Over the years, a large part of the investment narrative in the mutual fund industry has focused on Systematic Investment Plans (SIPs). And that's only natural, given the built-in growth in the Indian markets and a large population waiting to benefit from the wealth-creating potential of equities. However, the crash of March 2020 highlighted that while it's important to invest regularly, one should also have an exit plan so that an abrupt fall in the market doesn't leave you with a diminished corpus just when you need it.

Systematic withdrawal plan, or SWP, is the other side of the investment equation. It is the reverse of SIPs and helps you systematically exit equities. The process involved is simple: when you set up an SWP, a part of your accumulated corpus is transferred to your bank account monthly. So, you don't exit at one go, rather over a period. Just as SIPs help you average your investment cost, SWPs help you average your withdrawal. This ensures that you don't sell out at the bottom. Of course, this also means that you don't sell out at the top either. But then without the benefit of hindsight, who can tell when the market has made a top?

While this logic of SWPs appears to be irrefutable, in this article, we try to assess how effective SWPs have been in protecting your gains and thus helping you achieve your target amounts. To do so, we conducted a study on the past returns of the Sensex. Let's begin with the methodology.

Methodology

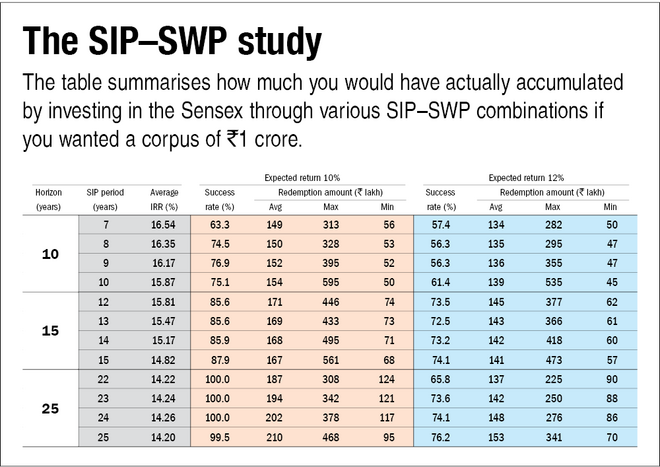

In our study, we set a goal of accumulating Rs 1 crore by investing in the Sensex over any 10-, 15-, or 25-year time periods since its inception in 1979. Overall, there were 373 instances of 10-year periods, 313 of 15-year periods and 193 of 25-year ones. For each of these horizons, we considered the following SIP-SWP combinations:

- SIPs in all years, no SWP

- SIPs in all years except the last one year and SWP in the last year

- SIPs in all years except the last two years and SWP in those two last years

- SIPs in all years except the last three years and SWP in those three years

For instance, for a horizon of 10 years, following are the different combination of SIP-SWP periods: 10-0, 9-1, 8-2 and 7-3 years. Also note that we didn't assume any returns on the corpus that has been withdrawn. Normally, you would keep the corpus withdrawn in a bank account or in a debt fund, which will earn you some extra returns. However, to be conservative, we didn't consider those returns. Also, we assumed that the units accumulated at end of the SIP period were redeemed uniformly over the SWP period.

Next comes the SIP amount. How much to invest? For that, we considered two return scenarios: 10 per cent and 12 per cent. For both the return brackets, we thus had 12 samples: four each (no SWP and one-, twoand three-year SWP) for the three time horizons of 10, 15 and 20 years.

Observations

The table 'The SIP-SWP study' summarises the findings of this analysis. The 'success rate' indicates if the particular SIP-SWP combination delivered the required amount of Rs 1 crore.

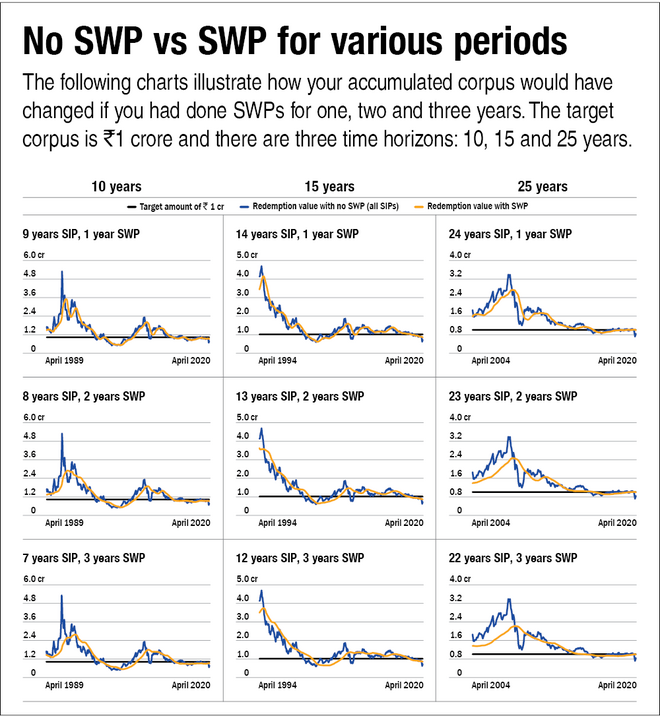

The graphs titled 'No SWP vs SWP for various periods' illustrate how the final redemption value fluctuated for various time periods.

Here are a few conclusions based on the data:

SWPs do provide downside protection:

As the table shows, the minimum amounts that one would have got at the time of redemption starts to increase with an increase in the SWP period. However, your chances of getting high returns also start to diminish simultaneously, as seen from the maximum amounts. Hence, SWPs tend to moderate the extreme outcomes in both the directions.

SWPs don't ensure that you will reach your target amount:

The success rate more or less remains the same with SWPs of different periods. Thus, having an SWP for a particular horizon does not necessarily improve your chances of achieving your target amount.

With equities, your time horizon matters:

As the time horizon increases from 10 years to 15 years to 25 years, there is a significant improvement in your chances of achieving the target amount, as depicted by the success rates. This reinforces the investing tenet that with equities, you must have a long-term horizon. In fact, the longer the horizon, the easier it will be for you to achieve your target amount.

It doesn't hurt to be conservative with your return expectations:

As the data shows, investments made with a conservative 10 per cent return expectation outdo those with an aggressive 12 per cent.

So should you do SWPs?

From the analysis above, it's evident that SWPs shouldn't be seen as a tool to help you accumulate your target amount. Rather, it's a method to not lose your accumulated corpus, especially in the event of a sudden crash. It's true that opting for SWPs can also lower your returns but again SWPs are not meant to boost your returns but protect what's already there.

Thus, if your goal is non-negotiable and will become due on a certain date, such as your children's education, it would make sense to create a buffer by investing extra over time. Alternatively, allocate any windfalls or bonuses that you receive to your crucial goals. This will ensure that you don't fall short of the required amount.

At Value Research, we advocate having a withdrawal plan in place. If you have been diligent with your SIPs and have built a corpus over the long term, it makes sense to also protect the gains. Alternatively, you may also like to move to more conservative instruments such as short-duration debt funds as your goal nears. Markets can really be wild and a sound withdrawal plan can go a long way in securing your goals.

How much return to expect from equity

In financial planning, we often consider past equity returns to estimate how much we should invest now. Sensex's returns over the last five, 10 and 15 years on a rolling basis have been steadily coming down. This has made some investors doubt whether equities are still worth the pain. But let's put things in perspective. If we look at equity returns on an inflation-adjusted basis, they have been hovering around 4-5 per cent per annum over the last 20 years. That's not as bad as it appears. Over the long term, in spite of a declining returns curve, equities have trumped inflation.

However, this also calls for resetting your return expectations periodically. A decade ago, when inflation used to be in higher single digits, it made sense to expect equity to return in double digits. Now as the Indian economy matures and inflation cools down, equity returns will also fall. So while making estimates for how much SIPs you will need to achieve a particular goal amount, it will pay to be conservative with your return expectation. This will not just avert any negative surprises later on to a large extent but will also create a room for positive surprises, if equities do witness a dream run.