Prashant (32) works in the legal department of a telecommunications company. He is married and has a one-year-old son. So far, he has been mainly saving through traditional products - bank fixed deposits, recurring deposits and the Public Provident Fund (PPF). However, just about six months back, he started a Systematic Investment Plan (SIP) of Rs 5,000 in a multi-cap fund to save up for his retirement on the advice of a friend. But the recent fall in the stock market due to the spread of COVID-19 has made him extremely anxious. Here is what he should do.

Do not stop your SIP

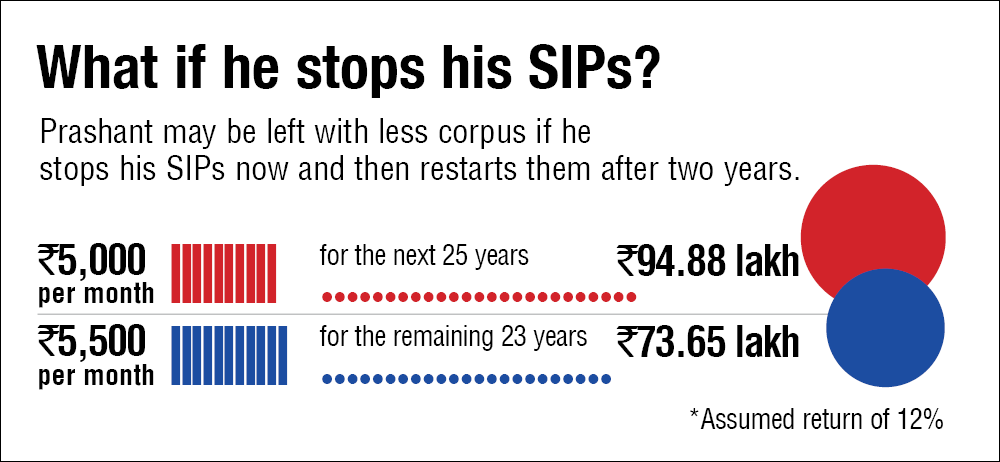

Prashant should not stop his SIPs. This is actually a good time for SIPs as he can invest when the market is cheaper. Later on, when the markets recover, investments made now will boost his overall returns.

