The National Pension System (NPS) has seen the number of subscribers under the 'All Citizen' model (meant for citizens other than central/ state-government employees) rise to 17.46 lakh as on June 30, 2021, as against 78,774 in March 2014. By the end of June 2021, the total number of subscribers across various models of the NPS reached close to 1.47 crore, with the AUM being more than Rs 5.99 lakh crore.

This government-backed long-term investment plan intends to secure the post-retirement years of its subscribers by helping them accumulate a corpus. Also, it helps subscribers get an additional deduction of up to Rs 50,000 over and above the Section 80C limit of Rs 1.5 lakh. While you can enjoy tax benefit on the investments made in the NPS during the accumulation phase, at the age of 60, you can make a tax-free withdrawal of the 60 per cent of the corpus. The remaining 40 per cent has to be utilised for buying an annuity plan, which gets you regular income during your golden years.

You can open an NPS account either through a point of presence (POP) or directly through the Central Record Keeping Agency (CRA). Let us first understand what a POP and the CRA are. A POP is appointed to open and provide all the related services under the NPS through its network of branches. Just visit a POP and they will help you open the account. The list of POPs can be found at https://bit.ly/3ctjbPD. Almost all banks and even post offices are POPs.

On the other hand, CRA is an agency which maintains the records of subscribers, processes their registration and withdrawal requests and so on. It is also responsible for generating regular account statements and issuing the Permanent Retirement Account Number (PRAN) to subscribers following registration.

Here it is important to know the difference of opening an NPS account through a POP and directly through the CRA. Besides the difference in the services provided by both, their recurring charges also vary. See the table 'Charges associated with the NPS'.

Account opening: POP vs CRA

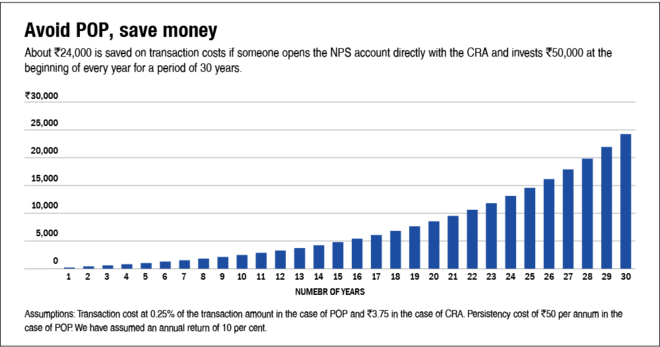

You must note that CRA charges are bound to happen, no matter whether you choose to open the account through a POP or not. A POP is simply an intermediary between you (the subscriber) and the CRA. By looking at the above-mentioned table, you may think that it is beneficial to open the account directly with the CRA and completely avoid the POP cost. By doing so, you save on not only the account-opening charges but also transaction and persistency costs, which are recurring in nature. If you invest through a POP, a minimum of Rs 20 is charged every time you make a deposit. This is in addition to the transaction cost charged by the CRA. Although it is possible to make subsequent deposits directly to the CRA through eNPS after opening the account through a POP, then also a trail commission is passed to the POP and a transaction charge of 0.10 per cent is charged. In that case, the minimum and maximum limits are Rs 10 and Rs 10,000.

Although it could be beneficial to open the account directly with the CRA, it may not be a wise decision for someone who is not financially savvy or comfortable with maintaining the account or carrying transactions over the internet on his own. The CRA interface is completely online and more suitable for 'DIY' investors. But if you are not aware of various asset classes, unsure about asset allocation, uncomfortable with online transactions or need some sort of assistance, or prefer the offline route, then you should opt for the POP route, as the POP will help you with these issues.

Steps to open an NPS account online

To open an NPS account online with the CRA, one can choose either NSDL or Karvy. Here is how you can open an NPS account online with NSDL.

- Keep handy a scanned copy of the PAN card, a cancelled cheque, your photograph, signature and Aadhar paperless offline e-KYC. To download your Aadhaar paperless offline KYC, visit https://resident.uidai.gov.in/offline-kyc.

- Visit the official website of eNPS (NSDL) at https://enps.nsdl.com/eNPS/NationalPensionSystem.html

- Click on 'National Pension System' and then on 'Registration'.

- Select the 'Aadhaar' option in the 'Register with' field. Alternatively, you can select PAN but then, the KYC will be routed through a bank where you already have relation and a charge of up to Rs 125 plus taxes may be collected.

- Select 'Tier 1 only' if you want to save taxes and follow the on-screen instructions.