For those who haven't yet made their tax-saving investments, the deadline extension to 30th June would have come as a welcome surprise amidst the otherwise gloomy scenario we find ourselves in now. This special report is just for you and will guide you in making the right tax-saving decisions.

Ideally, the right time to start making your tax-saving investments is not at the end of the financial year but at the start of it. When you begin early, you have more time to pick the best investments, while rushing often lands you with bad investments. But unfortunately, many of us see tax-planning as a year-end activity. Worse, some of us altogether fail to make any tax-saving investments due to outright 'busyness'.

Many investors are drawn to tax-saving investments due to the tax they can save. But that's just half the game. You cannot overlook the product in which you are making the investment. If you select a wrong product, though you will save tax, your overall outcome could be sub-optimal.

Your tax-saving investments can play a major role in your financial plan. They can be instrumental in wealth creation and protection. It is indeed worthwhile to pay attention to them.

Calculating income tax

For most of us, it is the accountant at our office who tells us how much we need to invest to save income tax. If you want to know your taxable income, you need to first take a sum of your income from all sources. Many of us have just one source of income - salary. But others may have multiple sources like income from property or business or capital gains, etc.

Overall, there are five such categories:

- Salary

- House property

- Profits and gains from business or profession

- Capital gains

- Sources other than the four sources mentioned above, such as interest income from bank deposits, income from lottery, etc.

