We have already gained insights into the basics of the P&L statement and the income part of it. Next, we will focus on 'expenses,' which is more important than the income part.

Like income items, expense items also follow accrual-based accounting principles. But expenses are more complicated. Here are a few important aspects of expenses:

Greater disclosure

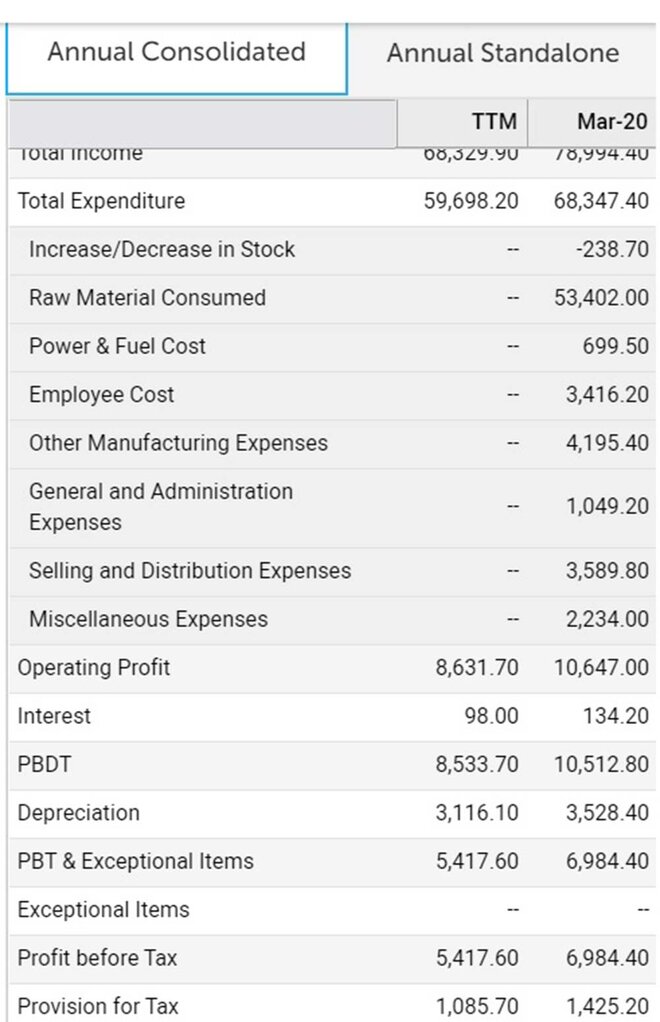

Unlike income items which are divided into two parts, expenses are divided into multiple heads, such as raw-material expenses, employee expenses, selling and distribution expenses, etc. The following is a screenshot of different types of expenses of Maruti Suzuki, India's largest car manufacturer.

A higher amount of disclosure with regard to expense items is very beneficial for investors because it enables them to keep track of a company's expenses over a period of time and compare different companies based on how efficiently they are running their operations.

Greater management discretion

Unlike income items, recognising expense items under the accrual-based accounting systems depends substantially on the management's discretion. For example, the decision to either capitalise or expense a particular expenditure rests on a company's management. This distinction arises because under accrual-based accounting, an organisation needs to only expense those items from which it will derive benefits in the current year. Think about rent or electricity expenses for a particular year. The benefits of this expenditure can be enjoyed only for a small period. But if the company purchases an asset, which will last for many years (such as a car or a manufacturing plant), then it would not be fair to charge the entire expenditure only in the first year. The correct thing to do would be to consider only the portion of the capital asset that has been used in the current year as expenses, a method known as depreciation.

Besides, accounting standards require the management's inputs for various decisions. Therefore, the management can exercise significant control over expenses. For example, while calculating depreciation, a company's management decides important factors, such as the expected useful life of the equipment, the choice of the depreciation method and the expected salvage value. Similarly, there are other areas where the management's inputs are integral to the accounting process. Although such inputs are believed to make the books of accounts more pertinent, there is always a possibility of unscrupulous managements misusing this discretion to manipulate earnings.

One-time expenses

Even though accrual accounting requires the management to account for all the expenses associated with a particular accounting period, sometimes certain expenses are not mentioned. These expenses could be in the nature of write-downs to goodwill (an accounting term that refers to the difference between the market value and book value of an asset), the unfavourable outcome of tax litigation, etc. Also, there are other scenarios where sudden unforeseeable events happen, forcing the management to take a hit. For example, a sudden drop in the prices of oil or gold could lead to a write-down in inventory for oil-marketing companies and gold jewellers. Even though both these categories of expenses are recorded as expenses, investors need to differentiate between them. While the former can be attributable to aggressive management practices, the latter is more likely than not attributable to the business's core nature.

Key takeaways

The expenses segment is a very significant part of the P&L statement. Investors need to analyse this segment with a fine-toothed comb before making any investment decision. The P&Ls of all listed companies are accessible on www.valueresearchonline.com for free.

Also in this series: