BEML was incorporated in 1964 as a public-sector undertaking with the name Bharat Earth Movers Ltd. It was a spin-off of the railway-coach manufacturing facility of Hindustan Aeronautics. In the late 1960s, the company ventured into manufacturing mining and construction equipment on the back of its technical collaborations with companies based in the US and Japan. The company then underwent a thorough restructuring in 2006 and divided its operations into three business segments: defence and aerospace, mining and construction, and railway and metro trains.

BEML is Asia's second largest manufacturer of earthmoving equipment and controls more than 60 per cent of India's market in that sector. The Government of India, which holds 54 per cent stake in the company, is currently inviting bids for selling around 26 per cent stake in the company.

Strengths

- BEML enjoys a dominant position in all of its segments. In mining equipment, the company has the highest domestic market share. It is amongst the only three companies in India that have manufacturing capabilities for rolling stocks.

- Historically, the company has managed to forge technical collaborations with foreign players. BEML, through its technical collaboration with Rotem, was the first company to manufacture metro cars for DMRC in 2002. Recently, the company has joined hands with Lockheed Martin for supplying sub-parts and components of aircraft.

- The company has a very strong order book of Rs 10,610 crore as of September 2020. This provides it with a strong future revenue visibility.

- The government is pushing for a higher share of domestic manufacturing under the AatmaNirbhar campaign. The company has achieved around 65-90 per cent indigenisation levels across product segments.

Weaknesses

- The company faces high customer concentration as a substantial part of its revenue is derived from Coal India, along with metro projects in Delhi-NCR, Bangalore, Kolkata and Mumbai.

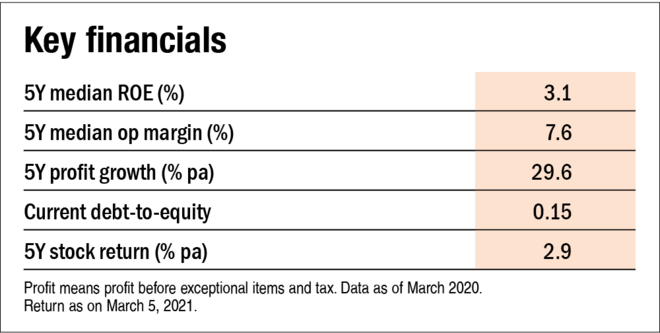

- Since equipment manufacturing takes substantial time, the company faced a stretched working-capital cycle of more than 300 days for FY20. With PSUs and the Ministry of Defence as its key customers, the receivable cycle for the company is also stretched. Such stretched working-capital cycles increase vulnerability of the balance sheet as the company has to rely on short-term borrowings.

- Though the company has managed to forge technical collaborations with private players, it needs to increase its in-house technical expertise in order to face competition effectively.

Opportunities

- Metro rail presents a big opportunity as multiple states in India are pushing for its development. The company has recently bagged an order of Rs 501 crore from DMRC for delivering 12 train sets.

- The defence segment of BEML is expected to be a key beneficiary of the AatmaNirbhar campaign as the government cuts down its reliance on defence imports.

Threats

- The company faces intense competition from private players, especially MNCs.

- COVID has adversely affected the economy, thereby impacting the financial condition of all the states and the national government. Rising deficits can cause delays in execution of infra projects.

This is an analytical article and not a recommendation to invest in this stock. You must do your own research before taking a call to invest. If you are interested in our stock recommendations, please visit http://www.valueresearchstocks.com