The banking and finance sector is the classic example of cyclicals. Its performance is directly linked to economic growth and interest-rate movements. High economic growth results in higher demand for credit, which benefits banking and finance companies. Lower/higher interest rates in the economy can increase/ decrease the spreads between interest paid and charged by banking and finance companies. What makes this sector stand out is the fact that the general business cycle also depends on this sector's behaviour. When banks turn risk averse, that can translate into credit crunch for other sectors. A liberal lending regime bolsters economic growth. So, while this sector is affected by the economic conditions, it also in turn affects the economy.

Historical perspective

Boom times, no doubt, augur well for this sector. However, as history reveals, every boom period came to an end, owing to excessive credit and the poor performance of borrowers. For example, during the mid-2000s, the boom in infrastructure lending in India ultimately resulted in a prolonged period of pain for lenders in the next decade because of poor underwriting standards.

Outlook

With lending playing a significant role in the overall economic growth, the sector is expected to do well in the future. During the previous year, the government unveiled a slew of measures aimed at improving lenders' access to funds, removing liquidity constraints and providing guaranteed loan schemes. Further, the regulatory uncertainty surrounding the recognition of NPAs has now come to an end.

Recent positive developments, such as reinstating access to the Insolvency and Bankruptcy Code, which is an effective recovery mechanism in the country, coupled with lower interest-rate regime, have augured well for this sector. As lenders already took pre-emptive provisions during the previous year, it should give investors comfort against any nasty surprises. Over the last few months, there has been a rally in PSU banks. One should avoid attributing it entirely to a change in cycle. The government's privatisation drive is a major force behind this rally. If the government successfully privatises a couple of banks, there could well be a re-rating of PSU banks. However, if politics, growth worries and balance-sheet concerns turn out to be the spoilsport, the rally may not go very far. Another concern is the second wave of COVID-19, which is now casting a shadow on the recovery of this sector.

Methodology

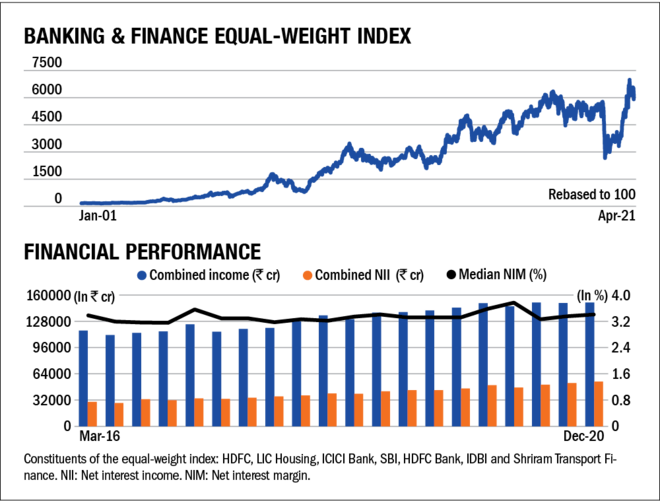

Equal-weight index: Sectoral cycles are a long-term phenomenon and to observe them we require a long-term index. Since the available stock indices generally don't have such a history and homogeneity, we had to create our own index. To do so, we considered companies that had a 20-year history.

Within a sector, there could be multiple industries, so we tried to make the index as inclusive as possible. We then assigned all the components equal weights. This gave us our 'equal-weight' index.

Financial performance: In order to see whether the various sectors are on the road to recovery, we assessed the combined five-year revenues, profits and median margins of the companies constituting the equal-weight index. An upcycle often results in an uptick in these three. Do note that the idea here is not to assess the quantum of revenues or profits but to assess the trend.