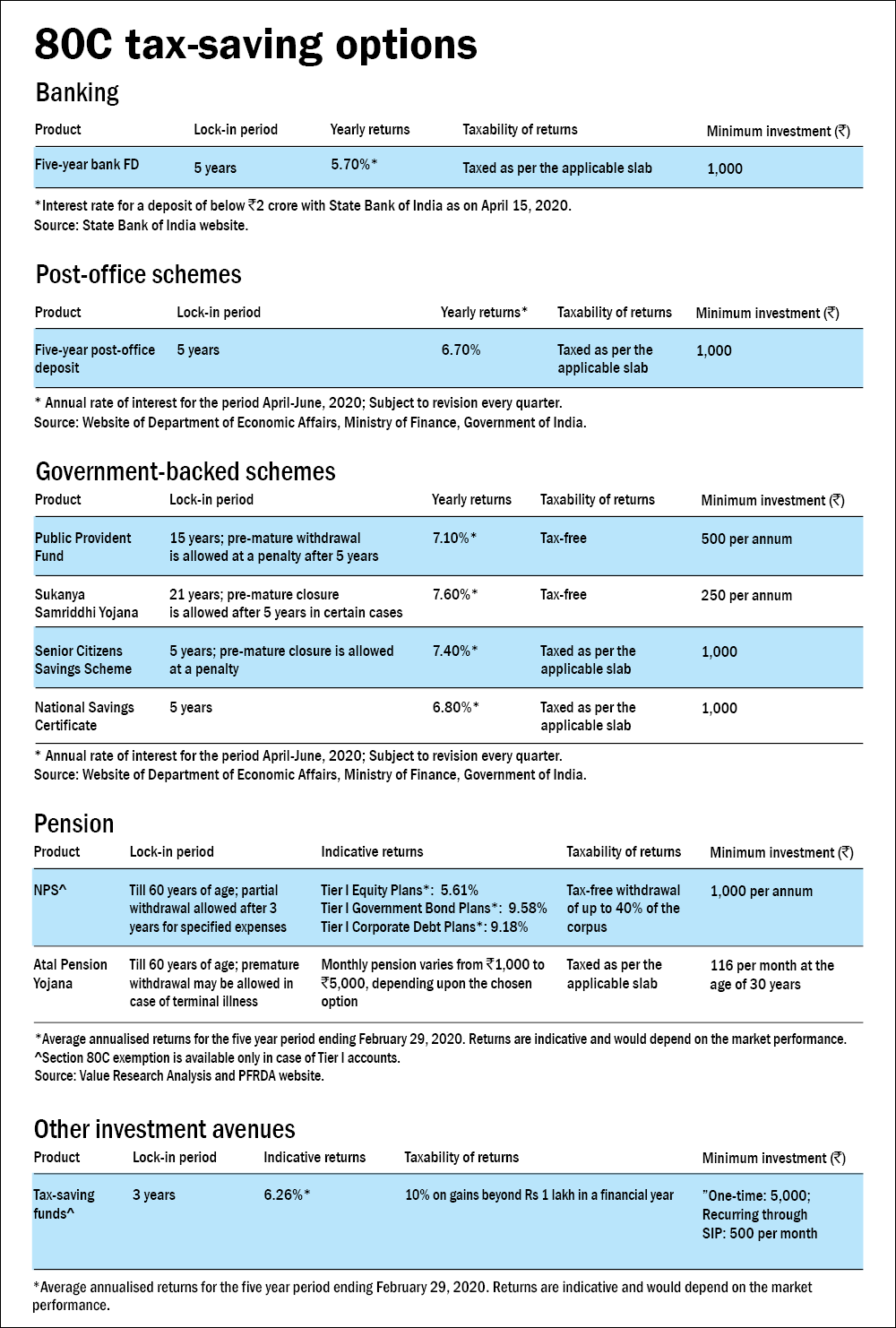

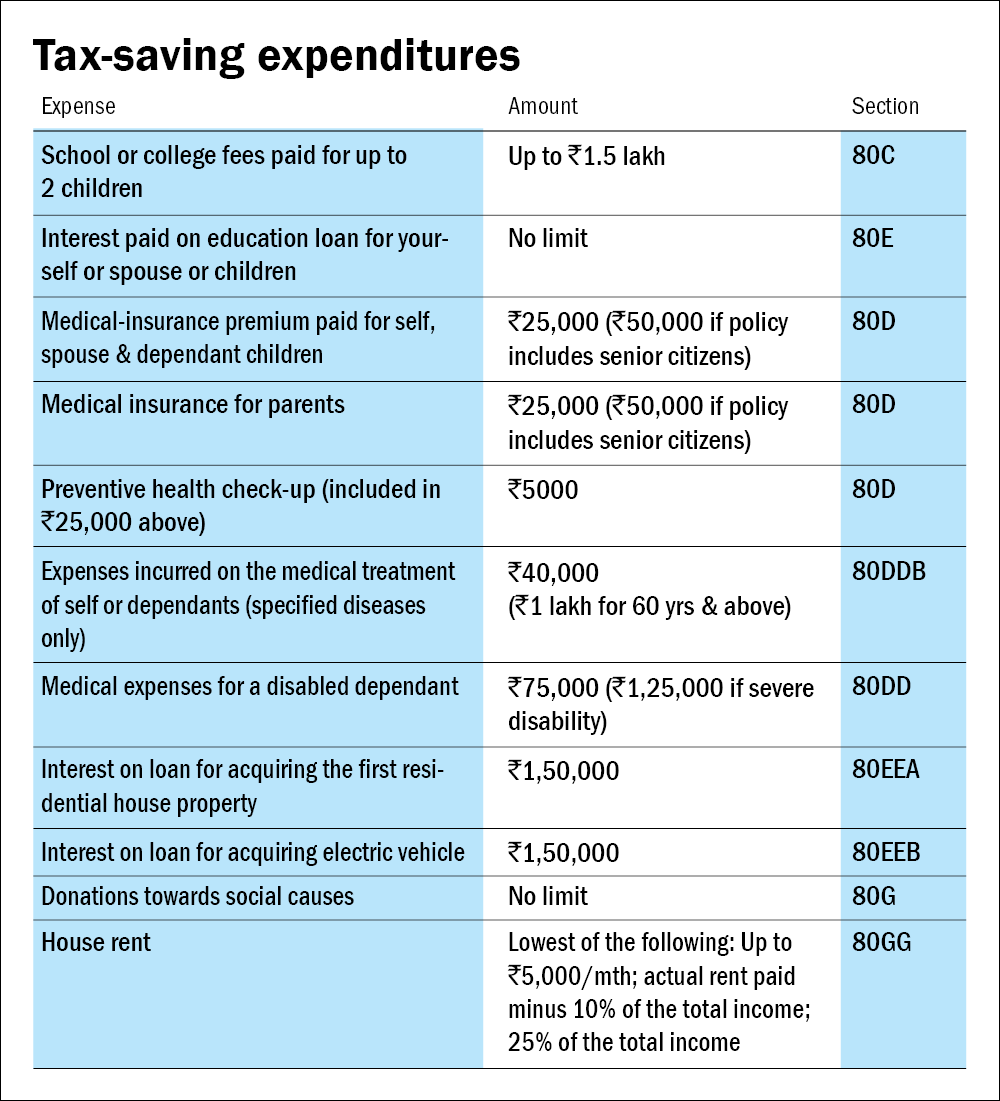

Once you have combined income from all sources, you arrive at your gross taxable income. From the gross taxable income, you deduct your tax-saving investments and expenditures. These fall under many categories, as described in the tables '80C tax-saving options' and 'Tax-saving expenditures'. What you are left with now is your taxable