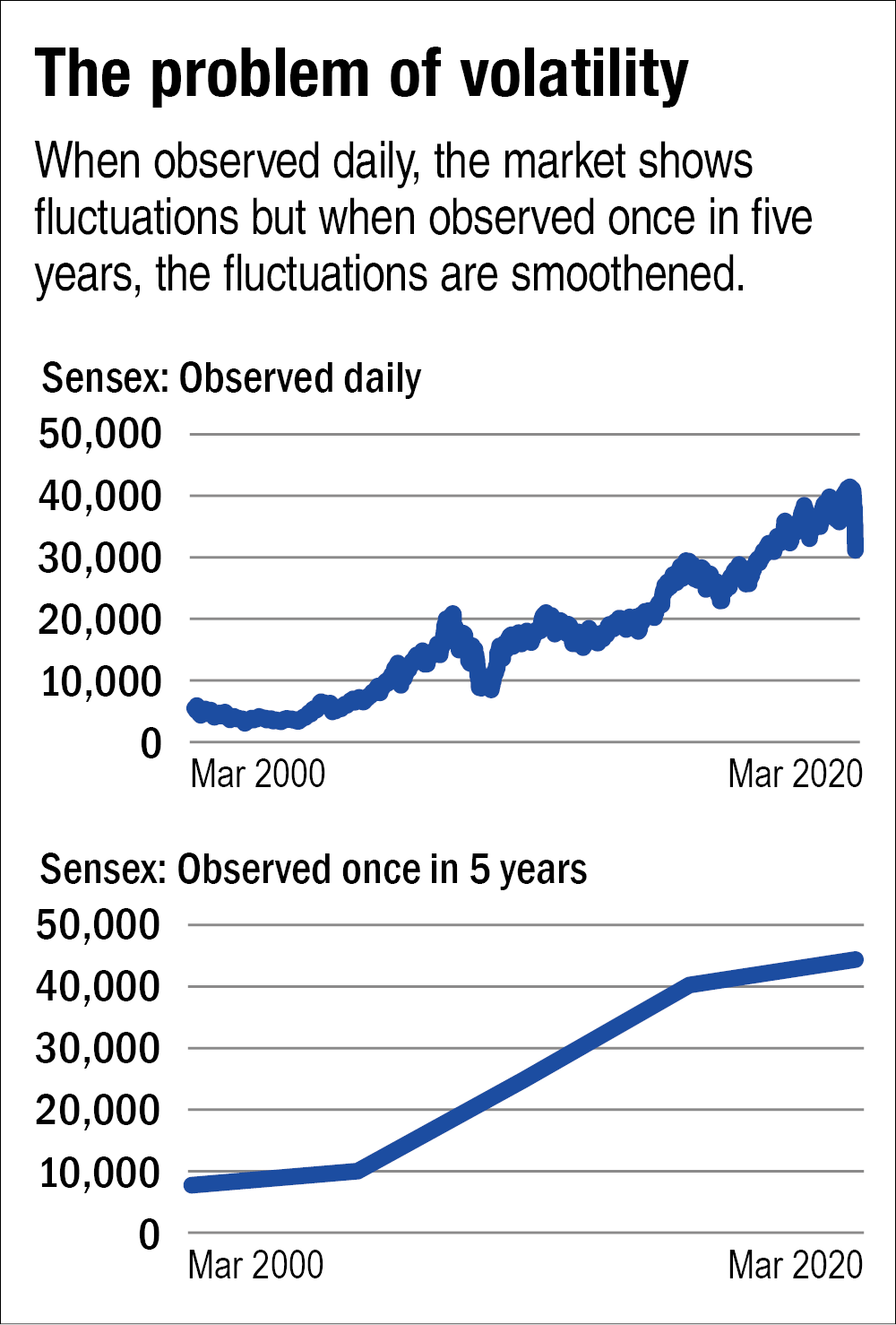

Understand that equities are volatile

Over short periods, equities can sharply move up or down. However, if observed over a long period, their movement has been linearly upwards. See the chart below

Income and expenditure

Prashant has a monthly income of Rs 60,000, of which Rs 30,000 is used for his monthly expenses and Rs 12,000 for rent. He has a surplus of Rs 18,000 every month.

What he has

Prashant's existing investments include Rs 1.7 lakh in a combination of a fixed deposit, recurring deposit and his savings bank account.

He also has Rs 1.2 lakh accumulated in the PPF and Rs 30,000 in an equity fund.

While it is true that this could be the best time to invest in equity funds, one should invest only one's long-term money, which is not required over the next five to seven years. If you have some extra money to invest for the long term, invest it in parts over the next six to 12 months. Do not invest a lump sum. If you invest the entire sum now, a further fall in the market can increase your anxiety

Prashant's goals

Prashant has two main financial goals: his son's higher education in about 16 years, and his own retirement in 28 years. While he estimates his son's education to cost Rs 10 lakh in today's value, this will inflate to Rs 25.4 lakh by the time he needs this money (at an inflation rate of 6 per cent).

Likewise, assuming an inflation rate of 6 per cent and a return of 8 per cent in his post-retirement years, Prashant would need Rs 5.20 crore for a comfortable retirement.

How to achieve the goal

- Start an SIP of Rs 3,000 in an aggressive hybrid fund.

- Increase contribution by 10 per cent every year.

- Switch to multi-cap funds once you get comfortable with equity.

- Start shifting to fixed income two to three years before the goal to avoid any abrupt market fall.

- Invest Rs 9,500 in equity-oriented funds and increase the contribution every year by 10 per cent.

- For this, invest in a good tax-saving fund to the required extent (maximum Rs 1.5 lakh in a financial year). Tax-saving funds are multicap in nature.

- For the remaining amount, use aggressive hybrid funds if you are uncomfortable with volatility. Otherwise stick to multi-cap funds.

(Assumptions: Inflation @ 6 per cent p.a; Return from equity-oriented mutual funds 12 per cent p.a; Return on retirement corpus after retirement: 8 per cent p.a.)

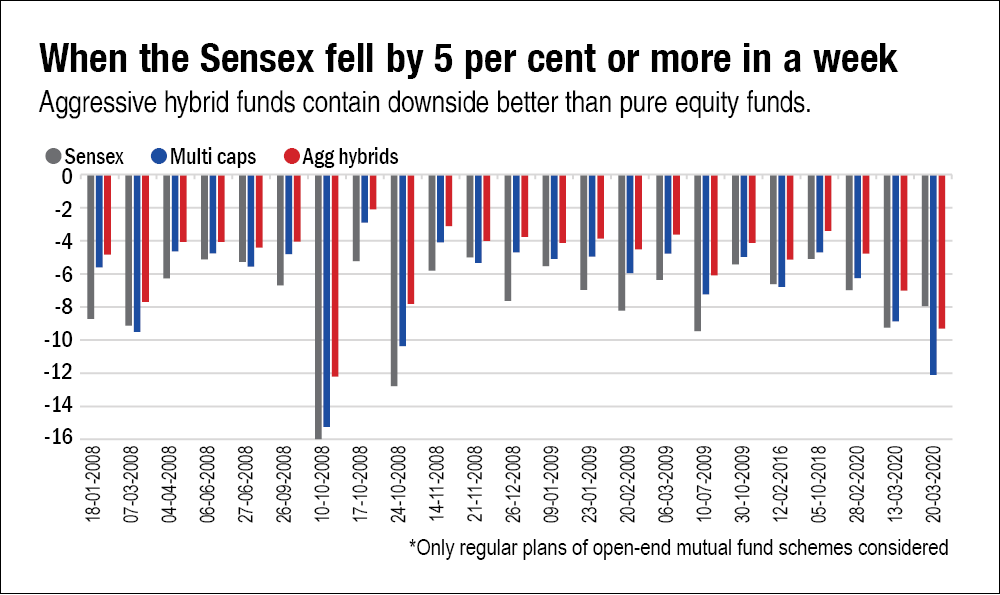

Beginner's should invest in aggressive hybrids

Though multi-cap funds are the ideal way to get equity exposure, for new investors aggressive hybrid funds are the best. Aggressive hybrid funds invest 65-80 per cent in equity and the rest in debt. Debt exposure cushions the fall. See the graph below. As one gathers experience in equity investing, one can explore pure equity funds also.

Don't ignore these