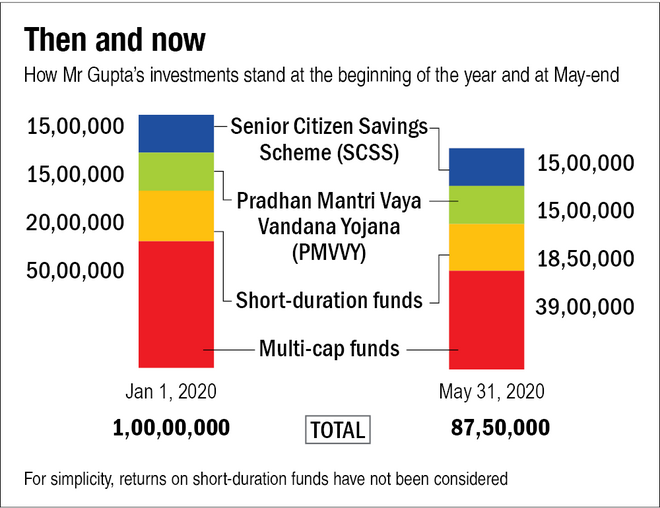

After his retirement last year, Mr Gupta invested his retirement corpus of Rs 1 crore equally in equity and fixed income. He invested Rs 15 lakh each in Senior Citizen Savings Scheme (SCSS) and Pradhan Mantri Vaya Vandana Yojana (PMVVY), which helped him get a guaranteed monthly income of Rs 20,000. His remaining fixed-income portion is invested in a combination of liquid and short-duration funds, from where he has set up a monthly withdrawal of Rs 30,000 to meet his expenditure.

Unfortunately, a massive fall of about 22 per cent in equities during March end and early April made him extremely anxious and worried that he may outlive his savings (see the graphic 'Then and now').

Here is what he should do now.

Do not redeem your equity investments

Given the prevailing situation, Mr Gupta may be tempted to withdraw his equity investments to safeguard the capital left. However, doing so would be a big mistake as that would make his notional losses permanent.

One must appreciate that equities are volatile in nature and can give you nasty surprises over the short term. It is important to stay invested in such times to reap the benefits over the long term. Over time, markets tend to recover and continue their upward march. That's why you should keep only that money in equity which you won't need at least for the next five years.

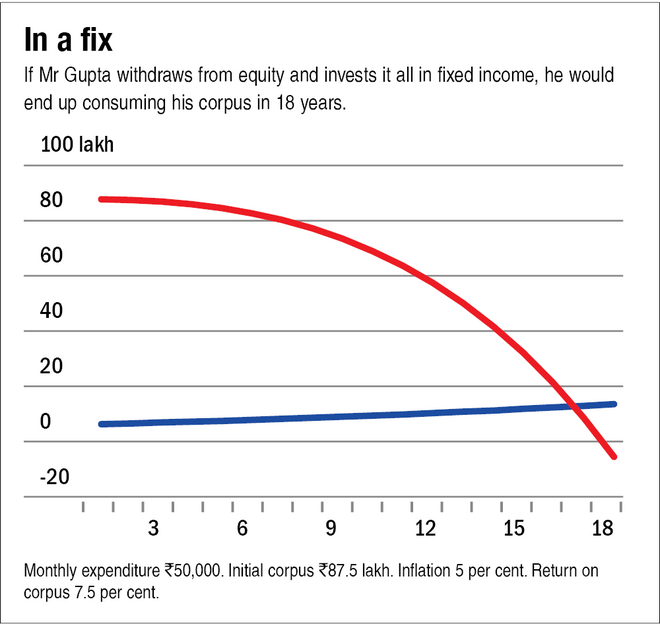

Further, resorting only to fixed income is not a solution either as fixed income fails to generate inflation-adjusted return over the long term. Mr Gupta can end up consuming his corpus faster if he relies only on fixed income (see the graph 'In a fix').

Utilise your fixed-income investments

Mr Gupta has made the right decision of investing the maximum possible amount in SCSS and PMVVY, which are high-yielding, government-backed and guaranteed return schemes. He was lucky to lock his money in these schemes at 8.6 per cent and 8 per cent, respectively. The interest rate for fresh investments in SCSS and PMVVY has now reduced to 7.4 per cent. This has helped him generate a guaranteed monthly income of Rs 20,000.

His approach of setting up an SWP of Rs 30,000 from debt funds to meet his monthly requirement of Rs 50,000 is also correct. Mr Gupta should continue to utilise his fixed-income investments to meet his living expenses for the next few years. He has sufficient money in fixed income for this purpose

Reduce your expenses

Since Mr Gupta is in the initial years of his retirement, he has a long way to go. Continuing with a monthly expenditure of Rs 50,000 may expose him to the risk of outliving his expenses.

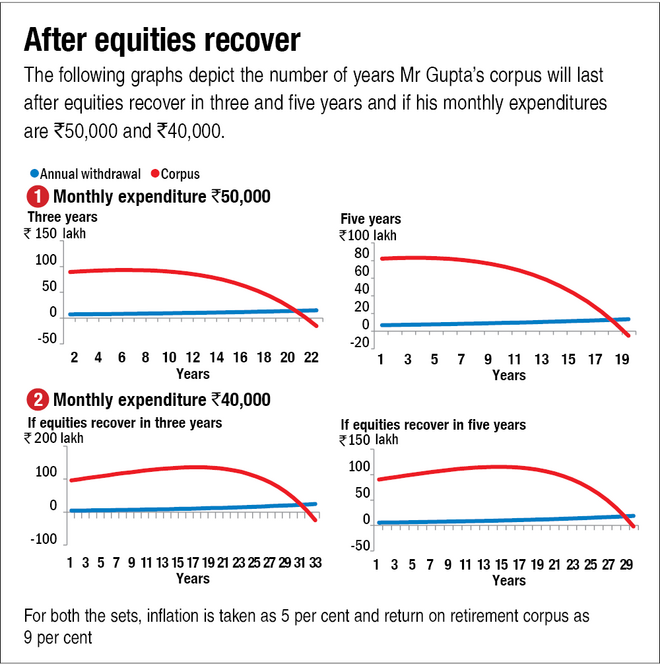

Look at the graphs titled 'After equities recover'. While it is not possible to give a definite time when equities would recover, we have considered two scenarios: three and five years. 'Recovery' means Mr Gupta recouping his losses of 22 per cent on his equity corpus. If Mr Gupta continues to spend Rs 50,000 every month, his corpus would last for about 19 years after the initial five years of recovery. However, if he curtails his expenses to Rs 40,000, the same corpus would last for about 30 years after the initial five years of recovery.

Mr Gupta should, therefore, try to reduce his discretionary spending and limit his monthly expenditure to Rs 40,000. This should reduce the chance of him outliving his corpus.

Don't ignore these

- Maintain a contingency fund equivalent to at least six-month expenses in a combination of sweep-in fixed deposit and liquid funds.

- Buy term life insurance if you have financial dependents and your assets are insufficient to take care of them in your absence.

- Continue with your health insurance as any unplanned medical emergency can eat away your savings. Many senior-citizen-specific health insurance plans are available in the market today