Riya is in the final year of her bachelor's in medicine and aspires to go abroad next year for higher study. Riya's father, Anil, is happy with the fact that his little daughter will become a doctor in a few years. But at the same time, he is worried because the money that he has been accumulating for her education may not be enough to finance her study in a foreign country. He is likely to fall short of about Rs 15-20 lakh, despite the fact that he started investing soon after Riya's birth about 20 years ago. Now, he has two options-one is to dip in his retirement savings and the other is to ask his daughter to pursue higher study within India instead of going abroad.

This is a very common situation that most parents get into. Nobody wants to compromise on their child's education and try to do the best they can. But the situation like this is common too. Although starting to invest as early and as much as possible helps, it does not ensure that one will be able to accumulate enough corpus for financing the higher education of one's child.

The rapid growth of education costs is, undoubtedly, a reason behind it. The other reason is the difficulty to precisely estimate and plan the amount that would be required in the future. Education costs vary widely based on the stream your child wants to opt for. Often, it is decided only when your child grows up enough to make the selection. So, what should one do in such a situation?

Education loans - a helpful resource

In such a scenario, opting for an education loan can be quite helpful. In fact, it could be a better alternative to bridge the shortfall rather than using your retirement corpus. Apart from securing your later years, an education loan will make your child more financially responsible.

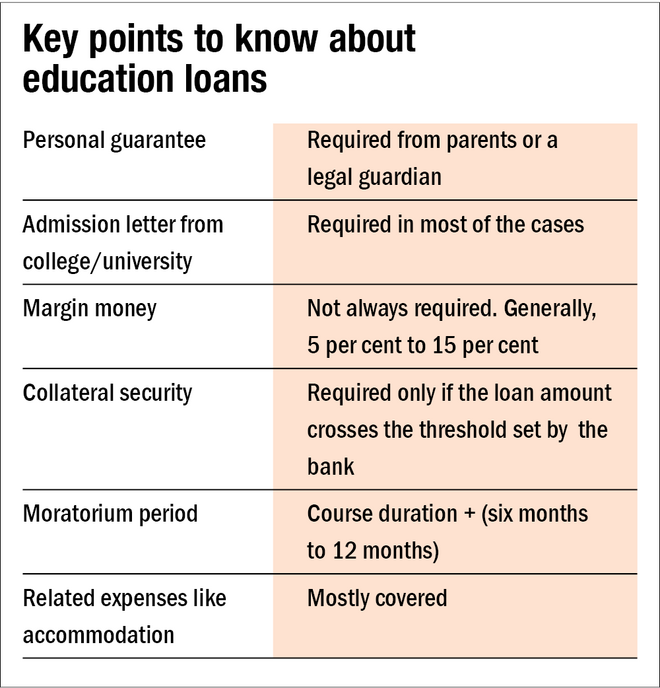

The concept of education loans is quite simple. A bank lends money to meet education costs and the same has to be repaid at a predefined time in agreed monthly instalments. In education loans, banks usually consider students as the main borrowers and grant the loans after the required paperwork. While providing an education loan, the bank generally asks for the admission letter from the college/university and then, it pays the fees directly to the institution. The loan can also be availed for related expenses like accommodation, books, etc. The bank may also ask you to finance at least five to 15 per cent of the total education costs as the margin money if the loan amount is quite high.

Students are primarily responsible for repaying the loan. However, they don't need to repay immediately. An education loan is structured in a way that its EMI starts only after a predefined moratorium period. It is the period between the date on which the loan is disbursed and the date on which the first EMI falls due. In addition to the course period, it generally includes a relaxation period of six months to one year after the course completion date. It gives students (borrowers) enough time to find jobs and start earning so that they can pay the EMIs.

However, while disbursing an education loan, the bank asks for a personal guarantee from parents or a legal guardian with sufficient income proof to safeguard its money if something goes wrong.

With the same intention, the bank may also ask you to provide some collateral security which could be anything-say a fixed deposit, residential property, commercial property, etc. However, collateral security is generally required after a certain threshold, which varies from bank to bank. For example, State Bank of India (SBI) asks for the security if the loan amount is more than Rs 7.5 lakh, while ICICI Bank has set this threshold at Rs 20 lakh.

The interest rate of an education loan

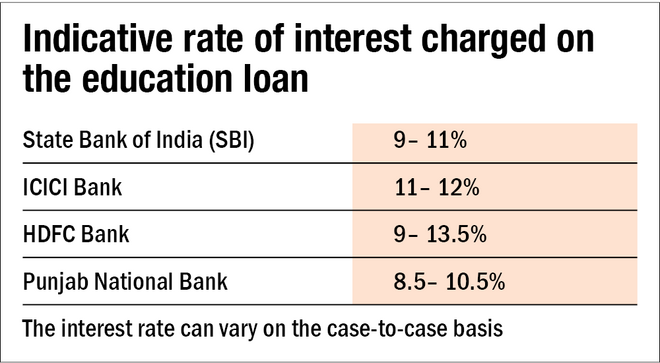

The interest rate of an education loan is generally lower than that of a personal loan but higher than that of a home loan. Right now, State Bank of India (SBI) charges an interest rate of 9.30 per cent. It could vary on a case-to-case basis. Besides, there could be one-time processing charges. Here is a glimpse of the interest rate charged by some prominent banks.

Viability of taking the loan

While opting for an education loan, you may think that you are taking the loan for an expenditure, which is not advisable. However, the perspective here is different. Don't look at it as a cost or an expense. Look at it as an investment in the future of your child which will help him/her earn a higher income (return). That way, it is a productive loan and would help you build an asset.

So, taking an education loan may not be a bad idea but look at it only as the second option to bridge the shortfall. Howsoever unpredictable the total education cost be, start as early and invest as much possible. And keep visiting the goal periodically to make any corrections that may be required.

Also read in this series: