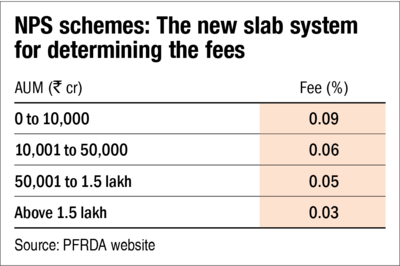

The Pension Fund Regulatory and Development Authority (PFRDA) has allowed pension-fund providers to charge an investment management fee of up to 0.09 per cent. Earlier, the fee was fixed at 0.01 per cent but now, a slab system has been introduced based on aggregate assets under management (AUM) of the pension fund under all schemes, with an upper ceiling being charged as an investment management fee (see the table 'The new slab system').

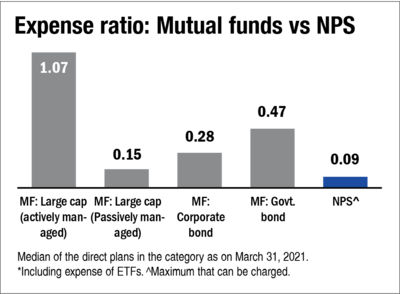

An increase from 0.01 per cent to 0.09 per cent (an 800 per cent increase) may seem exorbitant to many but the NPS still continues to be an extremely low-cost option as compared to other market-linked investment options, such as mutual funds (see the chart 'Expense ratio: Mutual funds vs NPS').

Although the NPS Tier I account comes with a lock-in period till the age of 60, the Tier II account acts pretty much like a mutual fund. So, an investor can invest in the Tier II account and withdraw the money at any time. It's, therefore, a worthwhile alternative to consider. In this article, we delve into three plans offered by the Tier II account.

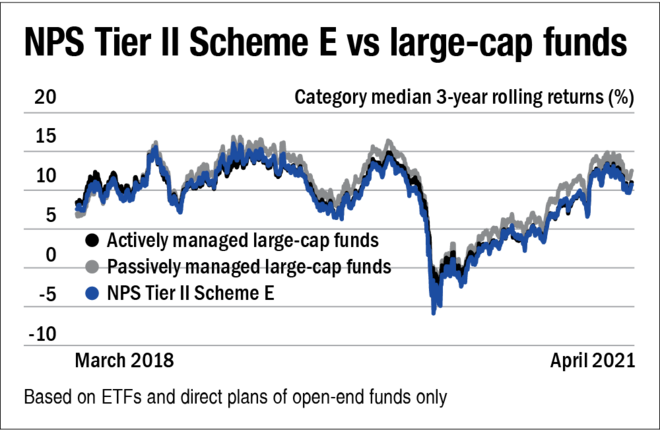

NPS Tier II vs equity funds

The equity plans of the NPS Tier II account always maintain a large-cap-heavy portfolio. Hence, they can be compared with large-cap equity funds. Of late, actively managed large-cap funds have come under the scanner for their higher expenses as compared to index funds and ETFs and for their inability to match up to the returns of the latter. On the expense front, the Tier II account trumps even passively managed mutual funds. But when it comes to performance, it has been able to outdo actively managed large-cap funds marginally. However, it has still trailed the passives in recent years, despite its cost advantage (see the chart 'NPS Tier II Scheme E vs large-cap funds').