income. Note that the interest from your savings bank account above Rs 10,000 is taxable as per your tax slab.

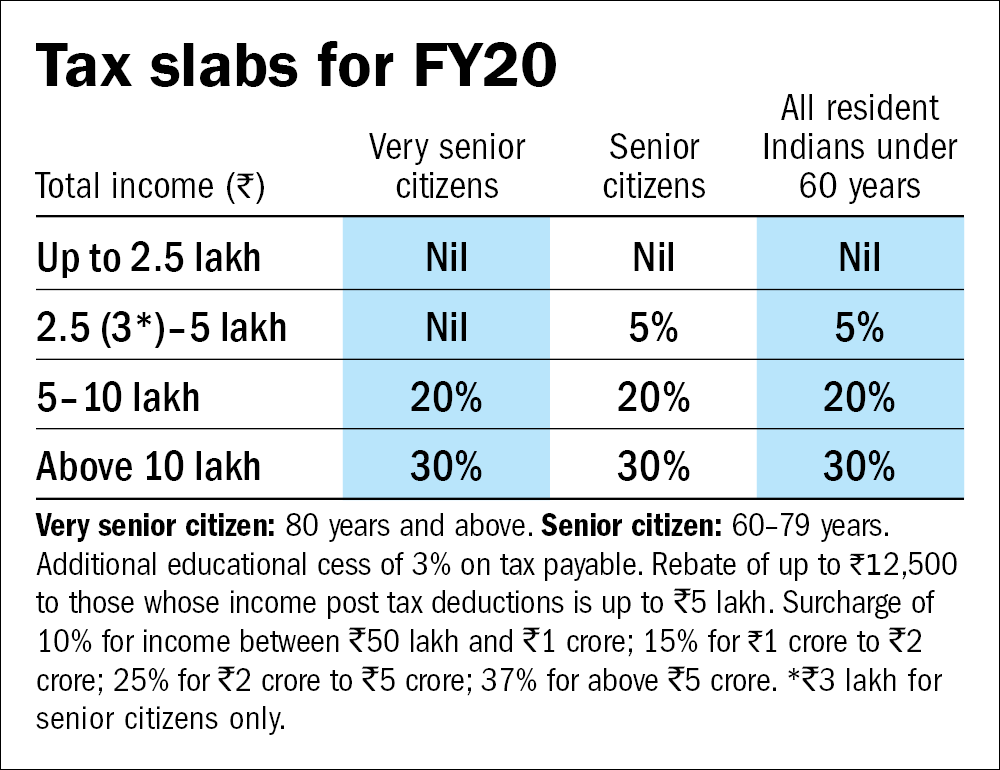

Check the tax slabs to know how much tax you need to pay. Do note that the Union Budget for FY21 has introduced an alternative tax structure, which is in addition to the existing tax slabs. You can pick either tax structure, depending on which saves you more tax.

Section 80C: Mainstay of your tax-saving investments

When it comes to tax-planning, Section 80C of the Income Tax Act provides many avenues, as given in the table below. You can invest up to Rs 1.5 lakh in these instruments. Section 80C consists of many options: tax-saving funds (discussed later), Public Provident Fund, National Savings Certificate, tax-saving FDs and so on. The Sukanya Samriddhi Yojana is meant especially for the girl child. Investments made towards the National Pension System (NPS) also come under this section. Note that you can also make an additional investment of Rs 50,000 in the NPS, under Section 80CCD(1B), beyond `1.5 lakh.

Most of us also have provident-fund deductions. These deductions (not the employer's contribution) are also included in Section 80C. Do take them into account when you calculate your investment amount. For instance, if you have made a provident-fund contribution of Rs 50,000, you need to make an investment of only Rs 1 lakh towards Section 80C.

Life insurance

The premiums paid towards life insurance also come under Section 80C. Life-insurance policies come in many forms. But the best is term insurance. Term insurance provides you a large cover at low premiums.

Term insurance is different from endowment and unit-linked policies (ULIPs). Endowment and unit-linked policies are also savings plans and the premiums paid towards them are accumulated over time. In the case of ULIPs, the premiums are invested in the stock market. On the other hand, while term insurance provides a large cover, you don't get your premiums back. This makes many investors think that endowment policies and ULIPs are better than term plans. That's not the case, however.

The primary function of insurance is to provide protection. The insurance products that double up as investments fail to provide both - the insurance cover is inadequate and the investment returns are disappointing. Therefore, as a general rule, don't mix insurance and investment. For investments, buy pure investment products. For protection, buy pure insurance products.

Life insurance isn't meant for everyone. It is meant only for those who have financial dependents. Non-earning members don't need life insurance. Many parents buy life insurance in the name of their little children. While buying life insurance in the name of your kids is emotionally appealing, it doesn't have any financial logic. Since parents are not financially dependent on their children, they should not buy insurance in children's name. Rather, they should buy it in their name.

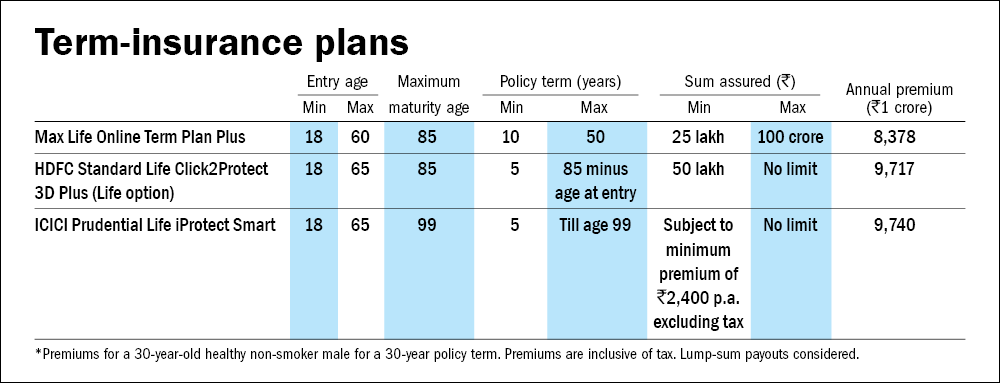

The table below lists three good term-insurance plans, along with their features.

Health insurance

While life insurance isn't meant for everyone, there is one type of insurance which we all must buy: health insurance. Medical emergencies can severely impact our financial health. Section 80D of the Income Tax Act allows deduction of health insurance premium of up to Rs 50,000 for senior citizens and up to Rs 25,000 for insurance of self, spouse and dependent children. Additionally, a deduction of up to Rs 50,000 is available for buying health insurance cover for parents.

