Pradhan Mantri Vaya Vandana Yojana (PMVVY), a government-backed pension scheme, has been extended for another three years until March 31, 2023. Initially, in 2017, the scheme was available for around a year. Later, it got extended until March 31, 2020.

Being operated by LIC, the scheme stopped accepting fresh subscription from April 1, as there was no intimation from the government about its extension. Nevertheless, in a press release dated May 20, 2020, the Union Cabinet approved its extension for another three years.

Although the scheme's features remain the same, there is a change in the interest rate. Now, PMVVY would offer a return of 7.40 per cent and would reset every financial year to stay in line with the Senior Citizen Savings Scheme (SCSS). Earlier, PMVVY offered a guaranteed return of 8 per cent.

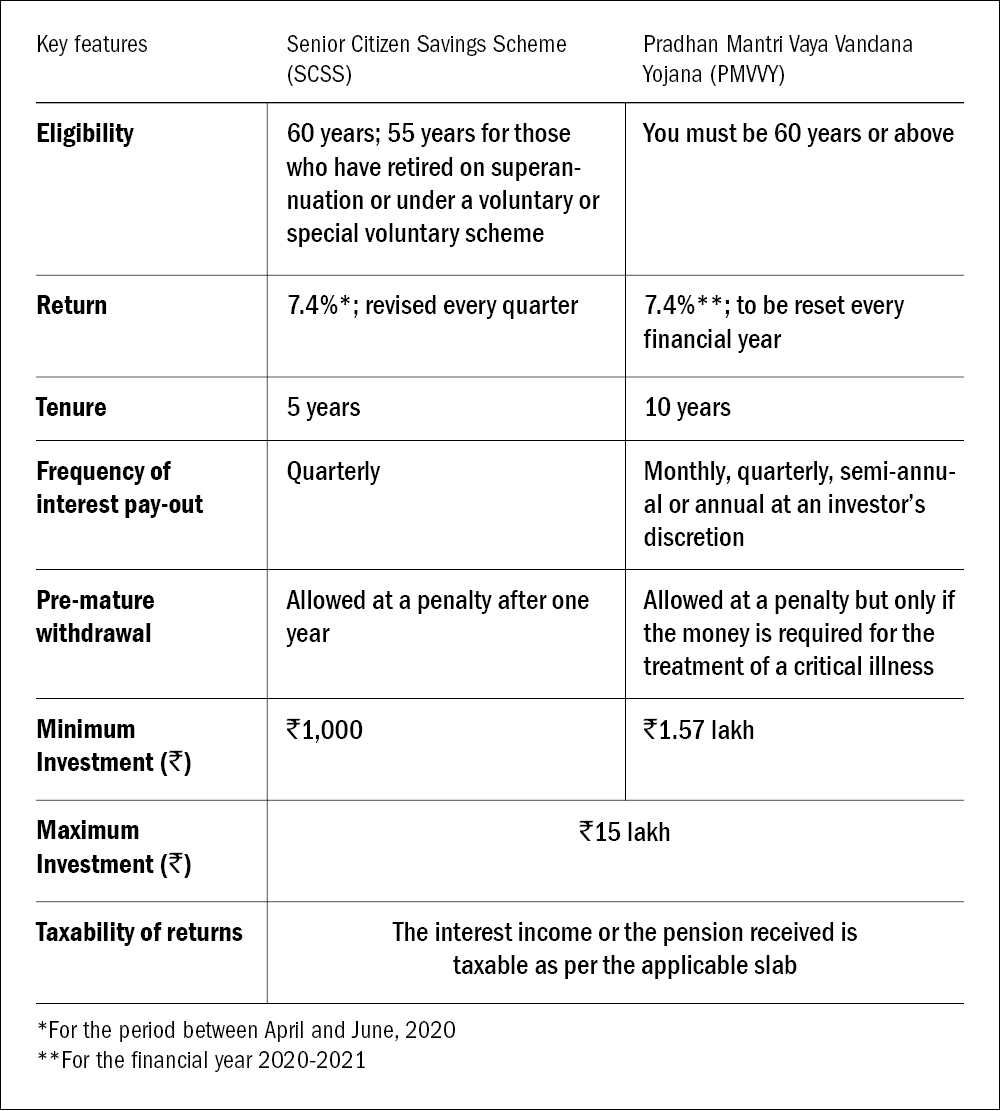

Even though the interest rate of PMVVY has been reduced, the scheme is still very lucrative, especially when compared with other fixed-income options to generate regular income for senior citizens. A bank deposit with a nationalised bank like State bank of India is currently offering an interest rate between 3.80 per cent to 6.50 per cent, depending on the tenure. On the other hand, the Post Office Monthly Income Scheme (POMIS) is fetching 6.60 per cent. So, even with the reduced interest rates, PMVVY and SCSS score higher in terms of generating returns. The following table encapsulates their key features.

So, when it comes to deriving regular income for retirees, both the schemes are good options. But as mentioned earlier, one should not solely depend on fixed-income sources. Allocate a portion of your portfolio to equity in order to keep pace with inflation. To know more about how to combine fixed-income and equity investments to derive steady income and yet benefit from equity, read this article.