Anil has recently retired from a government job and will be receiving a monthly pension of about Rs 40,000, which would be sufficient for his expenses. Besides, he has a corpus of about Rs 35 lakh, which he wants to invest to generate some income occasionally, either annually or every six months, to meet unaccounted expenses. At the same time, he would want to keep this money safe so that he can use it during the later years of his retirement or an emergency.

Anil is considering gilt funds, corporate bonds and company deposits to invest his retirement corpus in. He is lured by the fact that the current returns of gilt funds are even more than those of equity funds. Besides, these funds are safe as they invest in government bonds. Given that the interest rates of FDs are quite low, he is planning to invest this corpus in gilt funds and is seeking our opinion.

Don't think that gilt funds are risk free

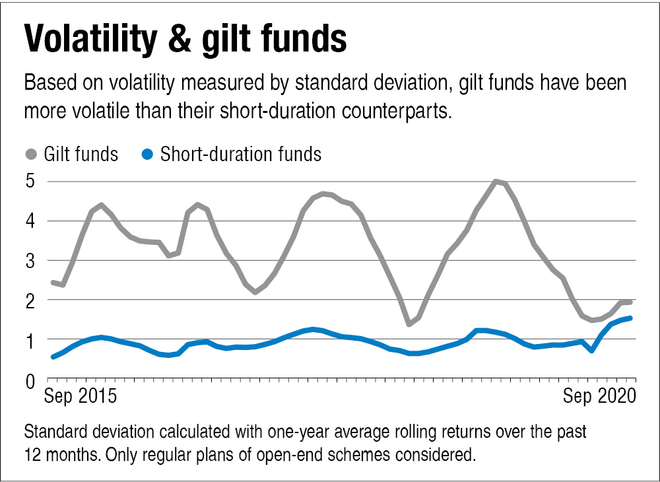

- Although these funds are safe and carry negligible default risk as they invest in government securities, they do carry the interest-rate risk. Further, they can be very volatile as they react to changes in the interest-rate outlook very rapidly.

- When interest rates go down, gilt funds appreciate and vice versa. Given the recent rate cuts, these funds have appreciated substantially. Since they have gained because of a fall in interest rates, their value would decrease with an increase in the interest rate. The graph below shows the highly volatile nature of these funds, which you should be careful about.

Do not go by recent trailing returns

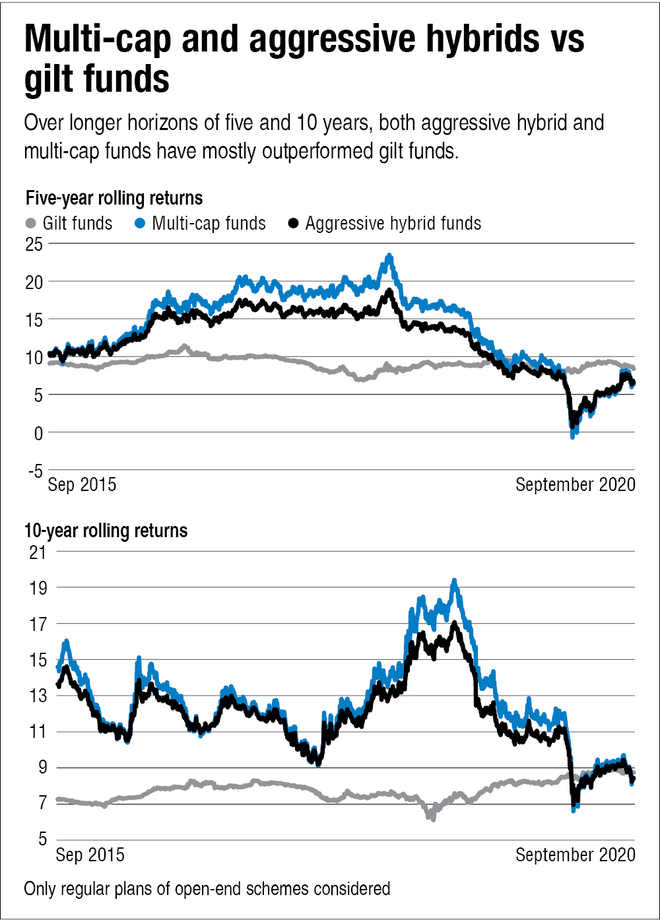

- You should not form your investment decisions based on the recent performance of a fund. Look at the graphs titled 'Multicap and aggressive hybrids vs gilt funds'. Although the recent trailing returns suggest that gilt funds have outperformed their equity counterparts, historically, equity-oriented funds have returned more than these funds.

- The recent rally in gilt funds was because of the rate cuts by RBI, while equities faced the brunt of the ongoing pandemic.

Debt funds are better than company deposits and corporate bonds

- Investing directly in a corporate bond or company deposit could be risky. Also, their ticket size is often high. So, if something goes wrong, a good portion of one's portfolio can suffer.

- One should minimise risk by investing in a carefully chosen short-duration or corporate bond fund. Since debt mutual funds invest in several securities, they are a better investment avenue as investors here can automatically diversify the risk.

Invest in Aggressive Hybrid Funds for supplementary income

- Since Anil wants to invest this amount for the long term and does not depend on it for essential expenses, he should invest it in an equity-oriented fund. An aggressive hybrid fund is good for him as it provides equity exposure but is not as volatile as a pure equity fund, given its sizeable debt allocation.

- He can set up an annual withdrawal of not more than 4-5 per cent of the corpus from the fourth year to support his supplementary-income requirement.

- Also, he must spread this amount over the next three years to reduce the risk of entering at the wrong market level.

Don't ignore these:

- Emergency corpus: Anil should create an emergency fund for any unaccounted expenses before investing in equity. For this, he can invest around Rs 5 lakh in a combination of a liquid fund and a sweep-in deposit. This would be sufficient for the next three years. He will have an SWP from aggressive hybrid funds from the fourth year and this amount can be used for any unaccounted expenses. Besides, he should maintain the emergency corpus, equivalent to at least six to eight months' expenses.

- Insurance: Being a retired government employee, he already has the required medical benefits from the government. However, considering that hospitals near his residence may or may not be covered under the government scheme or not, he can consider buying a small health plan independently. Anil doesn't need life insurance as he does not have any financial dependents.