Ritesh (35), has already decided to invest Rs 50,000 in the National Pension System (NPS) and wants to know which pension provider he should choose to get maximum returns. Besides, he also seeks our opinion on appropriate investment avenues to exhaust his 80C limit.

Enjoy additional tax benefits by investing in the NPS

- You can avail an additional deduction of up to Rs 50,000 over and above the 80C limit by investing in the NPS Tier I account under Section 80CCD(1B) of the Income Tax Act.

- Your money in the NPS will be virtually locked-in till you reach the age of 60. Thereafter, you can make a tax-free lump-sum withdrawal of up to 60 per cent of the corpus. The remaining 40 per cent needs to be utilised for buying an annuity plan.

- The NPS Tier-I account has a minimum annual contribution requirement of Rs 1,000.

- After three years of your investment in the NPS, you can partially withdraw (up to 25 per cent of your total contributions) for specific expenses, including the treatment of critical illness for self, spouse, children and dependent parents; children's higher education or wedding; and the construction or purchase of the first house.

- In the case of a premature closure, 80 per cent of the corpus needs to be utilised to buy an annuity plan.

Choose the active investment choice and allocate 75 per cent to equity

- NPS Tier I has two investment options - auto choice and active choice.

- The Auto choice allocates between equity and fixed income automatically, depending on the age of the investor. It is further subdivided into Aggressive Life Cycle Fund (LC75), Moderate Life Cycle Fund (LC50) and Conservative Life Cycle Fund (LC25), with the maximum equity allocation being 75, 50 and 25 per cent, respectively, up to the age of 35. Thereafter, the equity allocation reduces every year.

- On the other hand, the active choice gives the flexibility to the investor to decide the allocation between equity and fixed income. Investors up to the age of 50 can allocate a maximum of 75 per cent to equity.

- Since Ritesh is only 35 and has about 25 years for retirement, he should allocate the maximum possible amount to equity - 75 per cent by choosing the active option. Equity is the best asset class for long-term investments.

How to choose an NPS fund

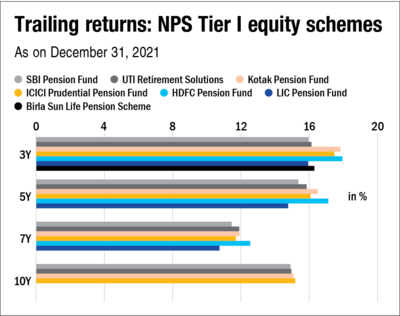

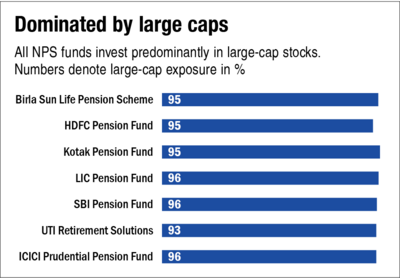

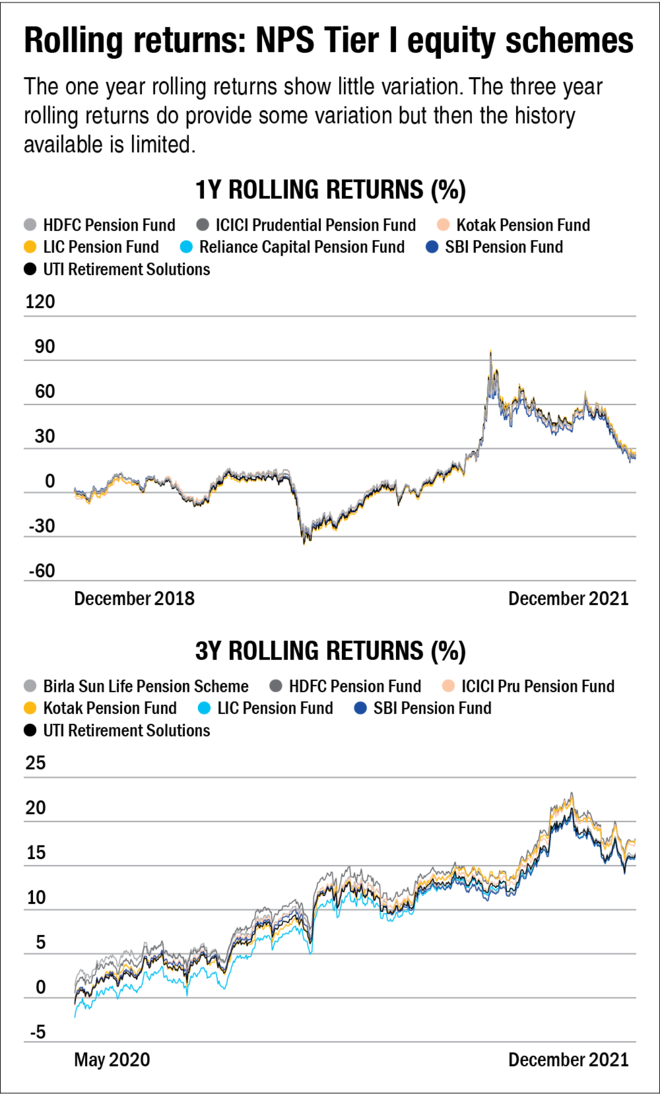

- All the seven pension funds available are almost similar, with no significant difference in their returns.

- Although three-year rolling returns of some schemes are higher than others, there is not enough historical data to prove their consistency.

- Thus, for Ritesh, it is more important to have the maximum possible allocation to equity than choosing the best-performing pension fund. It would help accumulate a larger corpus in the long term.

Invest systematically

- It is always advisable to avoid investing a lump sum in an equity-linked product. This helps reduce the risk of entering the market at the wrong level.

- Ritesh can choose to divide his investments between ELSS and NPS over the remaining three months of this financial year. From April onwards, he should start a monthly SIP in ELSS for this purpose.

- In the case of NPS, he can use the recently launched D-Remit facility, which acts quite similar to an SIP and the money automatically gets debited from your account every month on the chosen date.

Exhaust your 80C limit by investing in ELSS

- Equity-linked savings scheme (ELSS) are pure-equity funds with tax benefits under Section 80C. Among 80C instruments, they have the shortest lock-in period of three years.

- Ritesh should exhaust his remaining 80C limit by investing in ELSS. This investment can be linked to any of his long-term goals like retirement, children's higher education, etc.

Don't ignore these

Emergency corpus: Always maintain an emergency corpus equivalent to at least six months' expenses. It can be maintained in a combination of sweep-in deposit and a liquid fund.

Insurance: Buy adequate life and health insurance before investing. Their premiums would also help you get tax benefits. While the premium for life insurance is included in the 80C limit, Section 80D allows a deduction of up to Rs 25,000 for health-insurance premium of self, spouse and children. An additional deduction of up to Rs 25,000 is available under the same section for the premium paid on parents' health insurance. The limit of Rs 25,000 is replaced by Rs 50,000 in both the cases if any of the policyholders is a senior citizen.