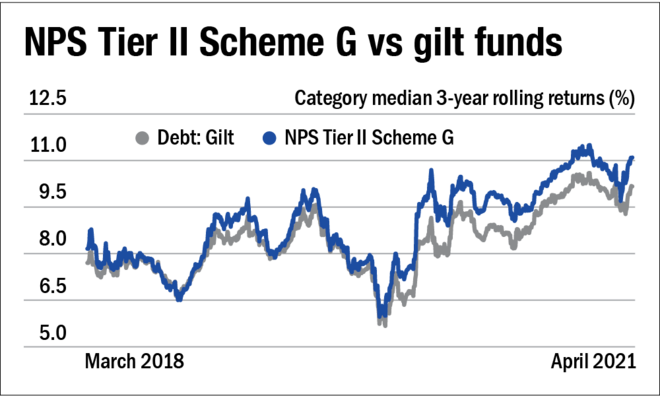

NPS Tier II vs gilt funds

The expense ratio plays an even more important role on the debt side. In the case of gilt funds, the NPS Tier II account is not only much better on expenses but also consistently outperforms its mutual-fund counterparts (see the chart 'NPS Tier II Scheme G vs gilt funds'). Having said that, gilt funds are not meant for everyone. They are meant for, at best, a supplementary allocation in the portfolios of those investors who can play the interest-rate cycle well. One can benefit most by investing in gilt funds when interest rates are beginning to decline and then making a timely exit when they start to rise. To that end, the Tier II plans can add that much more to one's returns because of their lower costs and better performance.

NPS Tier II vs corporate-bond funds

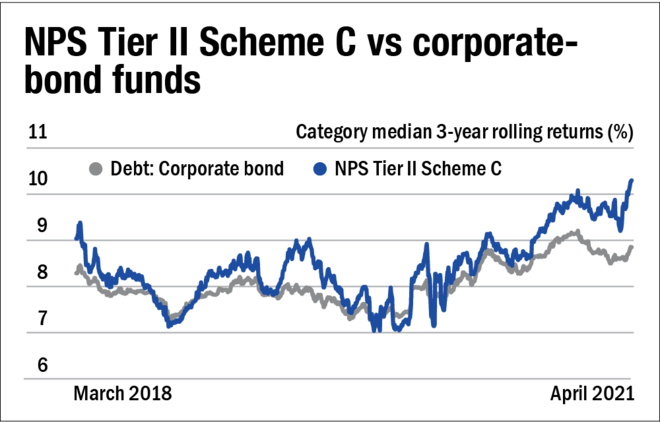

When it comes to the corporate debt plan, the NPS Tier II account has outdone mutual funds both in terms of costs and returns (see the chart 'NPS Tier II Scheme C vs corporate-bond funds').

However, do note that corporate-bond plans of the NPS Tier II account seem more volatile than their mutual fund counterparts as visible in the three-year rolling-returns graph. That's because the Tier II account maintains portfolios with a much higher duration. Bonds with a higher maturity period are more sensitive to interest-rate changes and that reflects the ups and downs in their performance.

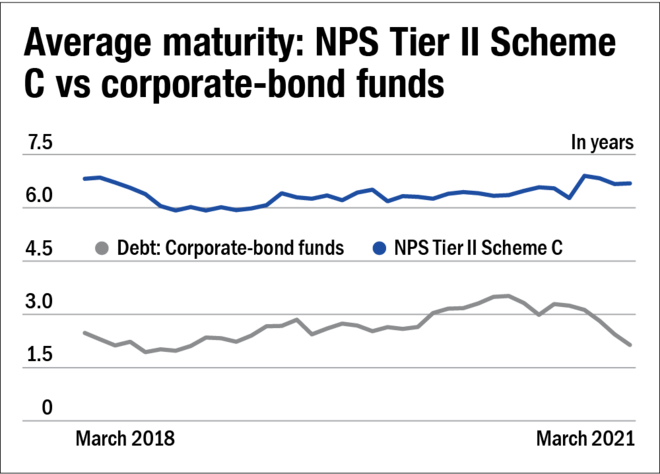

As the graph titled 'Average maturity: NPS Tier II Scheme C vs corporate debt funds' shows, the NPS Tier II account maintains average maturities in the range of six to seven years, which is much higher than the two-to-four-year band of corporate-bond funds offered by mutual funds. This exposes NPS Tier II corporate-bond funds to greater duration risk and hence volatility. Thus, such plans may not be suited to retail investors who want stability with their debt portfolios.