Rajendra Prasad is 60 years old. He retired a few months back and has about Rs 55 lakh. He wants to invest this amount in a way that he is able to generate a regular monthly income of Rs 35,000. Here is what he should do.

Moderate your income expectation

- Mr Prasad is expecting an annual income of close to 8 per cent from his retirement corpus. This is quite high.

- One should ideally restrict the annual withdrawals to a maximum of 6 per cent of the accumulation. Otherwise, you risk outliving your savings.

- Mr Prasad should curtail his monthly expenses to around Rs 25,000, specifically in the initial years to create some buffer.

Don't ignore inflation

- If Mr Prasad is able to manage his monthly expenses in Rs 25,000 today, that may not be the case after a few years. He will need more than Rs 25,000 for the same expenses. That's because of inflation.

- His retirement corpus should grow by about 9 per cent to provide for inflation and also grow his corpus.

Equity is a must

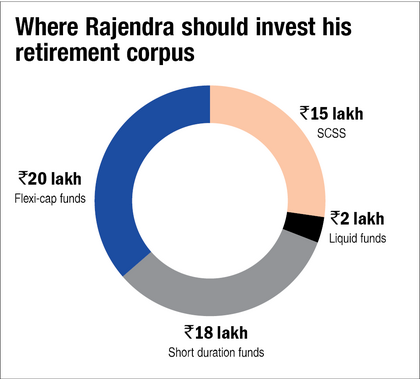

Contrary to what many believe, equity is indispensable in retirement. It helps in generating inflation-adjusted income in your retirement. Mr Prasad should invest Rs 20 lakh in two-three good flexi-cap funds. The investment should be spread over a period of two years to average the purchase cost. By investing a lump sum, he may run the risk of catching a market high.

Of course, then comes fixed income

Mr Prasad will be now left with Rs 35 lakh. This should be spread among different fixed-income products.

- Rs 15 lakh in Senior Citizen Savings Scheme (SCSS): This is the maximum amount an individual can invest in the government-backed SCSS. It will help Mr Prasad generate a guaranteed risk-free monthly income of Rs 9,500. SCSS currently offers 7.6 per cent per annum and the interest payout is on a quarterly basis.

- Rs 2 lakh in a good liquid fund: After SCSS, Mr Prasad would need about Rs 15,500 more for his monthly expenses. Money required for the next one year (Rs 1.86 lakh) should be invested in a good liquid fund. Mr Prasad may instruct the fund house to automatically credit his bank account with the monthly requirement through a systematic withdrawal Plan (SWP).

- Rs 18 lakh in two-three good short-duration funds: From the second year, Mr Prasad should fill his liquid-fund bucket through annual withdrawals from short-duration funds.

- Rebalance actively: As mentioned above, Mr Prasad should maintain at least 35 per cent of his corpus in equity. For this, he should actively rebalance his portfolio on an annual basis.

A bad idea

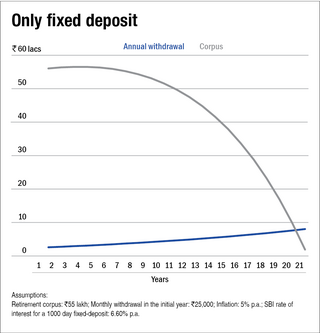

Many retirees prefer investing the whole corpus in a bank FD and opt for monthly interest payouts. This option appears convenient but it fails to provide inflation-adjusted income, so you may end up consuming your corpus much faster. If Mr Prasad chooses the FD way, he will be able to generate inflation adjusted income only for the next 21 years. On the other hand, if he is able to generate an annualised return of 9 per cent by investing in a mix of SCSS, short-duration funds and flexi-cap funds, his corpus would last longer, for the next 29 years.

How long will Mr Prasad's retirement corpus last?

Don't ignore your emergency fund and health insurance

In addition to Rs 55 lakh, Mr Prasad holds Rs 3 lakh in an FD and pays about Rs 3,000 monthly for a floater health insurance policy, which covers him and his wife. He should retain both. However, he may choose to use a sweep-in deposit facility instead of a regular fixed deposit for maintaining his emergency corpus as it is more liquid than regular FDs.

Tips to choose

A good flexi-cap fund

- Consider four- or five-star-rated funds on the Value Research website.

- Compare funds' performance with others in the same category through both bull and bear phases. It should be consistent over the long term.

- Look at the track record of the fund manager.

A good short-duration fund

- Scan the fund portfolio on the Value Research website. It should be majorly invested in top-rated papers. The exposure to lower-rated paper should be as low as possible.

- The portfolio should be well diversified.

- A short-duration fund giving extraordinary return would be assuming extra risk. Avoid it.