In today's highly stressful and fast-paced life, health-insurance has taken many independent forms, which were earlier offered as riders. These are indeed important and you must consider them as well. A couple of such insurance are personal-accidental insurance, cancer protection and critical- illness insurance. A personal-accidental cover provides compensation in case of a disability and accidental death. A critical- illness cover is meant for serious diseases which result in very high expenditures and which are not covered in normal health insurance. Even if they are, the sum assured is likely to fall short of the expenditure incurred.

Tax-saving funds

Tax-saving equity mutual funds, also called equity-linked savings schemes (ELSS), are a good tax-saving option as they provide equity advantage and hence better returns than most other 80C options. ELSS has a lock-in period of three years. For most other tax-saving options, the lock-in period is five years. For the PPF, it is 15 years.

ELSS is one of the few 80C options which provide equity exposure. The other options are ULIPs and the NPS. The EPFO has also started investing in equity, so a part of your provident fund gets invested in equity through exchange-traded funds (ETFs). ULIPs have an opaque structure and high costs. On the other hand, ELSS has a transparent structure and is professionally managed. Fund houses must regularly file disclosures of their activities. The NPS allows you to invest in equities but the best equity exposure you can get is 75 per cent (in the Aggressive Life Cycle Fund or through the Active choice). This also keeps coming down as a person gets older. Also, being a retirement tool, the NPS is illiquid.

An individual normally already has a debt component in his portfolio in the form of provident fund and FDs. This makes ELSS all the more important to generate inflation-beating returns and to properly allocate assets between equity and debt.

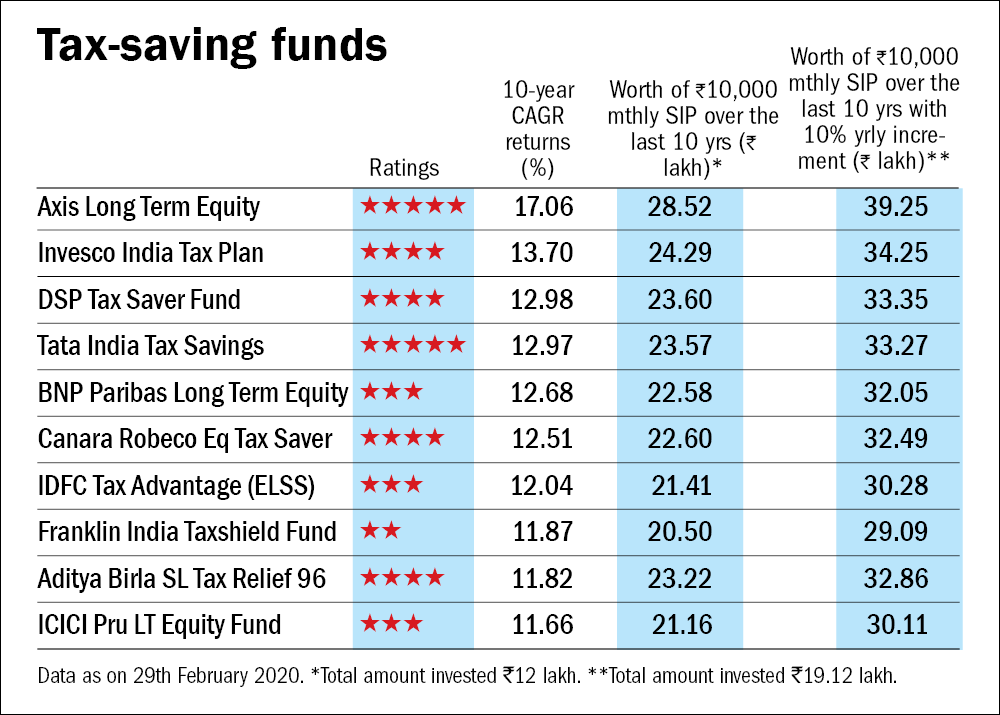

By linking your tax-saving investments to a long-term goal such as retirement or children's higher education, you can also accumulate corpus for it. The table below lists some top-performing tax-saving funds over the last 10 years. Please note that the table has returns as of February 2020. The markets crashed in March due to the COVID-19 outbreak and hence the latest returns may appear artificially low.