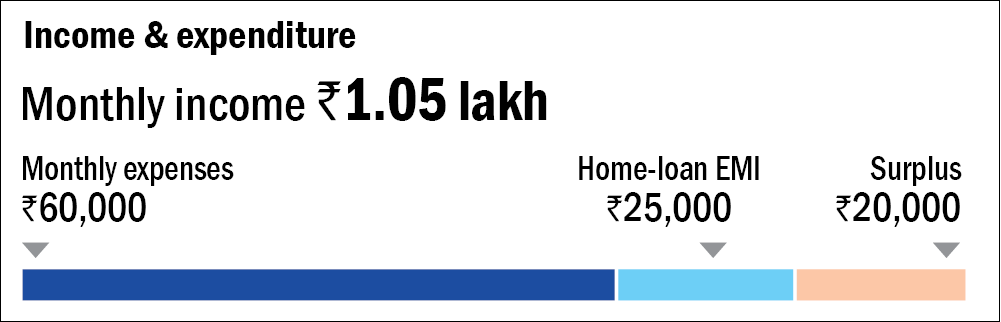

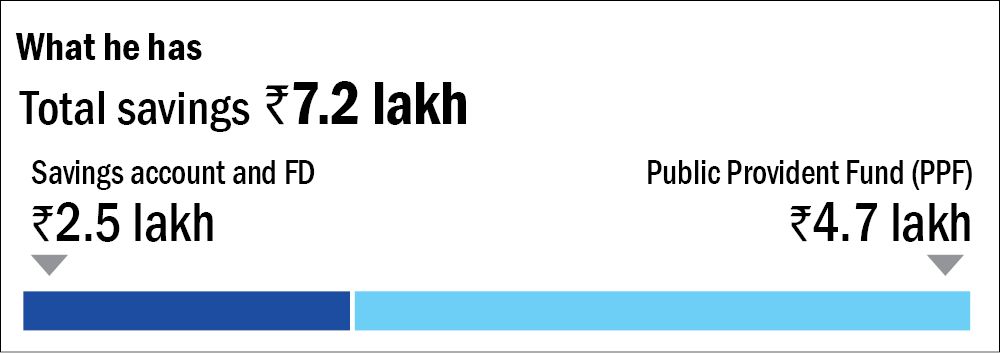

Nishant (34) works with an IT company. He and his wife Srishti (32), along with their four-year-old daughter, have recently moved into a new house. Nishant wants us to advise him on investing for his retirement and his daughter's higher education and wedding.

Why PPF is not great for long-term investments

Nishant wants to know how good the Public Provident Fund (PPF) is as a long-term investment option. He has accumulated about Rs 4.7 lakh in it. Nishant should heed the following:

- PPF interest rates and those offered by other fixed-income products have reduced over time. This trend is likely to continue as the economy moves towards lower inflation.

- PPF is all debt. Equity tends to give much higher returns over the long term and hence helps create wealth. So it should be the natural choice for your long-term investments, not debt.

- While it is true that investments in the PPF up to Rs 1.5 lakh are exempt from income tax, Nishant could instead save tax by opting for a good equity-linked savings scheme (ELSS) or tax-saving fund. As against the PPF's lock-in period of 15 years, ELSS has a lock-in of only three years. This makes it more liquid and efficient.

How Nishant can achieve his goals

Nishant can use ELSS, Employees' Provident Fund (EPF), National Pension Scheme (NPS) and aggressive hybrid/flexi-cap funds to reach his long-term goals. These include his daughter's higher education in 13 years, her wedding in about 22 years, and his own retirement in 26 years.

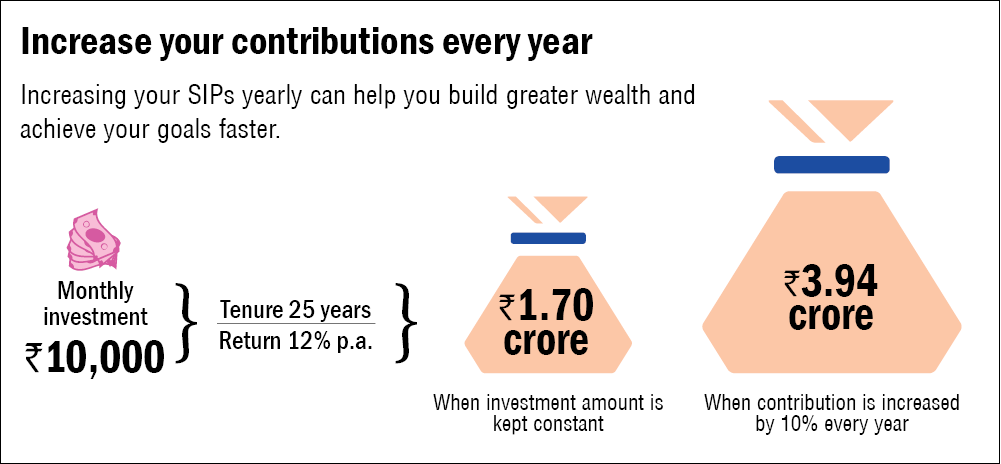

The current cost of his daughter's education is estimated at Rs 10 lakh, which on accounting for inflation would work out to Rs 21 lakh by the time he needs the money. Similarly, the cost for the wedding which would be Rs 15 lakh in the present time, would inflate to Rs 54 lakh by the time his daughter is likely to get married. An SIP of Rs 7000 a month would be adequate to take care of both these goals, as long as he increases this contribution by 10 per cent every month. This also assumes inflation will remain at 6 per cent. Nishant must remember to start moving the money from the equity funds to fixed-income options one or two years before these goals arrive.

As for his retirement, he would need a corpus of Rs 6.6 crore at the time he retires. For this he needs to do the following:

- Earmark the remaining surplus (Rs 13,000) and EPF corpus for retirement.

- Increase his contribution by 10 per cent yearly.

- Avail the maximum possible tax benefit through ELSS and NPS.

- Invest any residual income in a good aggressive hybrid fund.

- Move to flexi-cap funds after experiencing equities for three to five years.

- Start moving part of the retirement corpus to fixed income two to three years before retirement.

- Invest at least one third of the corpus in equity even after retirement. This plan assumes returns in post-retirement years at eight per cent.

Invest in the NPS for additional tax savings

Nishant can avail an additional exemption of up to Rs 50,000 under Section 80CCD(1B) by investing in the NPS.

- Investments in the NPS are locked in till the age of 60. Upon retirement, you have to buy an annuity plan with at least 40 per cent of the corpus.

- While investing in the NPS, Nishant should opt for the 'Active' investment choice, which allows investing up to 75 per cent in equity, since Nishant's retirement is many years away.

Link your tax-saving investments to long-term goals

By linking your tax-saving investments to your long-term goals, you don't just save tax, but you also build a sizeable corpus. In Nishant's case, that could be his retirement or his daughter's education and wedding.

Increase your contributions every year

Increasing the amount you invest via SIPs yearly can help you build greater wealth and achieve your goals faster.

Don't ignore these

- Do have an emergency corpus, equivalent to at least six months of your expenses. Keep it in a combination of a sweep-in fixed deposit and a liquid fund.

- Buy adequate life insurance.

- Get health cover for your family, even if you have one provided by your employer.