Resurgence of COVID in India had caught equity markets and policymakers by surprise. Possible lockdowns reminiscent of 2020 have made markets jittery. Coupled with a stronger dollar, this has led to a reversal of some international flows into Indian equity markets and a bout of selling.

As we step into the new reporting season, the outlook for the year ahead begins to look slightly less definitive, with unmitigated bullishness being replaced by a modicum of concern about the trajectory of growth. We look at the opportunities and risks that lie ahead.

The bull case

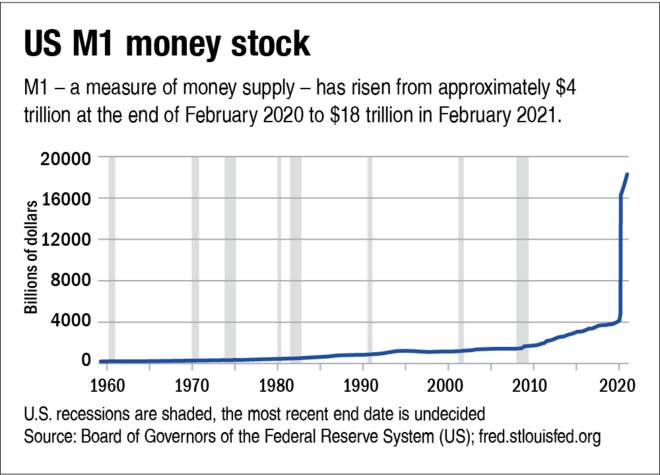

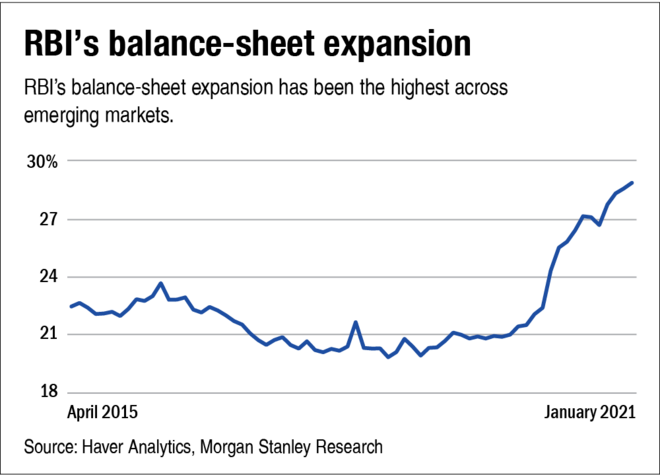

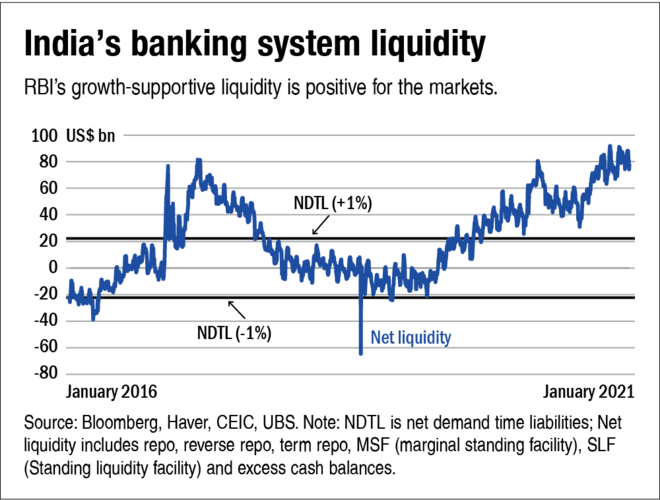

The bull case emanates from the money supply. US M1 - a measure of money supply - has risen from approximately $4 trillion at the end of February 2020 to $18 trillion in February 2021, i.e., almost 78 per cent of all money supply in dollar terms has been created in the past 12 months. This massive injection of liquidity in the US and other developed markets has been the primary cause of asset-price inflation. The US recently announced another COVID-related financial-support package for its residents, the cheques of which are just reaching the beneficiaries. This will further support consumption and speculative behaviour in global markets. The RBI has had its own balance-sheet expansion programme - the largest that it has attempted and the largest among emerging markets. This has helped sustain negative real interest rates, despite a large increase in government borrowing.

The difference from 2020

Unlike 2020, vaccinations against COVID are now available and treatment protocols are in place. Mortality remains low. Lockdowns, though being enforced selectively across several Indian states, are unlikely to reach proportions of last year. At best, a few months of spike and it should be possible to contain COVID infections and bring them down to manageable levels. In economic terms, this shouldn't result in more than 0.5 per cent of reduction in economic growth if that - easily manageable in the context of forecast double-digit growth.

