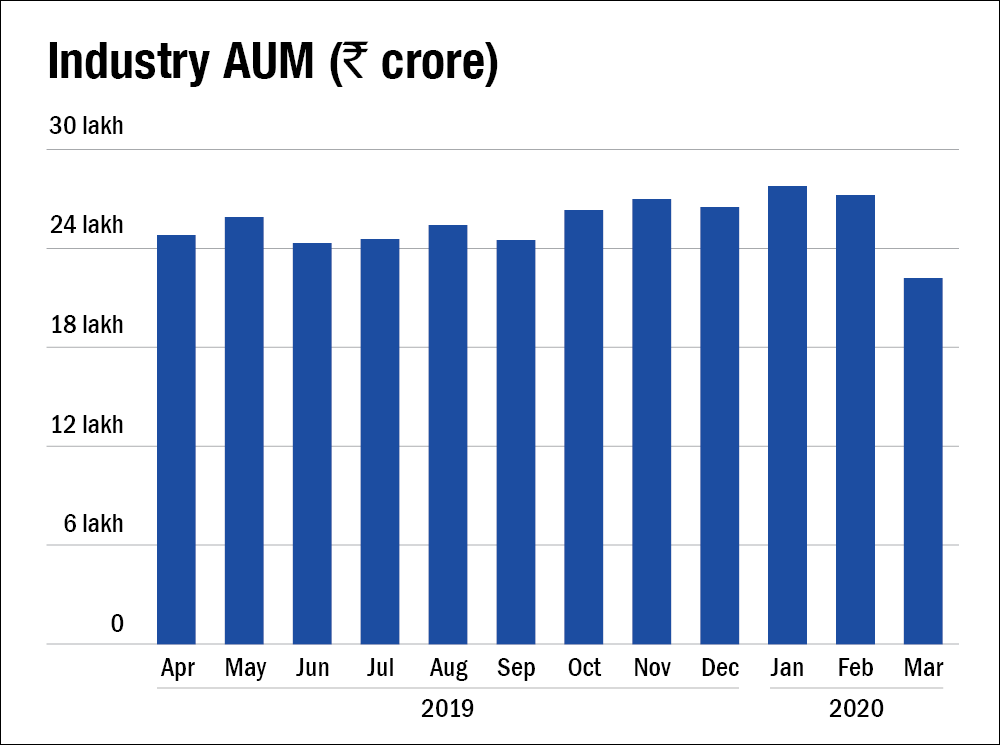

The AMFI data on inflow and outflow for the month of March suggests a fall of 18 per cent in AUM from Rs 27.22 lakh crore in February to Rs 22.26 lakh crore in March - the highest monthly fall in the AUM in the financial year 2019-20. While the overall fall in the market was primarily responsible for this decline in the portfolio value, wary investors pulling out money because of the fear of a further market crash also contributed to it. Interestingly, the volatile market witnessed widely contrasting trends at the asset-class levels.

Equity

The open-ended equity category saw a net inflow of Rs 11,723 crore in March - the highest net inflow observed in this financial year. Barring dividend-yield funds, each of the nine categories saw a net inflow, as several investors participated in the market in order to take advantage of this market fall.

Major inflows were observed in multi-cap funds (net inflow: Rs 2268 crore) followed by large-cap funds (net inflow: Rs 2060 crore) and focused funds (net inflow: Rs 1994 crore).

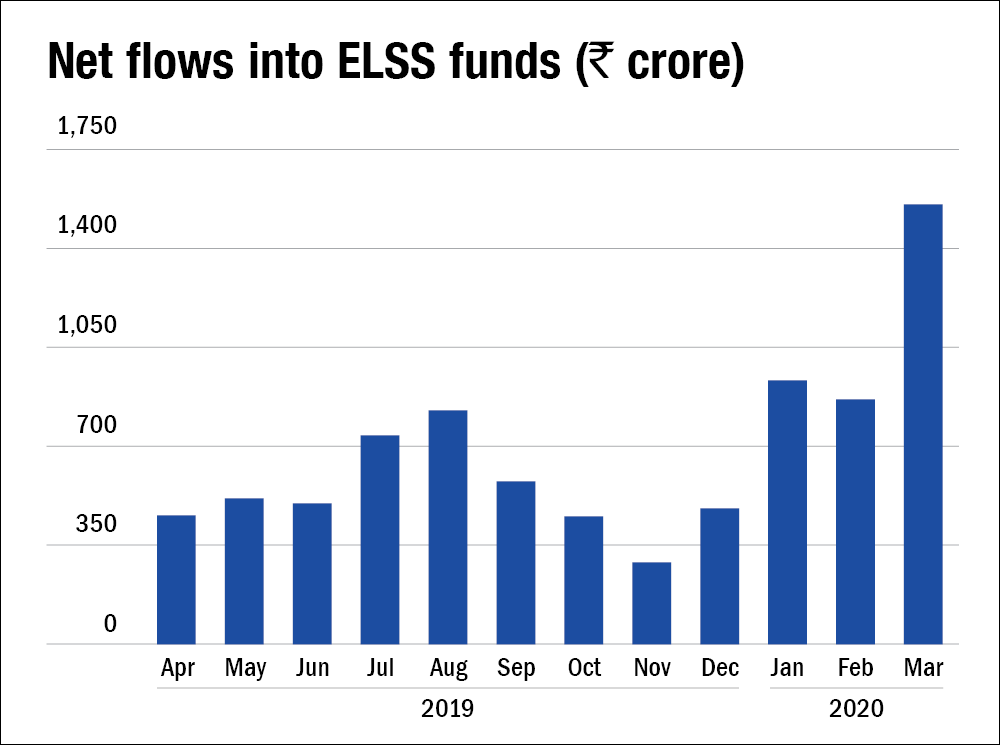

March, being the last month of the financial year, also witnessed a surge in the net inflows of tax-saving ELSS funds as compared to previous months (see the graph below). The net inflow recorded for this category in March (Rs 1551 crore) was thus 78 per cent higher than that observed in February (Rs 871 crore).

The ongoing market volatility; however, made investors wary of their choices, with investors avoiding high-risk equity segments such as small caps. Hence, the small-cap segment, which was an attractive investment zone for investors in the recent past, saw a decline in the net inflows from Rs 1498 crore in February to a mere Rs 163 crore in March. This was the lowest monthly inflow in the category in the financial year 2019-20.

Debt

Debt funds collectively witnessed massive outflows. As per the latest AMFI data, they lost about Rs 1.95 lakh crore on a net basis (see the graph below). Across the open-ended debt fund spectrum, 12 of the 16 categories saw outflows. This was largely led by liquid funds, which generally see negative flows at the end of every quarter, owing to advance tax payments.

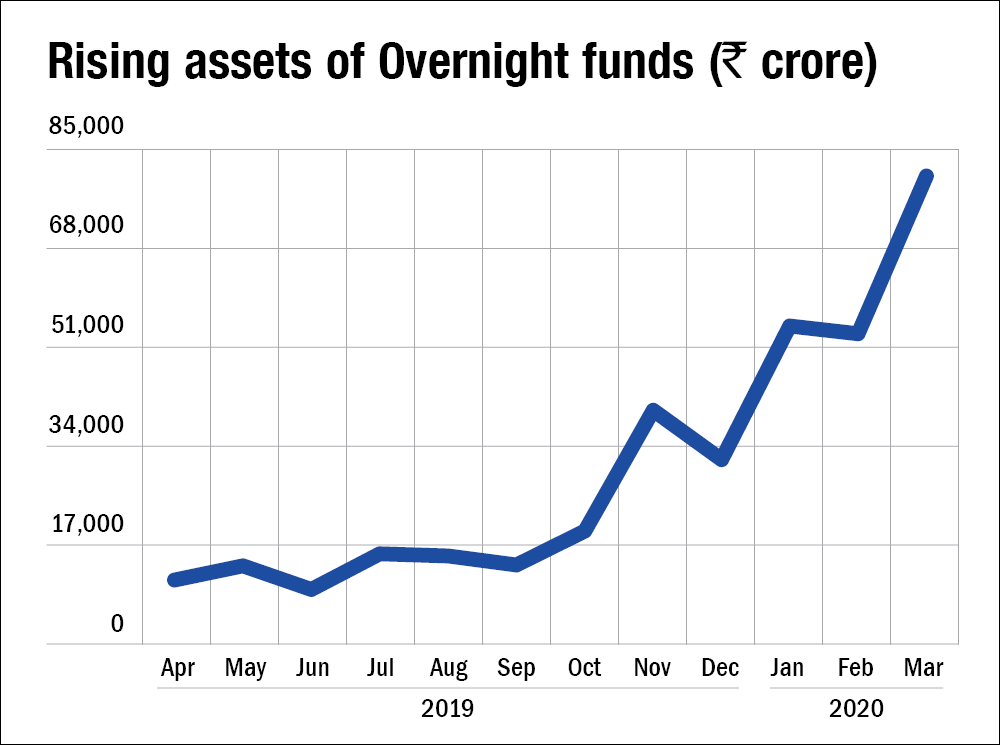

Quite visible was the flight to safety among investors. Rising net flows in overnight funds exemplify the same. Considered to be the most liquid and relatively safe debt schemes, the category collected about Rs 26,000 crore of net flows. This was the highest the category ever recorded in any month in FY20. Consequently, the AUM of these schemes grew about seven times over the last 12 months to Rs 80,174 crore as on March 31, 2020 (see the graph).

Other debt categories to report positive net flows were the long duration, gilt and gilt with 10-year constant maturity. These funds collected the net inflows of Rs 57 crore, Rs 747 crore and Rs 84 crore, respectively.

Conclusion

Investors should continue to stick to their investments and asset-allocation plans. They should not let their long-term investment plans get derailed by the sharp drop in the industry AUM.