Harish Sindhwani remembers the days when his investments used to earn a return of 1 per cent a day. When he had to borrow money, he was charged an interest rate of 1.25 per cent a day. In those tough times, one had to manage one's finances really well. With interest rates like these, even the smallest error brought instant ruin. Of course, the upside in making investments was huge. Sindhwani recalls how he managed to make a major purchase by investing the money and waiting just for two months. He still remembers what the purchase was-a cricket bat. The bat was for Rs 25 and he had just Rs 15 saved up from his pocket money. He invested it at 1 per cent a day and was able to buy the bat in less than two months.

Harish was 12-year old at the time and the financial institution that offered these borrowing and lending rates was his father. Senior Mr Sindhwani-who is now retired from his job as an economics lecturer in a college-no longer offers private banking facilities to his son, as his son is now a successful businessman and a very savvy investor. Harish credits his success in business and investing entirely to the fact that his father taught him everything about money at an age when the only thing other children knew was that money magically flowed out of their parents' purses and got them whatever goodies they asked for.

There is a lesson here that most of us would learn. As parents, most of us are increasingly obsessed with doing the best for our children. Perhaps, this is a side effect of having fewer children. But the time, as well as the money, that parents today seem to spend on their children seems out of proportion to what it was in previous generations. Of course, the neuroses of modern parenthood is something that an investment magazine is not qualified to comment on. But we are sure of one thing-if our children learn the basics of handling money, then they will face far fewer money-related problems as adults.

No matter what they do in their lives and how they handle life's inevitable successes and disappointments, a practical lesson on money is something they will definitely need. Here are some guidelines on how to teach your children to manage money.

Money is not a taboo

Many parents think that money matters should not be discussed in front of kids. They consider it their duty to protect children from the 'harsh realities' of the world, one of which is money. The result often is that children grow up with the impression that money doesn't have anything much to do with the necessities of life like food, housing and education. Instead, it is a fun thing that's connected with going out to eat at a restaurant or watch a movie or buy toys. And you can't blame them for thinking that because those are the only kind of expenses that they know about and participate in.

When it comes to the financial education of your children, two steps should be followed. The first one is to know how money works, while the second one is to be able to actually participate in the real use of money. The participation can first be on a mock basis and then, on a real basis.

The flow of money

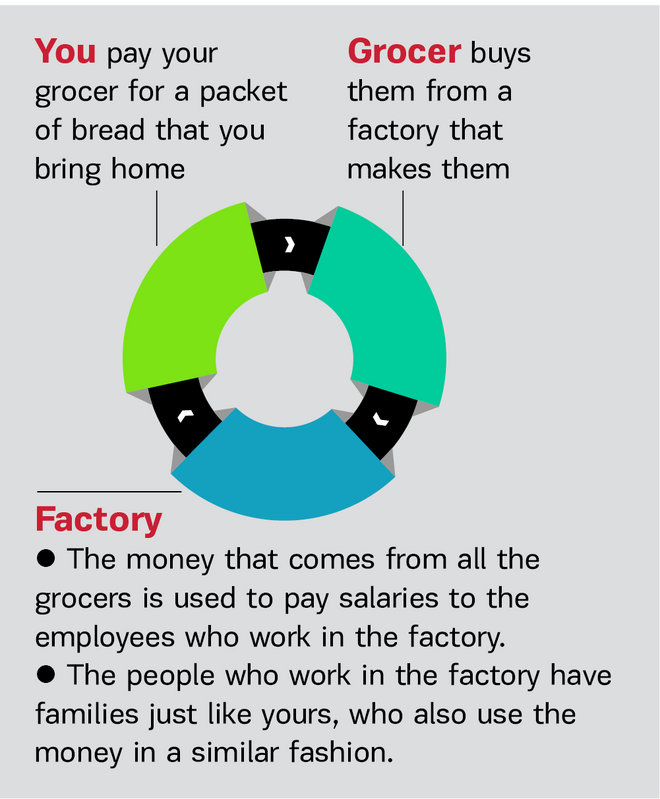

As early as at the age of five or six, you should explain to children what money is and how it flows through your lives. This can be done without revealing the actual sums. A child should know that you work-that you give your time-to earn money because it is needed. The money comes to your family and then, is used for various things-housing, food, education, health and other things. Explain to the child what happens to the money after you pay it to someone else-how there are other families like yours somewhere using the 'same' money after you've given it out to pay for things.

Here's an example that should make a child understand. You pay your grocer for a packet of bread that you bring home, make sandwiches and eat. The grocer doesn't make the bread loaves himself but buys them from a factory that makes them. In the factory, the money that comes from all the grocers, who buy loaves of bread, is used to buy flour, oil and other ingredients that are used to make them. It is used to pay salaries to the employees who work in the factory and to pay for other things like electricity.

The grocer and the people who work in the factory have families just like yours, who also use the money in a similar fashion. The example would work very well if you could somehow 'close the circle', that is, show some part of the money coming back to you. For example, if you are a businessman making furniture, you could talk about how some of the people working in the bread factory may actually buy furniture from you, using-as the child sees it-the 'same' money that you had paid for the bread.

While children usually understand far more than adults give them credit for, your profession could be something where the money flow is a little complex. For example, a government job cannot be fitted into this flow without explaining taxation and you will have to see whether your child is old enough to understand that. In such a case, you could explain the flow by using some neighbour's or friends' example. For an older child, it may be interesting to make the flow more complex by bringing in something they really connect to, like a favourite movie or a cricket player, or perhaps, a zoo.

Home banking

In order to tackle the specific source of most adults' money problems, it is crucial for children to get a first-hand feel for concepts like savings, credit and investments. The best way of doing that is to set up a home bank like the Sindhwani household did many years ago. The age at which these should be done varies, but 10 or 11 is probably right.

