Gaurav (34) works with a publishing house and has an annual salary of Rs 9 lakh. His wife is a homemaker. The couple has a four-year-old daughter. The family lives in a rented house, which costs Rs 15,000 monthly. The other household expenses are around Rs 45,000 per month, leaving hardly any surplus. Gaurav wants to know how he can still save on income tax. Here is a plan for him.

Opt for the old tax structure

In its Budget for FY21, the government introduced a new, simplified tax structure which has lower tax rates. However, if one opts for it, one has to forego most tax deductions and exemptions normally available. One can make a choice between the new tax structure and the old one.

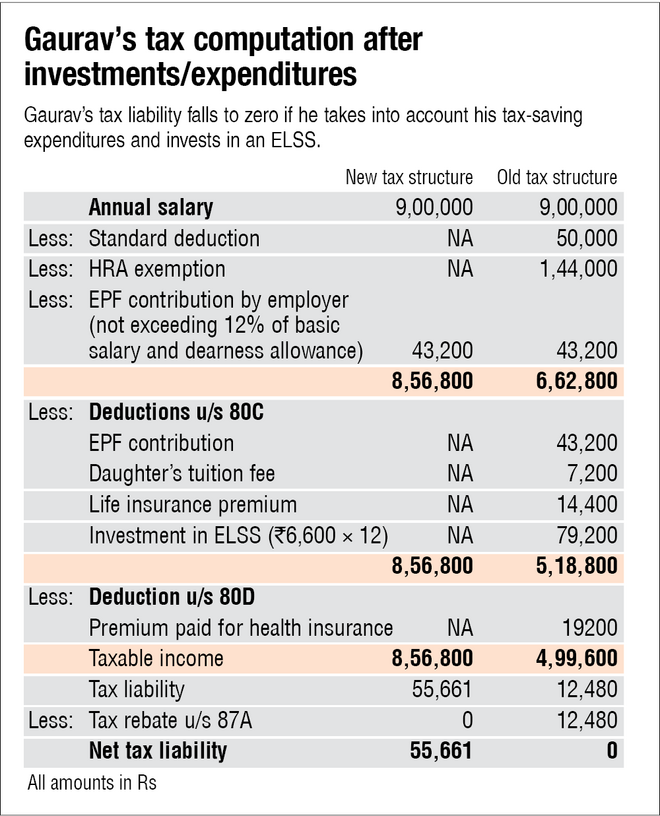

For Gaurav, staying in the old regime is more beneficial. Under the new regime, his tax liability will be Rs 55,661 for the year. Under the old regime, it will be Rs 36,379 without investing or spending any additional amount. That is a reduction of almost 35 per cent. See the table below.

The lower tax in the old regime is because of the various deductions it allows. These cannot be availed in the new tax structure.

Wondering if you should opt for the new tax regime or the old one? Check our tax calculator!

Deductions that can reduce your tax liability

The following deductions can be claimed in the old regime.

Standard deduction of Rs 50,000: Available to all. No need to present any documents for this.

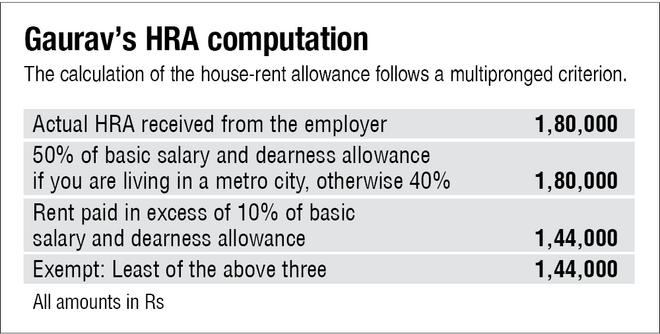

House rent allowance (HRA): Gaurav's annual salary includes an HRA of Rs 1.8 lakh. His basic salary is Rs 3.6 lakh. Based on the HRA criteria, he can claim a deduction of Rs 1.44 lakh. He will have to submit to his employer copies of rent receipts, rent agreement and the PAN of his landlord for claiming this deduction. See the table below

Employees' Provident Fund (EPF): Gaurav's mandatory contribution to the EPF is Rs 3,600 per month. His employer contributes an equal amount, which is included in Gaurav's annual salary. Gaurav can claim a deduction of Rs 43,200 (Rs 3,600 × 12) from his taxable income under Section 80C. His employer's contribution is also tax-exempt up to 12 per cent of the basic salary and dearness allowance. This will help Gaurav reduce his taxable income by a total of Rs 86,400 (Rs 43,200 + Rs 43,200). Note that only his contribution comes under Section 80C.

Tuition fee: Gaurav's daughter is in a playschool. The 'tuition fee' component of her monthly school fee amounts to Rs 600. The Income Tax Act allows tax deduction of the tuition fee paid for any full-time course (including play school and pre-nursery) under Section 80C. However, it is limited to two children and Rs 1.5 lakh. Hence, Gaurav can claim a deduction of Rs 7,200 from his taxable income.

With all these deductions, Gaurav can reduce his taxable income to Rs 6,12,400 and tax liability to Rs 36,379.

Do not compromise on insurance. It will also help you save tax.

Gaurav doesn't have life insurance. Being the sole breadwinner for his family, he must buy a pure term plan to financially protect his wife and daughter in his absence. A Rs 1 crore cover till the age of 60 will cost him around Rs 1,200 per month. The annual premium (of about Rs 14,400) can also be claimed as a deduction under Section 80C.

Gaurav has only a health cover of Rs 2 lakh provided by his employer. This amount is not just insufficient but relying solely on employer-provided health insurance isn't advisable. That's because it is available only as long as you are working with your employer. Gaurav must buy a floater health plan of Rs 5 lakh, covering his family. It will cost him somewhere around Rs 1,600 per month. This amount can be claimed as a deduction under Section 80D, which will further reduce his tax liability.

Buying life and health insurance as stated above will reduce his tax liability to Rs 29,390.

Invest Rs 6,600 in an ELSS

While Gaurav is hardly left with any surplus, he should cut his discretionary expenses and invest at least Rs 6,600 monthly in a good tax-saving fund (equity-linked savings scheme or ELSS). Not only will this bring his tax liability to zero (see the table below) but also help him invest some money for his long-term goals like his daughter's higher education and his retirement. Investments in an ELSS are tax-exempt under Section 80C. ELSS are equity mutual funds with a lock-in period of three years.

Build an emergency fund

Maintain an emergency fund of at least six months of expenses. It is very helpful during difficult situations like a job loss or a medical emergency. Due to the economic and health uncertainty created by the pandemic, an emergency fund has become all the more crucial. It can be maintained in a combination of a sweep-in fixed deposit and a good liquid fund.

Deduction of health-insurance premium under Section 80D

- A deduction of up to Rs 25,000 is available on the premium paid for the health-insurance policy of self, spouse and children.

- An additional deduction of up to Rs 25,000 is available for the health insurance policy of parents.

- The limit of Rs 25,000 is replaced by Rs 50,000 in both the cases above if any policy holder is a senior citizen.

Popular Section 80C avenues to claim deductions up to `1.5 lakh in a financial year

- Tax-saving funds

- Employee's contribution to EPF

- Public Provident Fund (PPF)

- Life insurance

- Pension schemes like NPS

- Five-year tax-saving bank FD

- Tuition fee paid for up to two children