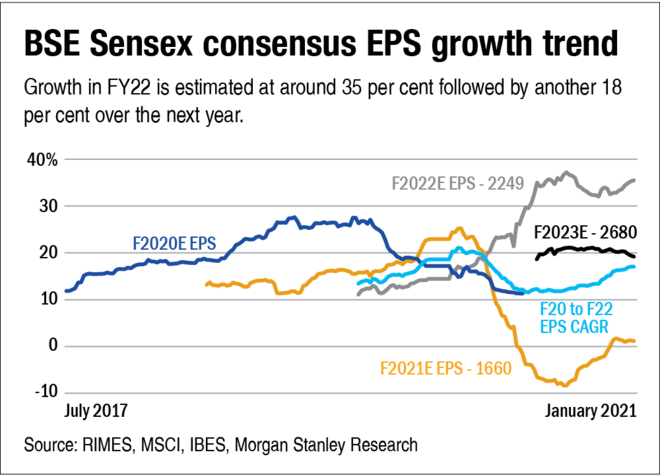

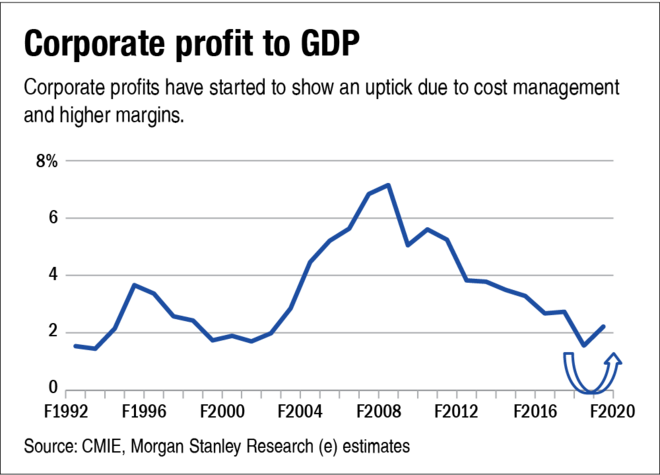

The bull case is predicated on an increase in corporate earnings. Key factors driving this are a recovery from a low base, increase in global trade due to synchronised demand revival across global economies fuelled by stimulus and a restructuring of global supply chains, with China ceding space to countries like Vietnam, Bangladesh and India. This is supported by government policies that are meant to make corporate India more competitive - production-linked incentives, restructured labour laws, lower corporate taxes for new manufacturing capacities and growth-supportive liquidity management by the RBI.

Coupled with this, corporate India has shown a remarkable ability to manage costs despite the lockdown, with several sectors reporting higher margins despite a reduced top line for FY21. The government's willingness to impose anti-dumping tariffs on imports, particularly from China, have also provided Indian corporates the ability to increase domestic prices and sustain profitability.

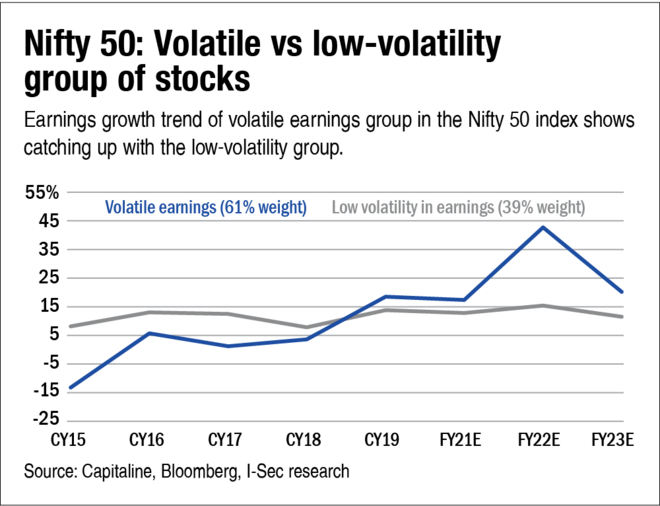

Consensus earnings growth estimates are at a multi-year high. Growth in FY22 is estimated at around 35 per cent followed by another 18 per cent over the next year.

