The production-linked incentive (PLI) scheme was introduced by the government last year in order to give impetus to domestic manufacturing and cut down on our import bills. The scheme gives the PLI licensee companies incentives on incremental sales of products that are manufactured in domestic units. The aim here is to create a scale of production by encouraging foreign companies to set shop in India and local companies to set up or expand their existing manufacturing facilities.

PLI beneficiary: Drug manufacturing

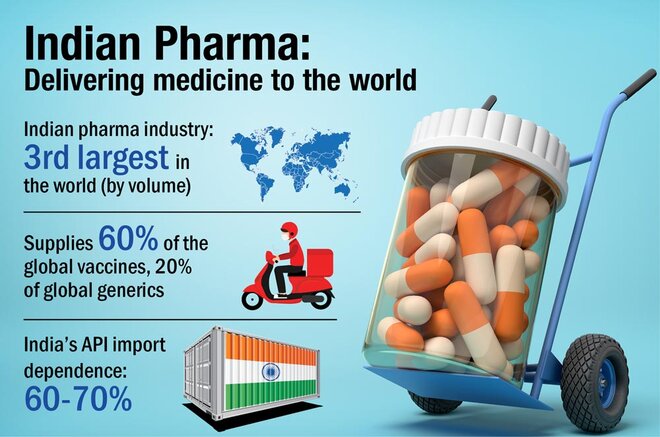

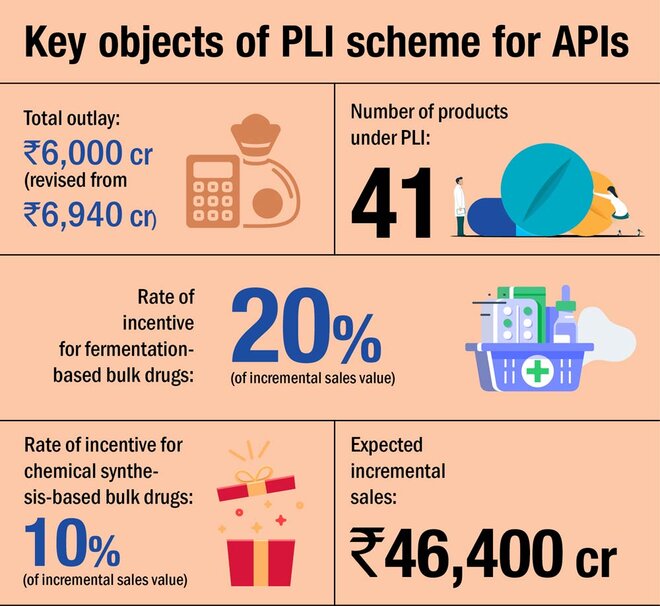

The Indian pharmaceutical industry is the world's largest provider of generic medicines. However, it still relies on China for around 60-70 per cent of its API and drug intermediates needs. APIs, or active pharma ingredients (also known as bulk drugs), are basically raw materials for medicines. And India's import dependence for them was felt ever more strongly during the COVID-led supply disruptions last year. This made the government want to promote domestic production of these drugs and it thus came out with a Rs 6,000 crore PLI scheme for the drug manufacturers.

Under the six-year long scheme, the government will provide financial incentives to the manufacturers of 41 identified critical bulk drugs, divided into two categories - fermentation-based and chemical synthesis-based. These incentives will be based on the incremental sales of these drugs over the base year (FY20) and the category they belong to. While fermentation-based drugs carry an incentive of 20 per cent, chemical synthesis-based drugs will carry a 10 per cent incentive.

Becoming import-independent: Aurobindo Pharma

Aurobindo pharma, apart from manufacturing APIs, also carries out generic formulations (formulations is the process of combining different chemical substances to form the final medicine). Its product pipeline focuses on oncology, hormones, biologics, derma, respiratory, depot injections, vaccines and peptides, all-in-all having an addressable market of over US $100 billion. The company derives around 75 per cent of its revenue from the Europe and the US markets alone.

Under the PLI scheme, it has got approval for three bulk drugs - Penicillin G, 7 - ACA, and Erythromycin Thiocyanate (TIOC) - all of which are currently 100 per cent dependent on imports. Bulk drugs form an integral part of the company's revenue (around 13 per cent in FY20). The company would be incurring a capex of around Rs 3,000 crore over the next 30-32 months for setting up three new plants, which would generate a conservative asset turn (sales generated from a given asset) of 1.2-1.5 times. The new capacity could add roughly Rs 3600-4500 crore to the company's top line.

The management believes that 40-45 per cent of the bulk drugs produced will be used for self-consumption, while the rest will be sold externally. Overall, the PLI initiative will help Aurobindo in backward integration and cut down its reliance on China.

Apart from this, Aurobindo has a pipeline of 54 injectable ANDA (new drug applications) pending for approval in the US and the EU and it expects multiple approvals. It is also looking at the opportunity to expand in China and has filed for 28 products ther, of which around 8-10 should be approved within the next 12 months. Furthermore, it has also set up a bacterial and viral vaccine manufacturing capacity and is expected to submit its COVID vaccine data in July 2021 for approval.

Riding the API opportunity: Aarti Drugs

Last year when COVID was spreading its grip across the world, countries, one after another, were realising their immense dependence on China. India wasn't any different. And when it came to pharmaceuticals, the country soon realised that around 60-70 per cent of its APIs came from China. The government then launched the PLI scheme to precisely reduce this dependence. Since then, API manufacturers like Aarti Drugs have seen a bombastic growth in their stock price.

Aarti Drugs, a part of the Aarti Group, is primarily an API producer (80 per cent of FY20 revenue), also having presence in formulations (11 per cent), specialty chemicals and more. The company makes APIs for use in antibiotics, antiprotozoals, anti-inflammatory and more across its 12 facilities with a combined annual capacity of 43,060 Mt.

One of the company's subsidiaries has received an approval for a drug called '2-methyl-5-nitro-imidazole', committing a production capacity of 4,000 MT per annum under the PLI scheme. The rate of incentive will be 10 per cent of the total sales value per annum for a period of six years and the production is expected to commence in 2023.

Aarti has set up a budget of Rs 120-150 crore for PLI-related schemes, out of which Rs 78 crore is going towards the above-mentioned approval. The rest would be used towards another drug for which the company will be applying under PLI soon. From the approved drug, Aarti expects revenues of around Rs 65 crore each, both externally and internally.

Furthermore, to exploit the supply chain diversification from China, Aarti has lined up a Rs 600 crore capex plan (which includes the PLI capex) towards APIs and intermediaries. There are seven projects under the capex plan which will help the company further integrate its operations and achieve its target of doubling its revenue in the next five years from around Rs 2200 crore currently to Rs 4500 crore.