School education costs are not much of a worry for parents. They are able to pay fees on a monthly or quarterly basis without putting a strain on their finances. However, when it comes to higher education, the situation is pretty different. The cost of higher education is quite high and you need this money within a stipulated time period.

Hence, accumulating a sufficient corpus for the higher education of kids is one of the major financial goals for all parents. Failing to achieve any other goal, for example a foreign vacation, may make you feel sad for a while but failing to provide adequate monetary support for the higher education of your child could be really heartbreaking and a lifetime regret.

Planning acts as the cornerstone of achieving any long-term financial goal successfully. How much you will have in your kitty after a certain period of time is a mathematical function of how much you are able to invest every month and the kind of return that your investment is able to generate. An online calculator can do this job quite well. Just enter the target amount, assume the rate of inflation and return, and the calculator will tell you how much you need to invest every month.

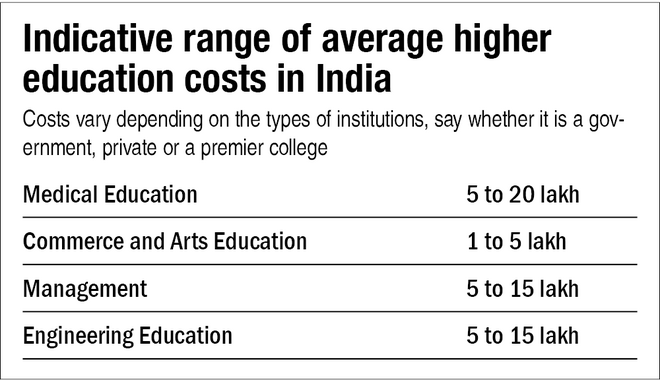

But when you plan for your child's higher education-a long-term financial goal-this simple task becomes more complex. This is because it is very difficult to give a precise number to the target corpus amount. You don't know whether your four- or five-year-old kid would become an engineer, a doctor, a chartered accountant, a teacher or something else. There are numerous career options to choose from and probably, there would be more options after five or 10 years. And education costs vary dramatically, depending on the stream your child would opt for. For example, someone who aspires to be a doctor and do some specialisation from an institution abroad would need much more money than someone who wants to be a teacher and groom young minds in India.

It is practically not possible to know the precise amount that you would need until the child grows up and becomes matured enough to pursue that particular course. Nowadays, it is quite common for children to select different career streams altogether from what they thought of while studying in the final years of school.

No doubt, there is so much uncertainty about the amount that you would need for your child's higher education. So, what would you do then?

Start early

There is no alternative to starting early. With the goal being so obvious in the future, it is important for you to start investing for it as early and as much as possible. Otherwise, it would be difficult for you to accumulate such a huge amount over a smaller time frame. There is no harm if you end up accumulating a larger corpus than the actual requirement, but you definitely don't want to fall short of it.

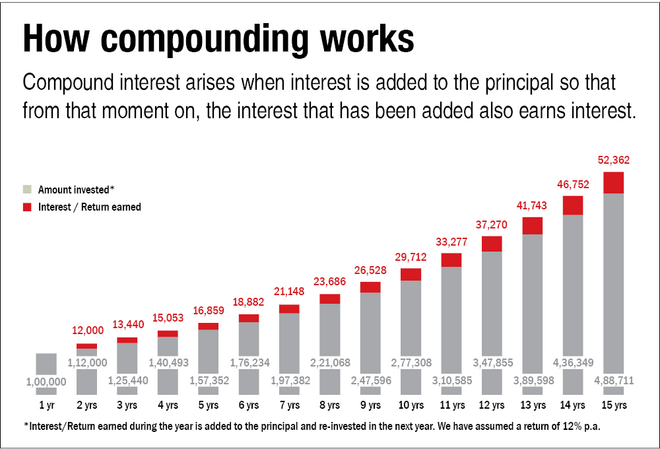

By starting early, you would get enough time to accumulate a significant corpus by investing a small amount regularly. Also, it would help you reap the benefit of compounding.

Let's understand this compounding part. Compound interest arises when interest is added to the principal so that from that moment on, the interest that has been added also earns interest. This addition of interest to the principal is called compounding. For instance, let's assume that you invest Rs 1 lakh in a product that yields 12 per cent annually. Then, at the end of the first year, the interest will be Rs 12,000. Now, in the second year, the 12 per cent interest would be levied on both your initial amount and the interest earned in the previous year. So, the total amount will become Rs 1.12 lakh. Next year, the second year's interest would get added and so on and on. Although we use the word 'interest', the idea of compounding is applicable equally to all forms of returns. So, the earlier you start investing, the greater would be the power of compounding.

Revisit the goal periodically and make the required corrections

Initially, you may not have any clear idea about your child's career choice. However, slowly, you will start having a better vision about it. Then, you can revisit your goal and make the required correction. For example, the parents of an 11th-class student would have a clearer vision about his possible career choice than those whose children have just started going to school.

Where should you invest?

Once it is clear that you must start investing as early and as much as possible, the next question that comes to the mind is-where should you invest? Well, the ground rules for investing would remain the same. Here also, the time horizon and your risk appetite ultimately define your investment avenue.

It is recommended to invest in equities for a goal that is more than five years away. And it is applicable to investing for child education. Equities help you earn inflation-beating returns and are considered as the most suitable asset class for investing with a long-term horizon.

To keep things simple, one may choose equity mutual funds for this purpose. You will not have to worry about which stocks to buy and when to buy. A professional fund manager will be doing all these things for you in return of a small fee.

Those who easily get unnerved with sharp market ups and downs or are investing in equities for the first time should start with aggressive hybrid funds. These funds invest about 20-35 per cent in fixed income and are less volatile. Once you get comfortable with the market movements, shift to pure equity funds.

But wait, mere investing is not enough. Planning the exit is as important as investing. Read our next story which talks about the same.

Also read in this series: