Mr Malhotra is retiring in a couple of years. He has Rs.50 lakh and wants to invest it in a fixed-income avenue in a tax-efficient manner. He is likely to receive sufficient pension after retirement and may not be dependent on this money for his daily expenses. But he does not want to compromise on the liquidity and would like to have the freedom of making partial withdrawals, whenever needed.

Initially, he decided to invest this money in a bank fixed deposit (FD). But then he read somewhere that debt funds are more tax-efficient. Now, he wants to understand how that's so. He also wants to know whether he should invest the entire amount in debt funds.

Tax treatment: FDs vs debt funds

- In the case of FDs, the interest is taxable on an accrual basis. This means even if you don't make a withdrawal of the interest, still you have to pay tax on the interest 'earned' as per the applicable slab.

- Unlike FDs, in debt mutual funds, tax liability arises only when you make a withdrawal. If an investment is sold within three years, the gain is added to income and taxed as per the slab. Otherwise, it is taxed at 20 per cent after providing the benefit of indexation.

- Since the benefit of indexation is available only after three years, the real benefit of investing in debt funds arises only when they are held for more than three years.

How SWPs trump FDs

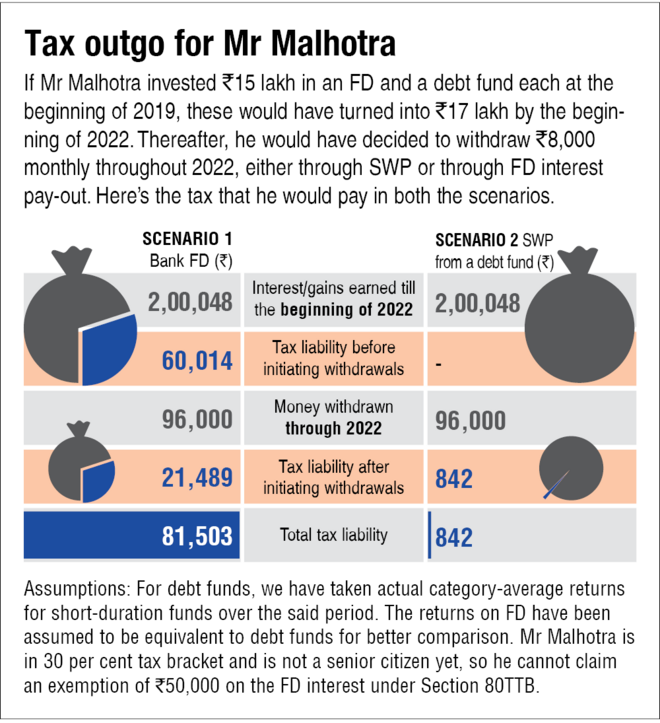

- Let us assume that Mr Malhotra falls in the 30 per cent tax bracket and consider the two scenarios mentioned in the illustration 'Tax outgo for Mr Malhotra'. In the first scenario, he invests Rs.15 lakh in an FD and in the second, the same amount is invested in a debt fund.

- By choosing the SWP route (Scenario 2), Mr Malhotra would save more than Rs 80,000 in tax-outgo. This is because of the indexation benefit that increases the cost of purchase, along with the fact that in mutual funds, one does not have to pay tax until the investment is redeemed. On the other hand, in a bank FD, tax is paid on the interest earned, irrespective of the fact whether you take the pay-out or let it accumulate.

- An FD could be beneficial only for investors falling in the lower tax bracket of 5 per cent or for a senior citizen who hasn't exhausted the Rs.50,000 limit under Section 80TTB of the old tax regime. However, one must consider the additional benefit of indexation and the possibility to earn higher returns in the case of debt funds.

How indexation helps

- Indexation allows you to nullify the impact of inflation on your investments. It does so by adjusting your gains for inflation.

- For the purpose of calculating the actual inflation-adjusted gains, the Cost Inflation Index (CII) is used. The government declares the value of the index for each financial year.

- To find the indexed cost, the following formula is used. This cost is then used to calculate the capital gains. It lowers the gain, thus reducing the tax.

- Indexed cost of purchase = Cost of purchase × CII for year of sale/CII for year of purchase.

Why not dividend plans?

- Gains from growth plans are liable for taxation only at the time of redemption, as discussed. However, in dividend plans, the entire dividend received is added to the income and taxed as per the applicable slab.

- Mutual fund dividends are often a combination of appreciation value and part of the money invested at the beginning. Therefore, the NAV reduces by the dividend amount as soon as it is paid. So, investors may end up paying taxes not only on the gain component but also on the principal.

- Also, dividends are not guaranteed and a fund house is free to declare them at will. So, SWPs are a better alternative to create an income stream than dividend plans.

Allocate a small portion to equity

- Mr Malhotra should invest at least Rs.17 lakh (one-third of the corpus) in equity funds to counter the effect of inflation.

- He may choose flexi-cap funds for this purpose. However, it is important to spread the money over a period of two-three years instead of investing at one go. Spreading the investment will reduce the risk of entering the market at the wrong level.

Don't ignore these

- Maintain an emergency corpus equivalent to at least six months of your expenses in a combination of cash, savings account, sweep-in deposit and liquid funds.

- Buy adequate health insurance. You do not need life insurance if you do not have financial dependents or if you have sufficient assets to support them in your absence.

- It is important to invest in equity even after retirement to beat inflation.