Writing about markets and valuations is Professor Aswath Damodaran's day job as Professor of Finance at the Stern School of Business at NYU. In a paper and subsequent blog post (https://bit.ly/3lybtpW), Prof Damodaram explains attractions and risks in investing in companies that operate in 'big markets'. He points out that many companies that initially raise money at monstrous valuations justify it on the basis that the 'total accessible market' (TAM) is extremely large. Uber estimated its TAM at over $6 trillion, and WeWork suggested that the commercial-real- estate market was enormous.

Even if that were true, and that's not a given, especially since many companies have business models that have not evolved, there are three other assumptions that are implicit when investors decide to put money into such companies. "First, the company must be able to capture a reasonable share of that big market, a task that can be made difficult if the market is splintered, localized or intensely competitive. Second, the company has to be able to generate profits in that big market and create value from that growth, also a function of the firm's competitive advantages and market pricing constraints. Third, once profitable, the company has to be able to keep new entrants out, easier in some sectors than in others. It is therefore dangerous to base an argument for investing in a company and assigning it high value based on enthusiasm for the size of the market that it serves, but that danger does not seem to stop analysts and investors from doing so."

ESG-based investing has been gathering momentum in recent years. This has given rise to investment opportunities in 'clean energy' and electric vehicles, to name a couple. We examine whether their current valuations are justifiable.

Electric vehicles

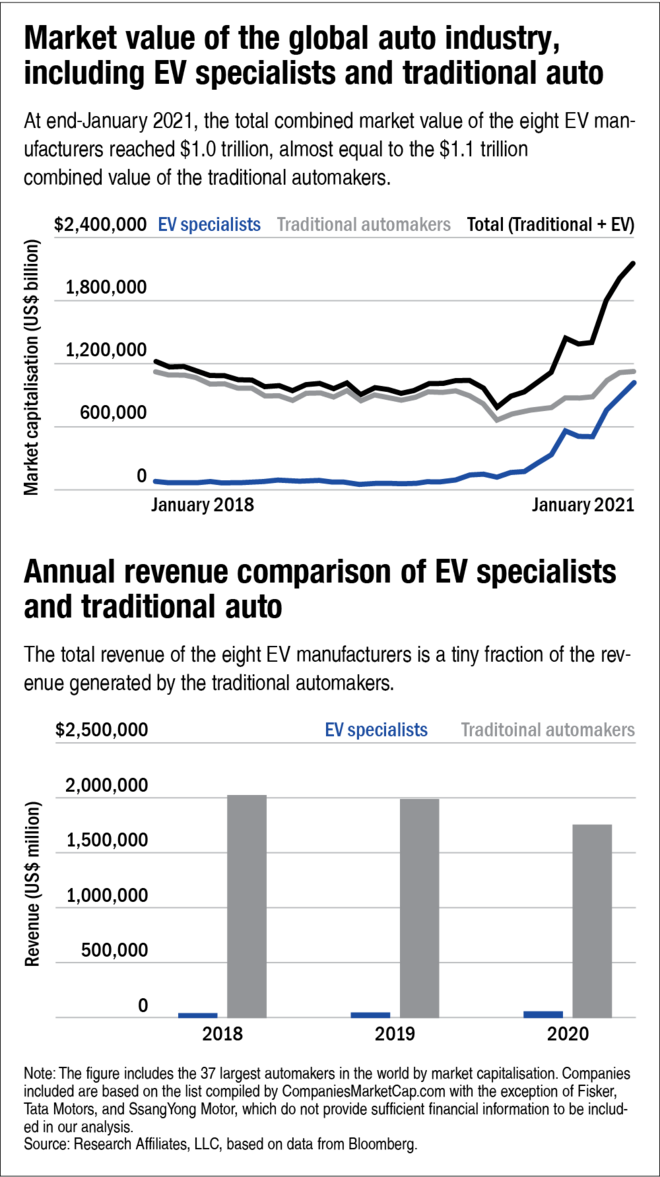

After two years of fall, the global auto industry gained market value in 2020. During the fall, while traditional automakers declined in value, EV makers gained. By the start of 2021, the market capitalisation of both segments was roughly equal despite the EV specialists making only a small fraction of the cars that the traditional manufacturers rolled out. On February 1, 2021, Tesla was priced at $852 per share, giving it a market capitalisation of over $800 billion (currently, $626 billion) and made up about three-fourths of the market value of EV specialists (and therefore of the traditional players as well). Tesla's humungous market cap is often justified by investors on the basis of its 'full-stack' business model with the supposed ability to disrupt batteries, solar panels and even space!

The EV industry delivered sales of 3.5 million in 2020, growing at a rate of 43 per cent. A combination of concerns about the environment as well as favourable government policies and tax incentives were responsible for the growth. For the moment, investors are assuming that not only will Tesla be a big winner, so will all the other EV makers - Nicola Corp founded in 2015 with hardly any sales is currently priced at 60,978 times price to trailing 12 months sales (this despite a fall in price from a peak of about $94 to a more recent $15). Relatively newer entrant Li Auto with a market cap of $23 billion trades at a price to sales of 30 times.

Automobile manufacturing is a highly competitive, capital-intensive industry. Even premium automakers trade at low single digit EV/EBIDTA, reflecting the constant investment required to develop new models to expand sales. This need for innovation is unlikely to change just because of a change from internal-combustion engine to electric motors. Besides, new entrants will chip away at the technological edge that current leaders enjoy. Despite the setback received due to COVID, it is likely that the Uber model of rent vs own will continue to gain traction, implying a lower demand for individually owned vehicles as technology progresses. All of this is not good news for carmakers.

Renewables

Something similar is going on in power-generation companies engaged in renewable energy. Adani Green Energy Ltd (AGEL) investor presentation claims a total portfolio of 14,195 MW (2,850 in operation, 3,345 MW ramp up, while 8,000 MW is contracted pipeline). Of the operational assets, 2,353 MW is in a 50:50 JV with Total. Adani is targeting a portfolio of 25 GW by 2025.

AGEL trades at a market cap of Rs 1,77,650 crore with a net debt of approximately Rs 19,000 crore (September 2020, Screener.in). Assuming that the entire pipeline of projects is fully funded and fresh capital (debt or equity) does not need to be raised, the market is assigning a value of Rs 15 crore per MW to the assets of AGEL

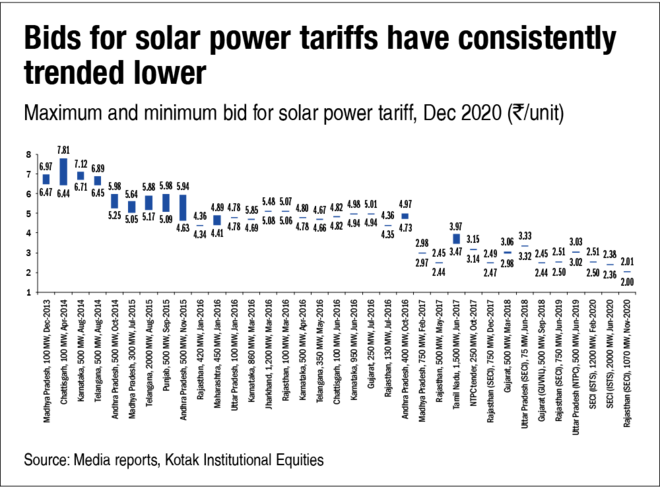

AGEL claims an average portfolio tariff at Rs 3.26 per unit. Tariff has been consistently falling for Adani, with the price bid in June 2020 coming in at Rs 2.3 per unit. This is in line with developments in the industry.

ReNew Power, another renewable energy company from India, is adopting the SPAC route for a NASDAQ listing. ReNew has 5.4 GW of operating assets and another 4.5 GW of committed capacity (where power-purchase agreements have not yet been signed), taking the total capacity to 9.9 GW. Assuming that the SPAC transaction were to conclude as planned, the valuation of ReNew Power would be at an enterprise value of $7.85 billion ($4.37 billion post money equity). This yields a valuation of Rs 5.74 crore per MW for the assets of ReNew Power.

NTPC, the country's largest power generator, currently trades at a market capitalisation of Rs 1 lakh crore, with approximately Rs 1,90,000 of net debt. Its generation portfolio of 63 GW comprises 58 GW of coal assets, with the rest comprising renewables (largely hydro). Without taking any of the pipeline assets into account, NTPC trades at Rs 4.6 crore per MW. Its declared pipeline till 2032 includes 32 GW of solar and wind power, which would take its renewable portfolio to 30 per cent.

The market clearly sees wind and power as winners, with coal not attracting investor appreciation on ESG concerns.

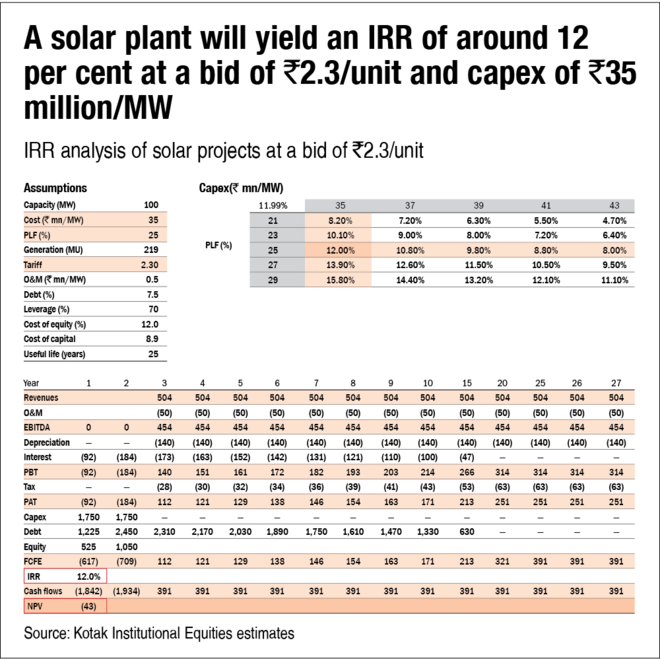

It can be argued with some conviction that with solar tariffs being lower than grid parity, the growth rates could remain at elevated levels. The issue here is the lack of entry barriers in this business, with technology being reasonably standardised and cost of capital being the key criteria for determining tariffs. Power tariffs have fallen to levels that leave little scope for execution errors. The illustration of the return on investment on a solar plant as computed by Kotak securities in their recent report is telling. One has to assume a capex including land of not more than Rs 3.5 crore per MW and a cost of debt of 7.5 per cent to get an IRR of 12 per cent on the project. Does this justify the 4.5 times multiple to investment that AGEL attracts or the listing pop that investors in ReNew Power would expect?

The markets are coming to terms with the possibility that interest rates may rise from the current levels. US bond markets are jittery and yields have shown an upward trajectory. If interest rates were indeed to firm up, the biggest fall will be in share prices of companies that have the highest growth projections in the future with lower cash flow now - they will behave like a long-duration bond. It may still not be too late to pare the portfolio of investments that reflect a very bullish 'big market' opportunity with no visibility of near-term earnings.