For the home bank to do its educational job, it is important that the child should have a predictable 'income'. Somehow, not many Indian parents give their children a fixed allowance but this is a crucial prerequisite for your child's financial education. In the absence of a fixed allowance, the child's basic attitude towards money is that whenever he needs it, he can ask for it and if his story is convincing enough, you will open your wallet.

Many well-off parents will find the idea of having a fixed allowance for their children repulsive. The attitude among the rich in India seems to be that because they are rich, their children should never feel any 'want' and whatever the kids ask for, they must get. As many of us have no doubt, this is a recipe for future disaster. Remember, a fixed allowance needn't be a small allowance. If you have lots of money and feel it's fine for your kids to buy expensive things routinely, then, by all means, go ahead and fix the allowance at Rs 10,000 or Rs 50,000 a month or whatever suits your lifestyle, but fixing the child's discretionary spending at some level is a must.

Let's take a look at some details of how the Sindhwani home bank used to work. The basic idea behind the home bank was to teach about savings. As compared to adults, children live on an accelerated time scale. A month feels like a much longer time for a child than it feels for an adult because a month is such a larger proportion of a child's life. A home bank will achieve its goals only if the results are quickly tangible to a child, and that's the reason why it should run on a daily interest cycle. Also, it should have a high enough interest rate to actually have a significant impact in just a month or two. A rate of 1 per cent per day is quite appropriate.

On these terms, a child can get a first-hand feel of the advantages associated with savings. The basic idea of savings, which is the postponement of gratification, gets reinforced superbly. The child sees that if he resists the temptation of spending Rs 100 out of his allowance for a month, the next month it becomes 133 rupees. Being able to resist the temptation of impulse buying is a great asset in today's consumerism and advertising-driven world. The arithmetic exercise needed to calculate a daily compounding interest is of course an added educational bonus.

Given the large number of people who are perpetually having problems with credit card overuse, the loans business of the home bank is probably more important educationally than the deposits business. A child will quickly see how taking a loan to spend must be done in a planned fashion. One must be able to repay the loan quickly enough from one's income. Giving in to an impulse and taking a big loan without a clear capacity for repayment will quickly lead to spiralling dues, just like they do on so many credit cards.

One feature that the home bank must have is a compulsory minimum monthly loan repayment, just like credit cards. This is to guard against loans going 'bad', that is, a child taking a loan and then finding himself able to not repay and still be able to spend future allowances. A compulsory repayment of 20 to 40 per cent of the outstanding loan is adequate for the educational purpose to be served and is a guard against large loans and spiralling interest.

While all this may sound so much rule-driven for a child, you must remember that the sole purpose of the whole exercise is educational. This 'banking' system must have fixed allowances and fixed rules for it to teach the child about the functioning of the real world. If the child can bend the rules by just asking you nicely, then the educational purpose is defeated, as in the real world, there is little chance of getting a lender to write off a loan merely by smiling and asking nicely.

Making kids ad-proof

For a young person, the ability to handle one's finances is basically tied to being able to spend wisely. Here, our increasingly consumerist, advertising-driven environment is the main enemy. Uniquely at this point in time, a bulk of Indian families with young children have parents who didn't have to withstand the continuous assault of advertising when they were young. Their own childhood happened in the seventies and eighties-long before liberalisation-when there were far fewer nice things for Indian kids to buy and little advertising to drive them towards overspending. Therefore, the current generation of young parents has no first-hand memory of how much more psychological pressure advertising produces on kids than on adults.

This means that an important part of a child's financial education must consist of the de-glamourisation and deconstruction of advertising. Teach your child to distinguish between advertising and content on TV and in print. Bring advertising into the money flow you explain to the child and clearly point out that in order to make more money, companies always claim that their products are better than others so that everyone can buy their products. A child must understand that a lot of things that are said in advertisements are simply not true. Advertising professionals understand child psychology and motivations and expertly manipulate them. In order to stand a chance of withstanding this assault on his pocket-money, a child must understand at least some things about the psychology and motivations of advertisers.

Transitioning to real finances

As a child grows up to mid-teens, it's time for transitioning him to handling some of his real expenses. Apart from the basics like housing, food and education, most other expenses should be shifted to the child's own, expanded allowance. You could budget things like clothes, shoes, gadgets and non-family vacations (which are the ones that start ballooning at that age) to a single annual figure and let a child apportion the money between these expenses. The very act of buying, say, cheaper shoes in order to pay for a portable MP3 player or a gift for his girlfriend is great financial training for the future adult.

Of course, at this time, you will probably have to change over your home bank to more realistic interest rates. However, if you have been running the home bank for some years, you will probably have a lot of ideas to customise its services in ways that are uniquely suited to your family.

At Value Research, we are acutely aware of the fact that a large proportion of people have very little 'money sense'. A good number of the queries and help calls we get from investors betray a near-zero understanding of the basics of savings, interest rates, budgets and investing. The reason why this happens is that (apart from learning the formula for compound interest at various stages in school), we have no education in handling money. The idea that money can be controlled and managed by thinking about it clear-headedly and by following some simple rules is something that never gets into the heads of most of us.

Money is a complex thing. This complexity comes not from the fact the arithmetical calculations needed to handle money are complex but that many of us tend to react irrationally and emotionally when faced with money issues. Understanding and managing money is a key skill that every human being needs, regardless of what he does in life or how much money he actually makes. And yet, this is the one thing few children get taught. Give your children the advantage of being able to manage money before they actually start earning it. This could be the most useful thing you can give to them.

Also read in this series: