In his treatise the Arthashastra, Chanakya suggested a method to reduce the loss caused by the theft of high-valued items. In those times, the market for high-valued goods barely existed and their export used to be highly risky. He said that such items should not be shipped together. Rather they should be distributed across several shipments and with other regular items. So, even if dacoits plundered a batch of shipments, the loss would be contained. Indeed, Chanakya was talking about diversification.

Diversification is one of the most important elements of the investing process. Simply put, it means 'don't put all your eggs in one basket'. This basic advice makes sense as the opposite of it would be clearly risky - concentrating all your resources in just one investment. What if that one investment performs poorly? What if it turns out to be a disaster? Of course, there are some savvy investors who profess focusing because that enhances the overall outcome, yet for most investors, diversification remains a sensible tool to reduce risk.

The next question is how much diversification is enough. Value Research has always said that fund investors would do well with just four-five funds in their portfolio. But the reality appears to be quite different. From investor portfolios created on www.valueresearchonline.com and from the queries that we receive, we have realised that the average investor has far too many funds. There are many reasons for this, including chasing past performance or some hot theme, not exiting poor performers, not keeping a tab on the portfolio, etc. But one reason that stands out is many investors feel that the more the funds they have, the better the extent of diversification.

As we have long maintained, adding more funds beyond a threshold contributes little to diversification but does increase the headache of managing the portfolio. In this story, we try to assess how many funds are needed for sufficient diversification. For that, we have done a comprehensive analysis, encompassing lakhs of datapoints.

Methodology

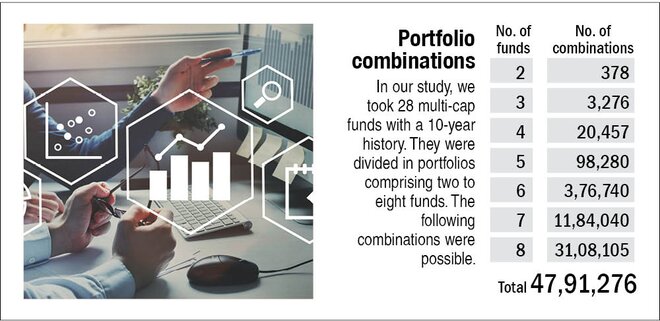

In order to assess how many funds are required to achieve sufficient diversification, we considered multi-cap funds that had a 10-year history as the sample universe. There were 28 such funds. Next, we made portfolio combinations from these funds, with number of funds in the portfolios varying from two to eight. The table 'Portfolio combinations' mentions the total possible combinations.

For each portfolio combination, we considered a monthly SIP of equal amounts in each of the funds. This SIP was done for a 10-year period. An annual rebalancing was done to ensure that all the funds in a portfolio combination have equal amounts. For simplicity, we excluded the tax implications of the rebalancing.

Finally, we calculated the returns for each of the resulting portfolios and also their corresponding volatility, as measured by standard deviation, during the period. Here are our findings.

Impact on returns

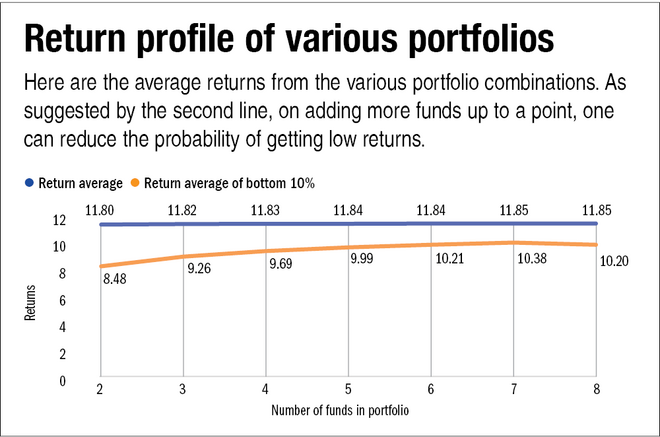

The graph 'Return profile of various portfolios' shows returns across various portfolio combinations. The average return from a two-fund portfolio is 11.80 per cent, while that from an eight-fund portfolio is 11.85 per cent. So, by diversifying more, do you achieve better returns? Note that there is a difference of just 0.05 percentage points between the returns from the two portfolio combinations. That's hardly rewarding for the lot of extra work you will undertake by managing eight portfolios, which will also have to be rebalanced annually.

Also, understand that the major purpose of diversifying is to reduce risk, not to boost returns. How do the various portfolio combinations fare in this respect? See the chart 'Return profile of various portfolios'. It compares the average returns of various portfolio combinations with the average returns of the bottom 10 per cent performers. These bottom 10 per cent represent the worst-possible combinations to invest over the last 10 years. If you go wrong in your selection in a two-fund portfolio, your returns fall substantially (about 3.5 percentage points per annum below the average for a two-fund combination). But the cost of going wrong reduces as you add more funds to your portfolio. However, this benefit diminishes incrementally. Beyond four-five funds, perhaps the complexity of managing a big portfolio starts to outweigh the benefit from diversification.

Impact on volatility

Another objective to diversify is to reduce portfolio volatility. When we look at the standard deviation (SD), a measure of volatility, the average SD showed a marginal reduction of 0.35 percentage points as we moved from a portfolio of two funds to eight funds (see the chart 'Volatility in various portfolios').

In order to magnify this impact, we looked at the most volatile portfolio combinations through their top-quartile average. The SD reduced from about 17 per cent for a two-fund portfolio to about 16 per cent for the eight-fund combination, a drop of a full percentage point. This suggests that adding more funds to your portfolio does reduce volatility.

Also, it is worth mentioning here that major chunk of this drop happens up to a four-fund portfolio and the quantum of this drop tapers significantly post that point. This suggests that beyond a limit, adding more funds to your portfolio doesn't result in a material reduction in portfolio volatility.

Diversification across stocks

Many investors think that by investing in more funds, they can get to diversify across more stocks. That would mean better risk management. Is this right? To assess this, we analysed three parameters in the combinations of multi-cap funds detailed above: the sum of top 10 holdings, the total number of stocks and the number of stocks each making up less than 0.5 per cent of the portfolio. To be conservative, we present to you our observations on the portfolios with the least amount of overlap. Naturally, the results will be magnified in the normal analysis.

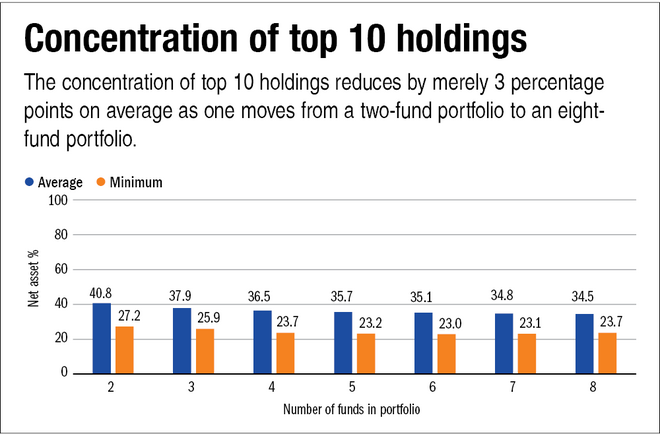

Let's first see the sum of top 10 holdings (see the chart 'Concentration of top 10 holdings'). The top 10 holdings account for at least about 27 per cent of the AUM of two-fund portfolios. This number stands at about 24 per cent for an eight-fund portfolio. So, when it comes to the concentration of your top holdings, there is a change of just 3 percentage points by adding as many as six more funds.

