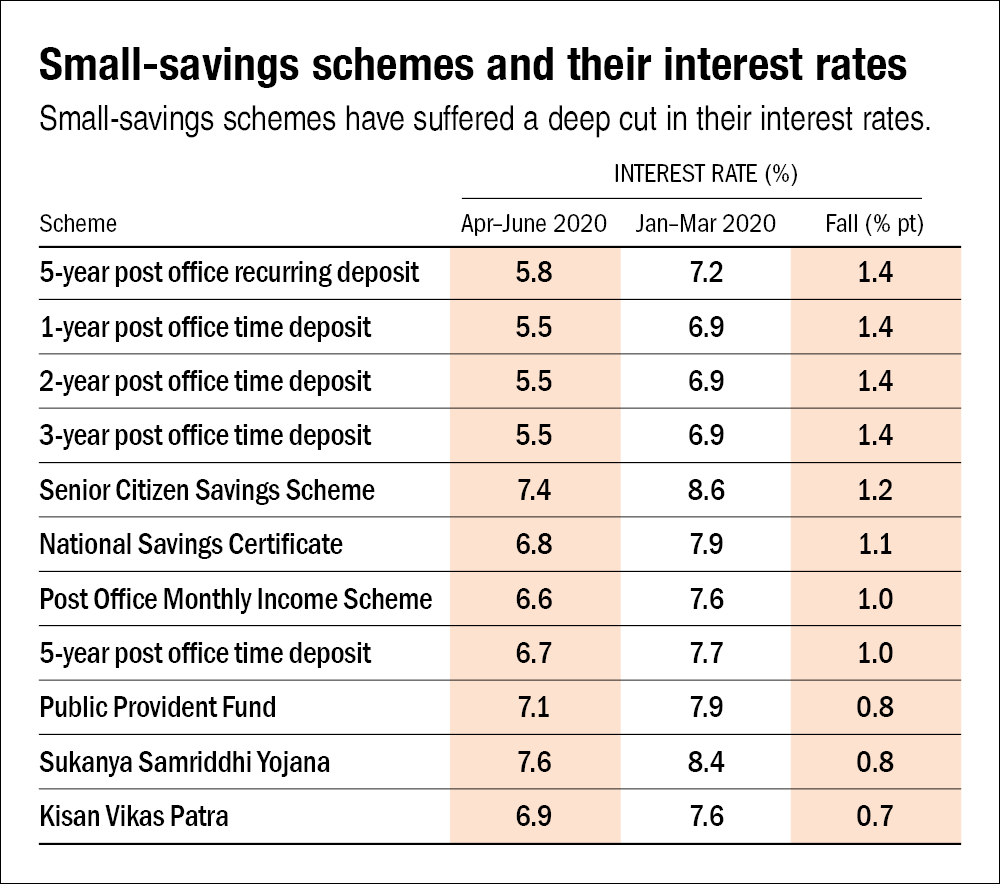

The interest rates in small-savings schemes have been reduced significantly for the April-June 2020 quarter, with the cut ranging from 70 basis points to 140 basis points across different schemes (100 basis points make one percentage point). This move was expected as the RBI had reduced the repo rate by 75 basis points in the last week of March 2020.

