In December 2018, SEBI permitted the creation of segregated portfolios, also called side pockets, in debt funds in case the credit rating of a bond goes below investment grade. Side-pocketing protects investor interests because if the bad debt recovers, they would be the beneficiary. It also helps funds contain the barrage of redemptions in the affected schemes.

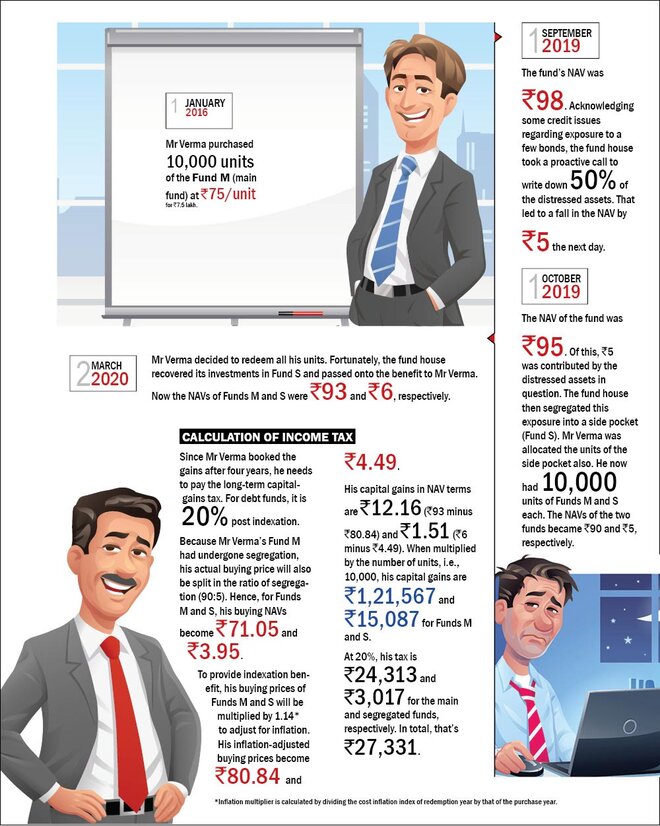

While side-pocketing was welcomed by investors, a lot of people had been wondering about the taxation of segregated portfolios. The Finance Bill FY21 has brought in clarity on the matter. The rules that came into effect from April 1, 2020 state that in the case of segregation of portfolios, the holding period of the segregated portfolio will include the period for which the units of the main portfolio have been held. Also, the cost of acquisition of the main scheme and the segregated portfolio will be the proportionate cost as determined on the date of segregation (see the infographic 'Taxation of segregated portfolio' at the end of the story).

Side-pocketing so far

The following funds have undergone side-pocketing. The NAVs of their main and segregated portfolios are given, along with the ratios of the split.

Taxation of segregated portfolio