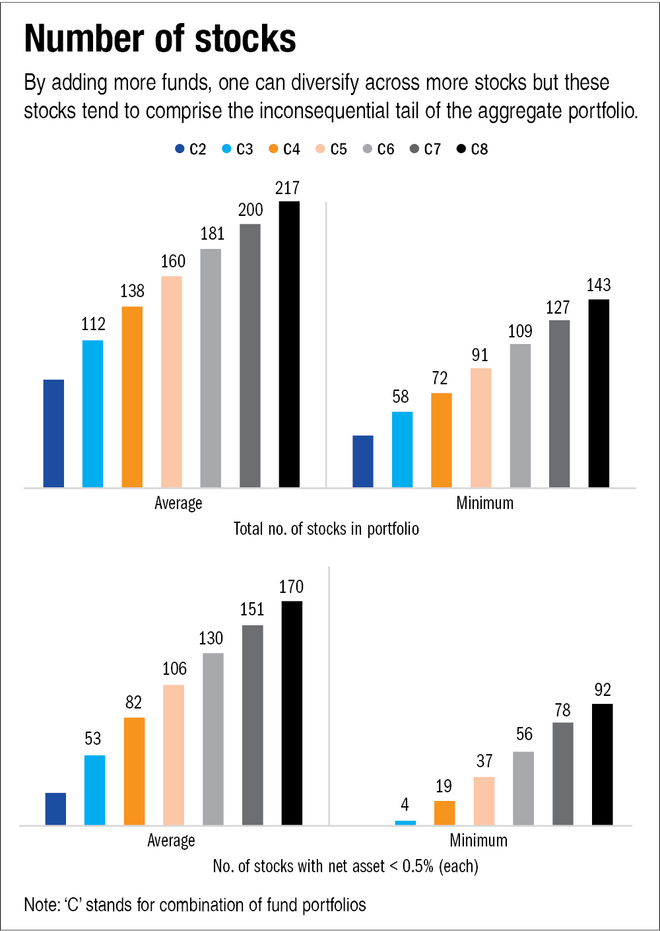

What about the number of stocks? On average, the number of stocks in your portfolio would rise to 217 if you have an eight-fund portfolio from about 82 in a two-fund portfolio. At the least, you would have 143 stocks in your eight-fund portfolio (see the chart 'Number of stocks'). Better diversification, isn't it?

The catch is if these stocks also command a sizeable AUM. In an eight-fund portfolio, on average, you would have as many as 170 stocks, with each of them commanding less than 0.5 per cent of the total AUM. Analyse this number against the 217 stocks you could have on average. It means that while you have more stocks by adding more funds, most of them will simply belong to the tail of your aggregate portfolio and hence won't contribute meaningfully to your returns. Nor will they help you reduce volatility significantly.

In a two-fund portfolio, you could have just 25 stocks on average, each of which would constitute less than 0.5 per cent of the AUM. The minimum would be zero in such a portfolio.

From this, we can conclude that with an increase in the number of funds, you may end up holding more stocks but the concentration is still limited to your top holdings. So, they can move your aggregate portfolio in either direction. Also, you will have a longer tail of inconsequential holdings which won't contribute meaningfully to your portfolio's performance. On the contrary, their dead weight could possibly hurt the performance of an otherwise promising portfolio.

Conclusions

The study above shows that in order to achieve sufficient diversification and enjoy its fruits, it's enough to invest in four-five funds. Any number beyond that will simply add to your work, without meaningfully contributing to your return or reducing the risk. If you are a new investor and have a limited surplus, even one fund is enough.

Do understand that a fund portfolio is not like a stock portfolio. While you must own 15-20 stocks to diversify well in a stock portfolio, for a fund portfolio, four-five funds are just fine. Don't forget that each of them is a cluster of several stocks, so you are actually investing in all of them.

Also, your returns are driven by the quality of your selection, not quantity. Keeping a tab on the performance of the funds in your portfolio, exiting the poor-performing ones, timely rebalancing, disciplined investing - all of these are instrumental to your portfolio's performance. It's not about the number of funds or the hottest new theme or timing your entry and exit.

How to reduce the number of funds in your portfolio

If you also have more than four-five funds in your portfolio and want to reduce the number, here is some help:

Exit the underperformers: First, find out funds in your portfolio that have been underperforming for quite some time now and exit them. However, short-term underperformance should not be the reason to sell. Take into account long-term performance vis-à-vis the category. Assess the performance across cycles.

Sell the fancy ones: If you have loaded up on some thematic or sectoral fund, you may want to give it another thought. Such funds ride high on some short-term trend but as the enthusiasm fizzles out, so does their outperformance. They also provide limited diversification as they focus on a sector or theme. For most investors, plain vanilla diversified funds are good enough.

Cull the duplicates: If you have multiple funds of the same kind, you may want to keep just one of each type. For instance, if you have several mid-cap funds in your portfolio, you may want to stick to just one and direct the funds in the rest towards that.

Cut the tail: If you have many funds in which you have meagre capital, you may want to exit them and direct their corpus to the remaining funds.

Follow the core-satellite approach: Have two-three multi-cap funds as your core holdings and any other funds, such as mid/small-cap and international ones, as supplementary. The core holdings will command most of the capital, while the satellite holdings will help give your returns a kicker.