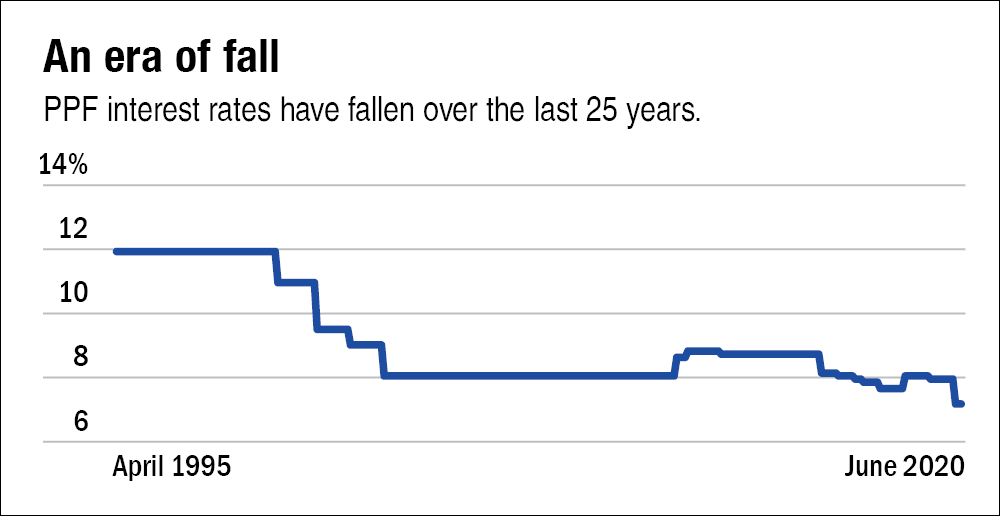

The Public Provident Fund (PPF), which is one of the most popular and sought-after small-savings schemes, is now offering 7.1 per cent as against 7.9 per cent during January-March 2020. This is the lowest PPF rate in the last 25 years. In March 2001, the rate of interest for PPF fell to 9.5 per cent from 11 per cent (a cut of 150 basis points). On the other hand, in March 2003, it was reduced to 8 per cent from 9 per cent (100 basis points).

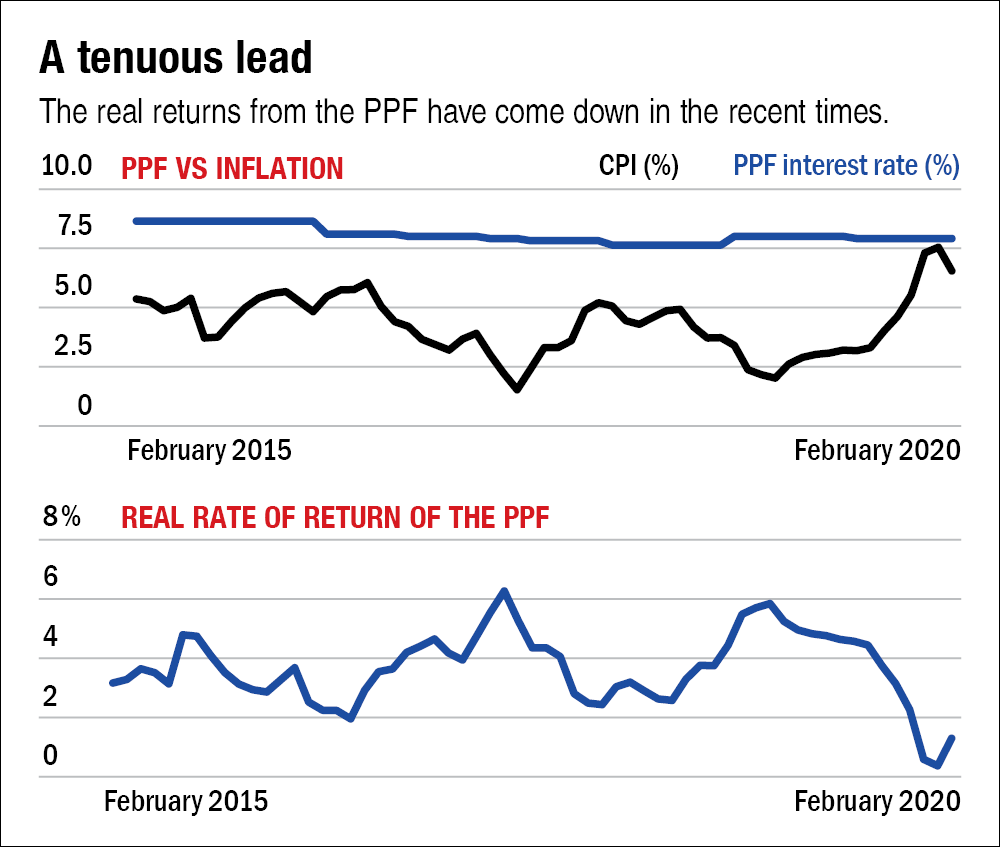

Although a low interest rate is surely disappointing, one should understand what really matters is the 'real rate of return' and not just the interest rate alone. Real rate of return is what you get after adjusting for inflation. It is the actual growth of your money. Thankfully, the inflation has been benign for quite some time and the real rate of return is still positive for PPF investors. But the minuscule real return generated by small-savings schemes may not be sufficient to keep up with inflation in the long term.

Therefore, long-term investors should aim for higher returns, which can be achieved by investing in equity. One might argue that many small-savings schemes also help avail tax deductions under Section 80C. But so do tax-saving equity funds. The average SIP return of tax saving funds for a 20-year period stands at 13.02 per cent as on March 31, 2020.

Unfortunately, due to the massive fall the market has witnessed in the current crisis, equity funds are quoting not-so-attractive returns. Don't be deceived by these. Once things normalise, equity-fund returns will also stage a smart comeback. In fact, this may be the most opportune time for long-term investors to invest in equity. However, one should invest only the money not required for at least five to seven years. Further, one should abstain from investing a lump sum and opt for SIPs to reduce the impact of volatility on one's overall returns.