In the view of the COVID-19 pandemic, Finance Minister Nirmala Sitharaman has announced a slew of relief measures for both corporates and individuals. For savers and investors, the deadline for making tax-saving investments in order to get tax benefit for the financial year 2019-20 has been extended to 30 June from 31 March.

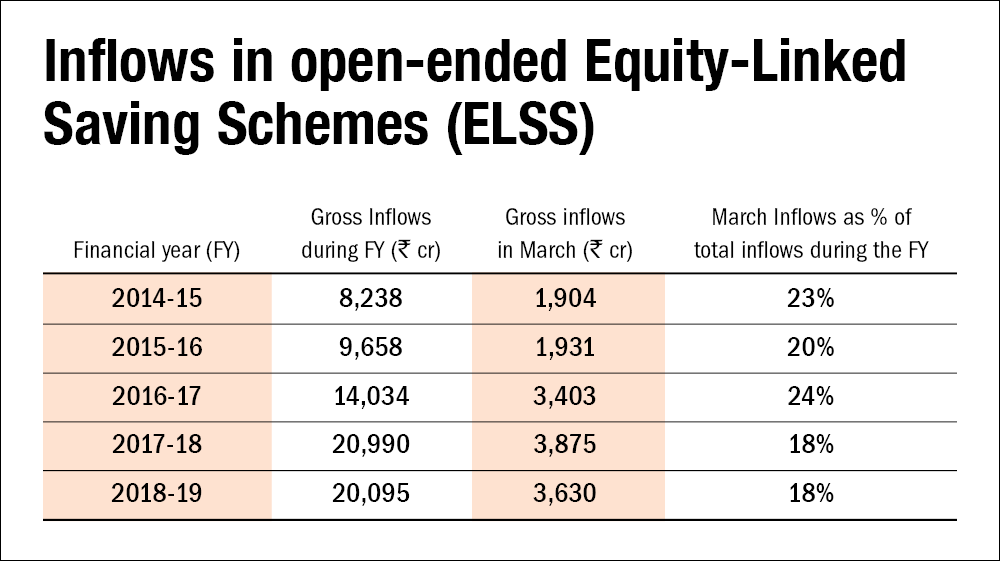

If past trends are anything to go by, tax-saving investments are usually backloaded, as people tend to invest in various tax-saving mutual funds, popularly known as ELSS, in haste in March every year. The following table shows that a bulk of investments in ELSS were earlier made in March.

Therefore, the extension in the deadline is a welcome move and likely to particularly benefit those investors who do not use the digital mode of investments. This is because the physical distribution network of mutual fund houses has now been shut down, owing to the nation-wide lockdown. Most banks and insurance companies are also working at a limited capacity.