The cautionary tale

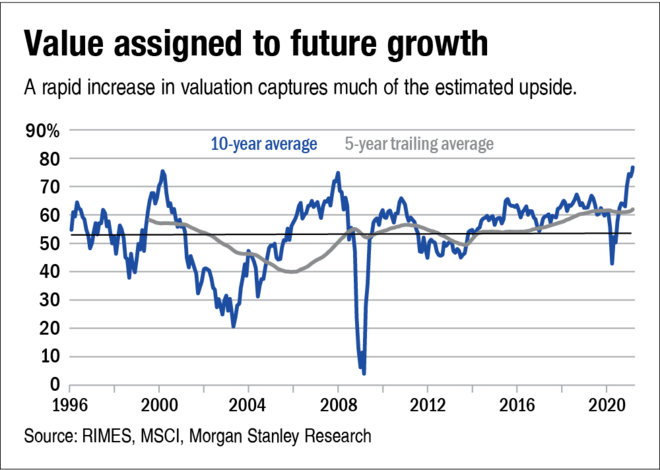

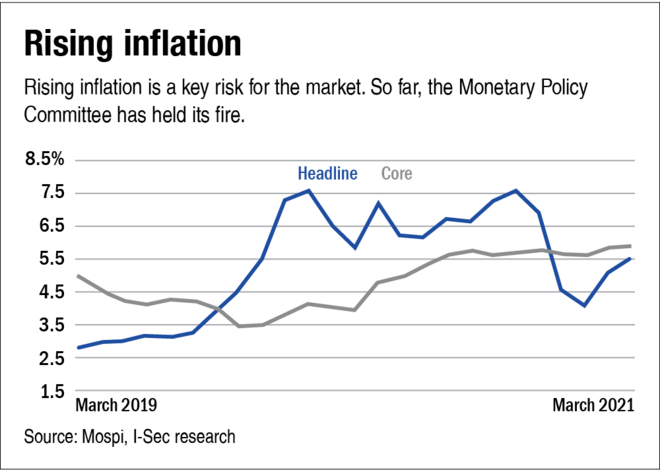

Key risk to the market arises from (a) a rapid increase in valuation that captures much of the estimated upside, leaving little in terms of margin of safety; (b) inflationary expectations that have risen higher than the mandate of the monetary policy committee (MPC) tasked with maintaining price stability.

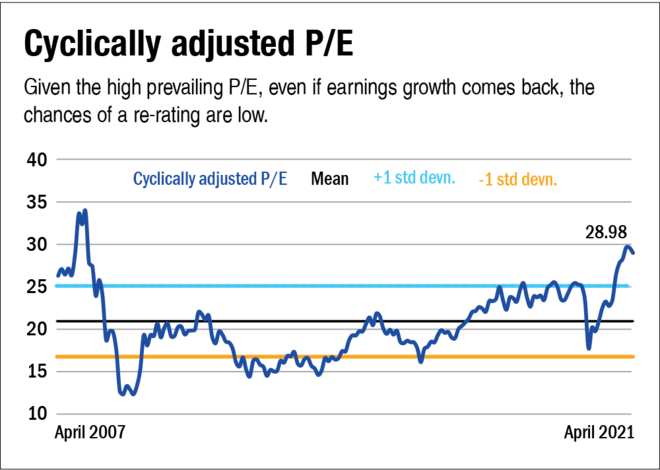

The sharp run-up that the market has witnessed over the past 12 months has ensured that the forecast earnings growth has been largely baked into the prices. With this, unless performance beats already-exalted expectations, there is little scope for further re-rating of markets. Much of the pervious five years' market performance can be attributed to rising P/E multiples even as earnings growth disappointed. Now as earnings come back, the likelihood of a further P/E re-rating is low, especially in the context of rising inflationary expectations.

Much of the increase in earnings is driven by sectors that are cyclical - metals, corporate-facing banks, textiles, real-estate, etc. These earnings are largely reflective of commodity-price increases. Most commodity cycles tend to last for a few years and result in price rises that overshoot fundamental demand-supply gaps. The commodity growth cycle has inherent in it its own demise as interest rates will have to rise to control prices (inflation). Though this may be somewhat down the road, it does reflect the more volatile nature of sectors driving index earnings growth.

Positioning

Portfolio positioning is tricky in a situation such as this. Headline index has little room to perform over the next six months till estimates for 2023 start getting factored in. Growth has largely been priced in but interest rates are likely to remain benign, favouring risky assets. This is a scenario that is ideal for widening of market performance and favours mid- and small-cap stocks. Large-cap stocks will likely continue to witness sector rotation, driven by portfolio positioning of large funds.

Assuming that commodity prices remain firm, stocks that benefit from this, i.e., metals and mining, are likely to see another leg-up. Auto and auto ancillaries, consumer electricals and construction can be adversely impacted. IT, pharma and metals will also benefit from a depreciation of the currency. Pressure on the rupee can be expected with rising inflation and higher energy prices, though this will be managed by the RBI, given the large foreign-exchange reserves that it has accumulated.

The second half of the year will likely see greater pressure to raise interest rates. Government borrowing would be largely done and inflation expectations will likely remain elevated, forcing the MPC to take remedial action. Higher interest rates are generally negative for earnings. However, the impact is especially strong for real estate and consumer discretionary. Banks will benefit at least in the first stage of the upcycle.

In sum, investors should increase their investment horizon if they don't want to trade. This is also likely to be a good year for those that enjoy mid-cap stock picking as the preferred mode of investment.