Custom duty, a tax imposed on goods when they are transported across international borders, is used by the government to earn revenue, safeguard domestic industries, and regulate the movement of goods. A change in custom duty can prove to be both, a boon as well as a bane for local industries. A reasonable duty allows the local manufacturers to compete effectively against international competition. However, perpetually high duties can make the local manufactures complacent and give rise to monopolies. This is why changes in custom duty by the government are of special importance. Let's have a look at two major custom duty changes announced by the government in this Budget and the companies that stand to benefit from them.

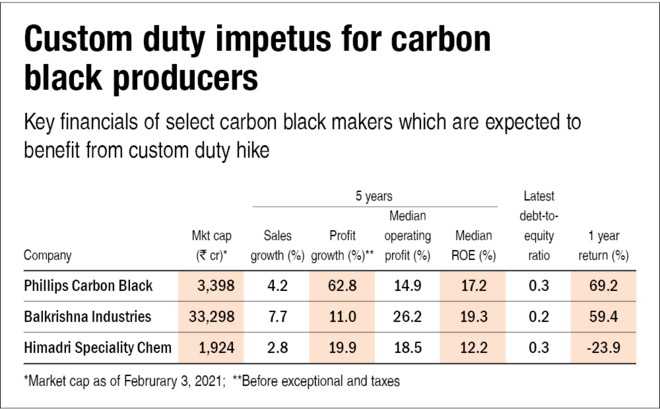

Custom duty on carbon black increased from 5 to 7.5 per cent

Carbon black is a material produced by the incomplete combustion of heavy petroleum products such as FCC (fluid catalytic cracking) tar, coal tar, or ethylene cracking tar. It is mainly used as a reinforcing filler in tyres and other rubber products.

The carbon black global industry, worth $17.2 billion as of 2018, is dominated by China which contributes nearly 43 per cent of the global carbon black production. Globally, the top ten players account for almost 60 per cent of the global carbon production capacity. In India, Phillips Carbon, with a capacity of 571 ktpa, dominates the domestic industry. It is followed by Birla Carbon (314 ktpa), Himadri Specialty Chemicals (180 ktpa), Balkrishna Tyres (140 ktpa) and others. In 2019-20, India imported 187 kilo tonne of carbon black. (source: DGFT)

The increase in custom duty on carbon black comes at the heels of an anti-dumping duty removal on carbon black imports from Russia and China. An increase in custom duty will provide safeguard to carbon black producers in India. However, the tyre manufacturers, for whom carbon black is an essential input, will continue to experience elevated prices.

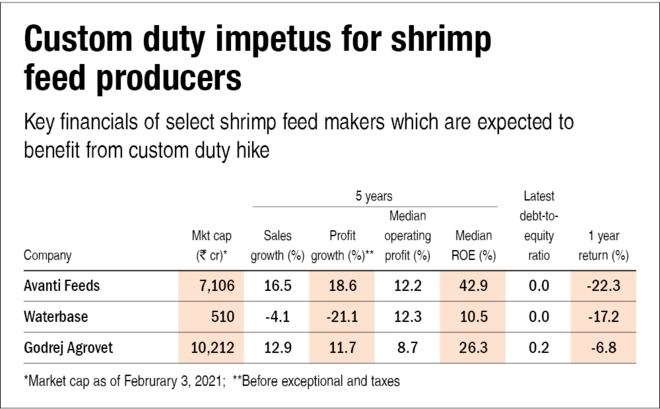

Custom duty on prawn feed and fish feed in pellet form increased from 5 to 15 per cent

In an attempt to give further push to the domestic aquaculture industry, the government has increased custom duty on shrimp feeds, specifically prawn feed and fish feed in pellet form, from 5 to 15 per cent. Feeds form a substantial part of the shrimp farming. In 2019-20 alone, India exported 6,52,253 million tonne of shrimp, mainly to the USA and China, valued at $4.9 billion.

Shrimp feed industry in India is dominated by Avanti Feeds holding a market share of around 45 per cent. The other key domestic players include Waterbase India and Godrej Agrovet. Avanti and Waterbase are trying to diversify their revenue stream around the shrimp farming value chain. While Avanti Feeds is focussing on value added products through shrimp processing (amounting to around 20 per cent of its revenue), Waterbase India is increasing its presence in the hatchery and farm care products business. An increase in custom duty on shrimp feed imports will be beneficial to these players.